New South Wales is pinning its hopes on solar-battery hybrid projects to deliver more of the capacity needed to replace its ageing coal-fired power generators, and is looking to boost support for the technology as it prepares to resume a series of major auctions this year.

The state is looking to make changes to the design of its underwriting agreements – known as Long Term Electricity Service Agreements (LTESAs) – to better support solar-battery hybrids, which are emerging as the go-to technology because of the plunging cost of battery storage and the low cost of solar.

These hybrids – which combine solar and batteries behind the same connection point so the output can be stored for evening and morning demand peaks – have dominated recent federal auctions because they are proving quicker, easier and cheaper to build than large scale wind farms.

They have other advantages too – they can be more readily sited on existing network infrastructure (because of the flexibility and features of the battery components) – and usually face fewer hurdles in planning processes, and less blockages in equipment supply chains and transport logistics.

The proposals are part of a number of changes unveiled by ASL, the consumer trustee responsible for the state and federal capacity auctions, which also include a focus on encouraging projects located outside renewable energy zones.

There are also changes that will help projects fearful of being stranded or constrained because of delayed infrastructure, receive higher compensation to offset lower output in their early years.

NSW is facing growing pressure to build sufficient capacity to replace its ageing, and increasingly unreliable coal fired power stations, with closure dates already slipping for the Eraring and the Vales Point facilities.

There is a growing expectation that Eraring, the country’s biggest coal generator at 2.88 GW, will continue at least on a partial basis beyond August, 2027, because the state government is concerned about potential shortfalls, or at least price spikes in evening peaks.

NSW had sought a minimum 12 GW of new capacity by 2030, but has now upped this target to 16 GW of capacity to ensure that the gap from retiring coal plants is filled as overall demand rises to meet the needs of industry and household electrification, and the growth in EVs.

The changes have been unveiled as NSW is expected to fill its quota of the federal government’s Capacity Investment Scheme in the current auction – results are due by May – and intends to resume its own generation auctions in the June quarter.

It will seek a total of 5 gigawatts of capacity to be awarded in two auctions this year, with further auctions to be held in 2027, according to its newly released investment priorities.

“2026 is a big year for our work supporting the delivery of the NSW Electricity Infrastructure Roadmap, with generation infrastructure LTESA tenders scheduled to recommence from Q2 alongside our next long duration storage tender,” says Nevenka Codevelle, the CEO of ASL, which manages both the CIS and NSW auctions.

“ASL recognises that since the development of our Long-Term Energy Service Agreements, market conditions and technologies have evolved, with a noticeable shift toward solar-hybrid projects.

“These projects generally offer a shorter time to market and we recognise their potential to help meet our 2030 infrastructure investment objectives.”

Solar-battery hybrids are able to dodge the negative price events that usually force solar farms to shut down in the middle of the day, and can store the energy until it is needed, when it is more valuable and when demand is higher.

Australia only has one true large scale operating solar-battery hybrid, at Cunderdin in Western Australia (pictured above), that now sends power to the grid on a daily basis into the evening peaks, and often through the night.

See our story: The solar farm that winds down at dusk, charges up for dinner and is still generating at midnight

The first solar hybrid on Australia’s main grid, the Quorn Park facility near Parkes in the central west of NSW, has now been energised, while two other facilities, Maryvale and Goulburn River, are being built after becoming the first solar hybrid projects to win underwriting tenders in NSW in 2023.

Since then, another 18 solar-battery hybrids have won underwriting agreements through two CIS auctions, including five in NSW – Glanmire, Bendemeer, Middlebrook, Merino and Tallawang. Many more are working their way through the planning process and community consultations.

The emergence of solar-battery hybrids, and because the cost of battery storage is still falling, has already had an impact on the Australian Energy Market Operator’s planning blueprint, the Integrated System Plan, which now counts a much higher proportion of such hybrids, and a lot less wind capacity in its latest draft report.

Solar-hybrids are expected to do well in the current CIS tender 7, which is seeking a total of 5 GW of generation capacity, with some developers now also pushing wind and battery hybrids. Victoria, however, only wants wind-based projects rather than solar-battery hybrids as part of its allocation.

The changes being considered by ASL for the NSW tenders will focus on how best to tailor the LTESA product to the particular nature of the technology.

ASL has released a consultation paper on the potential design of a Hybrid Generation LTESA product, that will specifically support solar-hybrid projects, and maximise their potential revenues.

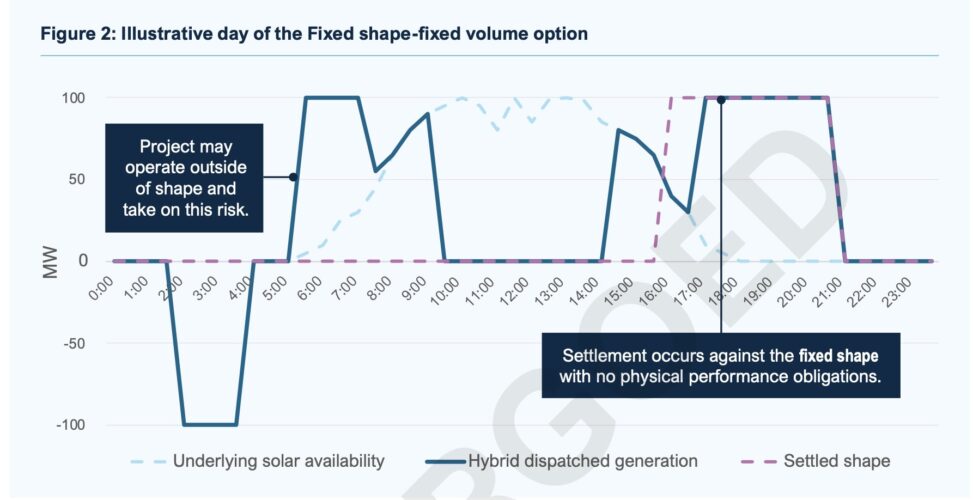

It is seeking feedback on two potential options, with one using a fixed shape and fixed volume model, possibly based around existing ASX products such as morning and evening peaks.

The other option is a model based on generation-following and price risk sharing, and which would be focused on exports and imports, and the possibility the facilities will be a more active player in the market.

As an illustration, it suggests a solar only profile might attract a price of around $65/MWh, a solar-hybrid with a shaped model could attract a fixed price of around $90/MWh between 9pm and 6am, and a generation following solar hybrid model could have a fixed price of $100/MWh and a 50 per cent price risk share.

It notes that these numbers are indicative only. How project owners run those assets will likely depend on their individual needs, their customer requirements, and their total portfolio.

ASL wants to finalise the options before it resumes its own NSW tenders in the second quarter of 2026, with 2.5 GW of capacity on offer, followed by another 2.5 GW tender before the end of the year.

It insists, however, that wind will remain a critical part of the equation.

“Whilst these potential products have been specifically designed to support the increased level of solar-hybrids in the market, we want to be clear that wind projects also remain a key priority and could also access this new product and will still be supported through our existing Generation LTESA product,” Codeville said.

If you would like to join more than 29,000 others and get the latest clean energy news delivered straight to your inbox, for free, please click here to subscribe to our free daily newsletter.