Transgrid, the NSW-based transmission company providing the backbone to the country’s biggest state grid, has put out an urgent call for 10 giant spinning machines and 5 GW of battery storage to protect the heartbeat of the grid as it shifts to periods of 100 per cent renewables.

The latest assessment of system strength needs by Transgrid – revealed in its final regulatory document – signals a significant shift in its thinking about new technologies and their ability to replicate the critical system services traditionally provided by coal, gas and hydro.

It now says half of the state’s system strength requirements could be provided by battery grid forming inverters in coming years, and accepts that they are likely to provide all the efficient system strength needed in the future – a major concession to the likes of Tesla and Fluence who have pushed the technology.

But Transgrid argues that in the short term, the NSW grid still needs 10 synchronous condensers – giant spinning machines that do not burn fuel – to support the grid as most, if not all, of the state’s coal fired power generators to retire in the coming decade.

The assessment is included in its new Project Assessment Conclusions Report (PACR), the final step in a three-stage regulatory process that it has now submitted with the AER.

Last year, in the second stage of the process, Transgrid spoke of the need to deploy 8 to 14 syncons – big spinning machines that do not burn fuel – and up to 4 GW of battery storage to protect the grid’s “heartbeat”.

See: The race to protect “heartbeat” of the grid as wind and solar replace coal and gas

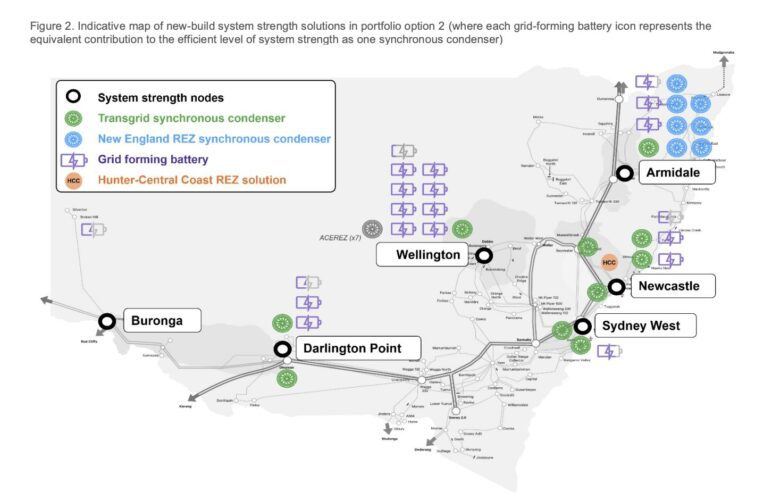

Now it is looking at a mix of 10 syncons, and 5 GW of battery storage inverters (the duration is not important for this service), with other sources including hydro and existing thermal generators.

The syncon requirements do not include the 7 identified for the Central West Orana renewable energy zone, and an estimated 7 for the proposed New England REZ, which will come under separate grid management.

“The NSW grid has traditionally relied upon coal generators to provide system strength as a byproduct of their typical operation,” acting executive general manager of network Jason Krstanoski said in a statement.

“There is now an urgent need to maintain this heartbeat, as we accelerate the transition to wind and solar and as 80% of the coal capacity in NSW retires in the next decade.

“This portfolio of system strength solutions is vital to enable the NSW power system to accelerate the transition to 100% instantaneous renewables, unlocking renewable generation that would otherwise be constrained.”

Transmission companies are responsible for system strength in their respective states, and most have identified a mix of syncons and grid forming inverters as the main solution as coal exits the grid, and is followed by the shutdown of many of the remaining gas generators.

Powerlink recently released its own assessment, identifying the need for 9 syncons, and South Australia – which is already well ahead of the rest of the country in the integration of wind and solar – has already installed four syncons on its grid.

“Our modelling identifies that 5 GW of grid-forming batteries (by 2032/33) provides the equivalent stable voltage waveform support as approximately 17 synchronous condensers,” Transgrid says in its PACR report.

“We expect the 5 GW of grid-forming BESS will contribute to growing confidence in the technology to support system strength and enable testing to potentially contribute to the minimum level of system strength over time.”

That is a significant admission. Battery storage provides, including the likes of Tesla and Fluence, have argued in recent years that their technologies can provide the services needed, but network providers and market operators have been conservative in their thinking because of the lack of demonstration at scale.

In the meantime, however, Transgrid and the other transmission companies are relying on syncons. It would like to install some as early as May 2028, but the huge global demand for syncons means the first are only likely to be available between one and two years later. But it needs to act fast to get in the queue.

Syncons are not cheap. Each of these machines, weighing around 175 tonnes, are estimated to cost around $160 million, and Transgrid says the 10 needed for the overall network will cost a total of $1.6 billion. If further studies on the New England REZ find another seven are needed, that pushes the bill out by another $1 billion.

The 5 GW of battery grid forming inverters would cost around $2.6 billion, according to Transgrid estimates, but because these machines have multiple applications, including storage, arbitrage and other system services, the incremental cost is only very small.

And it says the savings are considerable, more than $8.8 billion in total market benefits, and an extra $1.2 billion saved if syncons can be installed quickly, because it would replace the fuel cost of coal, gas and hydro generators that are switched on just to provide system strength.

Other measures needed to support system strength include enabling 650 MW of existing synchronous capacity so they can act as syncons – often by adding a clutch to remove the requirement to burn fuel. In the Hunter REZ, Transgrid believes that 200 MW battery grid forming inverters could deliver the required system strength.

The issue of system strength and who or what can provide it is an important one. While Australia’s main grid has experienced occasions when there has been sufficient “potential” renewables to provide all demand needs, this has not been allowed to happen because of the need to deliver system services.

However, if Australia is to meet its federal target of 82 per cent renewables by 2030, then it will need to be able to operate its grid at or close to 100 per cent renewables on many occasions.

System engineers say that as coal retires, the grid will operate “at the edge” of its secure operating envelope.

And it is interesting to note that the load shedding that occurred last year when a transmission line tripped in Victoria, taking the state’s largest coal fired generator out with it, was the result of insufficient system strength, rather than a shortfall in electrons.

Transmission companies such as Transgrid say they have been learning more from the likes of Tesla and other battery suppliers about the capabilities of many – but not all – grid forming inverters, and they now accept that many can deliver what it says on the tin, at least in regard to supporting stable voltage waveform.

But on other key measures, such as protection levels of fault current – it’s still a case of wait and see. Which is why Transgrid and others such as Powerlink are insisting that syncons are urgently needed, even if future needs after the turn of the decade are able to be met with inverter technologies.

It will be interesting to see what the battery companies – and dozens were consulted as part of the regulatory process – along with other technology providers have to say when they respond to the report.