New South Wales authorities say they are preparing for a potential faster closure of the state’s remaining coal generators over the coming decade, as well as global supply chain issues that could delay the infrastructure need to replace them.

The NSW government has adopted a renewable infrastructure roadmap, and a series of auctions and tenders that have now been adopted as a blueprint for the rest of the country as it takes on the task of building enough wind, solar and storage to replace its ageing and dirty fossil fuel capacity.

NSW has the biggest coal fleet in the country, at more than 10GW, and with the exception of Queensland is state most dependent on coal for its electricity supplies.

Queensland has vowed to shut all its state-owned coal generators by 2035, but the NSW plan assumes a quicker exit, with four of the five generators closing by 2033, starting off with Liddell next year and Eraring in 2025. But there is widespread belief that the fifth generator, Mt Piper, could also close early.

“We’re modeling three scenarios,” Andrew Kingsmill, the head of technical advisory services at EnergyCo, which is managing the roll out of five renewable energy zones in the state, told a market briefing on Tuesday.

“One scenario is allied with the Step Change scenario in the (Australian Energy Market Operator’s) integrated system plan”, which assumed an 82 per cent share of renewables in Australia’s main grid by 2030.

“If you like, that’s our base,” Kingsmill added.

“One (other) scenario aligns with a faster coal closure, because there is potential for that and we will need to plan for that.

“But the third scenario is particularly this question and it is what if global supply chain delay the rollout of infrastructure?”

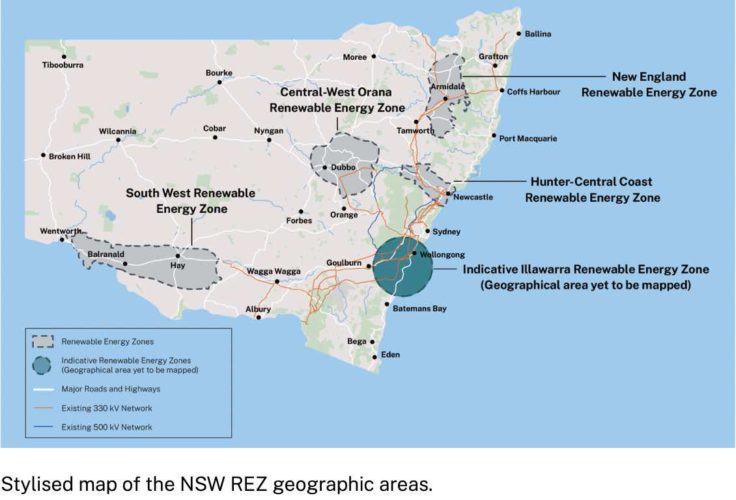

Kingsmill said these considerations would be taken into account as it prepares its network infrastructure strategy which is due to be rolled out in the new year and which will detail the timing on the five new renewable energy zones in the state.

Four of these zones have already been declared – Central West Orana, New England, South-West, and Hunter-Central Coast – and all have received interest from an abundance of wind, solar and storage projects. A fifth REZ, in the Illawarra, will be declared in the new year.

NSW has already embarked on the first of its planned series of tenders, seeking around 1000MW of wind and solar capacity and 600MW of long duration storage.

At least another two tenders will be held in 2023, including access rights to the first REZ in Central West Orana, and for more renewable generation to accompany the Waratah super battery (pictured above) that will be located on site of an already shuttered coal fired power station at Munmorah.

It will act as a sort of giant shock absorber on the grid and allow more renewables into the major load centres after the closure of Eraring in 2025.

James Hay, the EnergyCo CEO, said the auctions were being timed, quite delibarately, to spread out investment over time to try and dodge the supply chain issues. The state is looking for at least 12GW of new wind and solar capacity to be built in the coming decade, plus storage.

“We’re very cognisant that if we tried to develop all the projects concurrently, we would run into major supply chain issues,” he said.

“So in taking that program approach, we’re trying to space out the projects as best we can to ensure that they’re available for delivery when they are needed, but also to alleviate some of those constraints.”