Broken coal plants and the soaring cost of fossil fuels, both coal and gas, have received most attention for their part in Australia’s unprecedented wholesale electricity price spikes. But hydro, and the government owned retailer Snowy Hydro, have also played a key role.

Data released by the Australian Energy Market Operator on Friday shows that hydro generators set the price in 47 per cent of trading intervals in the June quarter, when prices surged to their highest ever average of $264/MWh, treble the price of a year earlier, and five times that of 2020.

Most of these prices were set by Snowy Hydro generators, and another set of data reveals that the dramatic withdrawal of hydro capacity when the administered price cap was imposed in June, leaving the market unmanageable and forcing AEMO to suspend it for the first time.

It begs the question. If a government owned generator is making windfall profits (i.e. the cost of water didn’t go up) through its bidding behaviours and withdrawal of capacity, should that money be returned to the taxpayers who own it?

First to the bidding.

It is clear that the hydro generators weren’t there to lower the price. As this graph below shows, the prices set by hydro generators averaged more than $300/MWh, four times more than brown coal, more than three times more than black coal, and nearly as much as gas. Only diesel set a higher price, of $446/MWh.

AEMO describes the bidding pattern of the hydro generators, and most of these were set by the Snowy Hydro generators Tumut and Murray (for one third of all trading intervals) as an “opportunity cost”.

There’s no doubt they were taking advantage of the system. The cost of water didn’t go up as it had for coal and gas, although the ability of hydro generators to generate at will was limited not so much a lack of water, as too much water, because releasing water into already flooded or overloaded waterways would have caused more damage.

This meant that the hydro generators had to choose the best moment to supply power to the grid. And, of course, they chose to maximise their profits when they did.

As AEMO notes, hydro generation offer pricing generally reflects the opportunity value of limited water in storage, which in turn is driven by market prices and the pricing of competing fuel sources.

In effect, hydro becomes a proxy for gas generation. And Snowy operates hydro, as well as gas and diesel. Hydro and gas each accounted for just nine per cent each of total generation in the quarter, but set the price nearly two thirds of the time, and always at or near the highest prices.

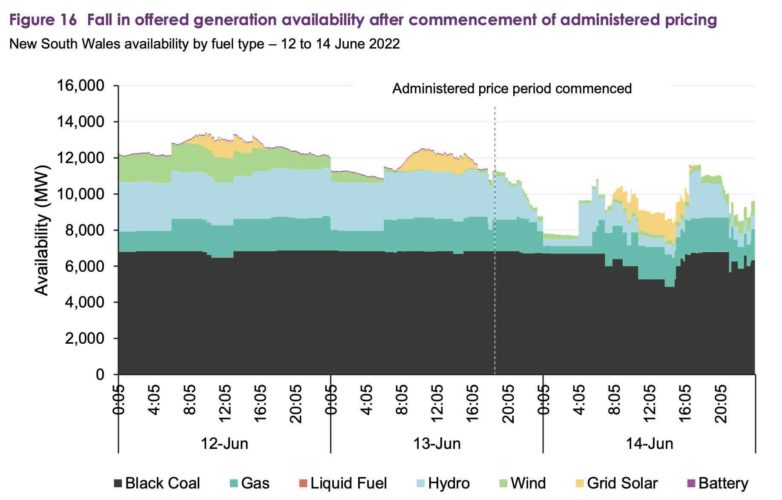

As for the bidding, this graph above shows the sudden withdrawal of gas (green) and hydro blue) just in the NSW market after the market cap was imposed on June 13.

“Compared to prior days there is an obvious reduction in offered availability from late on 13 June and continuing into 14 June,” AEMO notes. It says the increased in availability on June 14, on right hand side of the graph, reflects its directions to tell them to make their generational available.

It begs a question though. Several, actually. One is that which we raised at the time, in this piece, about what exactly utilities that provide an essential service think they should be doing in the midst of a crisis. Is making money their only aim?

See: The day the fossil fuel industry lost all perspective, and threw away its social licence

The second more specific question is what exactly is the role of a government owned utility. Or, more to the point, a taxpayer owned utility?

Is it there to maximise revenues and profits to boost the coffers of government revenue and deliver bonuses to staff, or – because they are dealing with an essential service and a public good – to protect their shareholders, who are both taxpayers and consumers.

It’s a tricky question. Some argue that, in principle, ownership should not affect commercial behaviour. But if, as in this case, the windfall is not of the generators’ making, then perhaps the right response from government is to hands the windfall back as lump sum compensation to vulnerable consumers.

In effect, this is what has happened in Queensland, when in 2017 the state government gave explicit instructions to a state-owned utility to tone down their bidding behaviour, leading to a dramatic fall in wholesale prices to the lowest in the country.

This year they didn’t do that, but offered big rebates to consumers to protect them from soaring electricity bills. The federal government might consider the same for Snowy Hydro, but given the budget constraints, and the likely blowout of costs for Snowy 2.0, it probably can’t afford to.

“They did this because they could,” says Bruce Mountain, from the Victoria Energy Policy Centre.

“It might be argued that some part of the gas withdrawal can be justified to the extent that they could not cover their production costs after the (automatic price cap) commenced.

“But this would not be true of hydro. Once again we see the extent of market power in the NEM. Yet more evidence of regulators fast asleep at the wheel.

“It would be nothing short of immoral if the Australian Government does not return this to windfall to consumers, to begin to compensate those least able to weather the effects of this market abuse.”