What you learn in this note.

- NSW has always been a net importer of electricity, putting it at risk if other states’ supply demand position changes.

- NSW on present indications will be a much bigger importer after Liddell closes in 2022.

- NSW talks a good talk on renewable energy but offers few actions to support the fine words. Its share of new renewables is far smaller than its share of electricity consumption and this is particularly marked in PV.

- Transgrid has employed Aurecon to map and identify two renewable energy zones in Southern NSW/ Northern Victoria, and in South western NSW that based on resource quality, suitable existing land use and transmission potential access could support 71 GW of new PV and wind. Yes 71 GW.

- Transgrid only has capacity at present to connect 5 GW of new renewables across its own grid. Yet it already has 3 GW of transmission access agreements either done or under negotiation. Under privatized ownership its keen to develop the new renewable zones but this will require early stage transmission investment. It takes longer to build transmission than renewables.

- We think a signal by Transgrid in the form of actually committing to transmission expansion in these zones would be seen as a signal by renewable developers to commit to new developments in NSW.

- New transmission in the South and South west will in any event be required if Snowy 2.0 goes ahead expensive though Snowy 2 will be.

- The NSW State Govt which will likely receive over $3 bn for its 58% stake in Snowy could help push some of that 3Gw of “nearly there” renewables over the line by a reverse auction or some other tangible support. This would be positive for NSW in many ways, energy security, regional development, environmental strength. Marginal seats in say Eden Monaro could benefit greatly.

NSW has generally been a laggard in energy policy

The history of NSW electricity policy has been disappointing over many years. Arguably the worst part of the policy was the “trading rights” auction dreamed up by the ALP and Frontier economics. This eventually lead to Vales Point being sold for $1 million, and the only bidder for Macquarie Generation being AGL.

The Liberals embraced Macquarie’s sale to AGL and this withstood an ACCC challenge in the Australian Competition Tribunal [perhaps it should be renamed the anti competition tribunal].

AGL is showing itself to be a good steward of Macgen but there can be no doubt the merger has contributed to the tight market conditions customers face today.

The State ALP also essentially encouraged the NSW distributors Ausgrid, Essential and Endeavour but particularly Ausgrid, to gold plate their networks. The Liberals put a stop to additional gold plating and then sold off a good part of the networks.

The road to Hell is paved with good intentions.

Having washed their hands of ownership but leaving NSW consumers with ageing coal fired generation, over capitalized networks with high running costs the Govt has then proceeded to move to the sidelines.

Fine speeches by Energy Minister Don Harwin and renewable advocate Amy Kean abound, but actions are few and far between and NSW is obviously lagging.

For instance a tender for 135 GWh (a puny 35 MW) of energy for the Sydney Metro was announced in January 2016 but we don’t think its been awarded yet. I guess prices have fallen. The NSW Govt has a net zero emissions “aspiration” by 2050, but visible support for new renewable energy is slim.

Snowy worth at least $3 bn to NSW and $1.5 to Victoria

For that matter if the Federal Govt ever gets around to buying NSW out of its 58% ownership of Snowy the NSW Govt would get over $3.5 billion on our rough estimates and the Victorian Govt over $1.7 bn.

Snowy, never an open company under “let’s keep it to ourselves” CEO Paul Broad has become even more secretive about its financials than ever.

It’s the people of Australia selling to the people of Australia but the people don’t get to see any numbers, only smart politicians can be trusted with the financials. Based on the FY16 minimalist annual report, which did at least identify the one offs, we get to an enterprise value of $6 bn as follows.

We used 17X ebitda (a very high multiple) because of Snowy’s scarcity value as a large capacity hydro asset. This estimate of value could be wrong by $ billions.

The NSW Govt stake may have been worth as little as A$1 bn back in 2005 when an IPO of Snowy was attempted. Now we are guessing its worth over $3 bn. Anyhow, the money could easily be ploughed back into the electricity sector. Another question is whether Snowy 2.0 a hard rock tunneling project has any value and if so how much of that the NSW and VIC Govts can capture in the sales price.

Lagging NSW – the numbers speak for themselves

Despite those fine words of Harwin, NSW is in fact lagging other States.

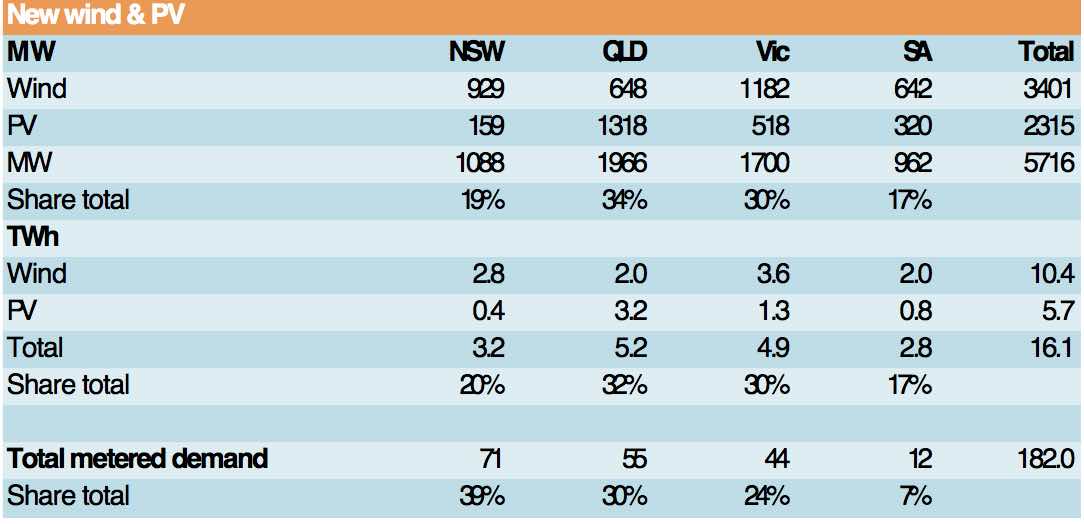

In terms of new build NSW is responsible for about 21% of the total across the mainland States about half of its share of total electricity demand.

As disappointing as the overall figures are, considering that NSW has good resources and relatively low total renewable penetration, it’s the PV market where NSW – 159 MW – is just 6% of the total under development. That’s a real shocker.

NSW is behind in the rooftop market as well, and even in the less than 10 KW household sector NSW performance is disappointing.

The tables above clearly shows how State Govt policies do produce outcomes. QLD with its 50% renewable target has 34% of the MW being built and Victoria with its 40% renewables by 2025 has 30% of the MW with more sure to be developed. Of course Victoria has a real new for more supply since Hazelwood closed.

However, it’s not just the renewable energy target of the State and the policies to support the target that’s important its also the attitude towards transmission.

Queenslan for instance has its powering North Queensland plan. The main element of this is a $500 m (of which $150 m is funded) transmission loop running West of Townsville to basically facilitate the Genex Kidston and Windlab Kennedy energy parks.

That area of North Queensland and the projects announced to date might amount to say 2 GW of generation. A lot of that generation though is still a long way from anything but industrial load.

By contrast in NSW Transgrid has announced it has 3 GW of transmission connection agreements from various project proponents, but as yet none of those are proceeding. If its happening in every other State except NSW, its worth asking why?

In any event about 5-6 GW of renewables are needed to replace Liddel.

Transgrid says it has limited new connection capacity

According to the Transgrid 2017 Transmission planning report only 5 GW of new capacity is available.

Transgrid proposed establishing 3 renewable energy precincts

Transgrid commissioned Aurecon to measure the potential in the South west and Southern renewable zones

Showing both the efficiency of a newly privatized business and with an eye on the returns on offer, Transgrid has gone further than just announce the zones. Its commissioned some preliminary analysis by Aurecon to analyse the potential for new PV and wind development in the South West and Southern Precincts. Aurecon analyzed land at a granular 50 x 50 metre grid based on three criteria.

- Resource potential (irradiance, wind speed)

- Existing land use;

- Access to transmission

The insight was taking account of existing land use. A GW of PV takes about 45 sq km of land. If you try to put those PV farms on prime agricultural land, it will at the least be expensive.

71 GW of high quality resource capacity

The headline conclusions of the study were that between Yass and Balranald (that is the South west Precinct) as much as 40 GW of PV could potentially be installed in sites meeting the study criteria. About 3 GW of wind could be added in that region. In total looking at the South Precinct as well, and recalling that extends to North West Victoria about 71 GW was identified.

This renewable capacity would fit nice with Snowy 2.0 should that proceed, although Snowy 2.0 is only likely to provide and additional 2 GW of expensive (hard rock drilled) pumped hydro capacity.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.

Hear Giles Parkinson, David Leitch, and special guest John Grimes discuss this issue and more in this week’s Energy Insiders Podcast.