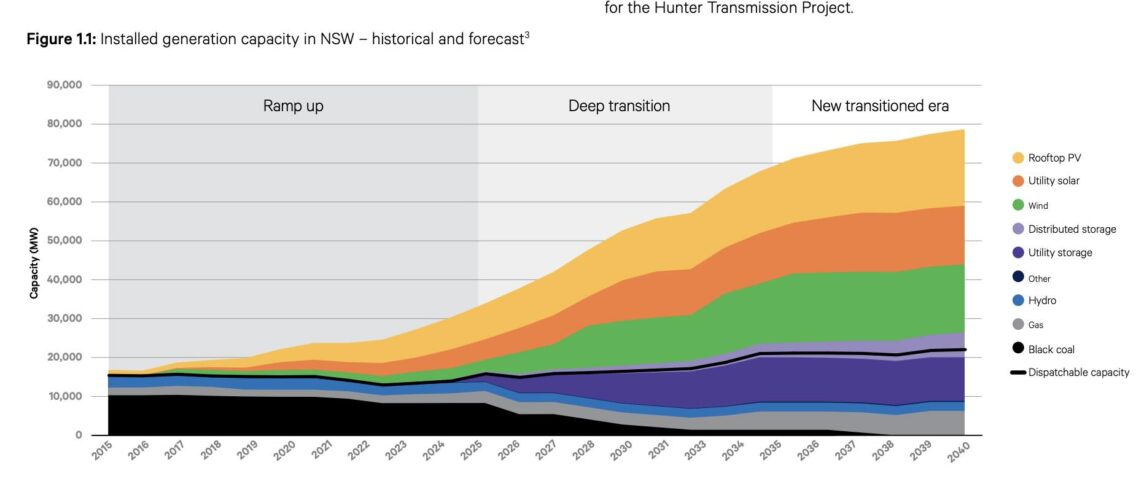

Transmission company Transgrid has laid out an updated plan to support the transition of NSW – still the country’s biggest coal state – to 90 per cent renewables within a decade, and it forecasts some radical changes in the way the grid is managed.

Transgrid CEO Brett Redman describes the next phase of the switch from centralised fossil fuels to renewables and storage as a “deep transition”, with the rapid closure of the state’s remaining coal fired generators, and an accelerated buildout of new wind, solar, storage and transmission.

“We forecast NSW transitioning from the current threshold of about 40 per cent renewable energy, to around 90 per cent in 2035,” Redman says in remarks accompanying the release of Transgrid’s Transmission Annual Planning Report (TAPR).

“It will take the aligned efforts of our entire sector to accelerate progress and ensure renewable generation and security services are ready on time as coal retires so that energy consumers have ready access to more affordable energy.”

Transgrid predicts that by 2035, coal will account for just 5 per cent of NSW’s generation mix – presumably from one or two units at Mt Piper. It will require more than 23 gigawatts (GW) of additional utility-scale wind and solar capacity, and 10 GW of utility storage.

Consumers are also set to invest in another 8 GW of rooftop solar and 3 GW of household battery storage. Large-scale renewable generators and storage will account for over 70 per cent of total generation, with another 20 per cent from household solar and storage.

But this will have impacts.

For the first time, because of the rapid growth in rooftop solar and household batteries, Transgrid is predicting minimum demand in the country’s biggest state grid will fall to zero at times – mostly in spring – by the early 2030s.

“By the early 2030s, the impressive rise of rooftop solar may see minimum demand from the grid hitting zero, a tipping point for how the grid is planned and operated,” Redman said.

On the flip side, the growth of these consumer energy resources, including electric vehicles, will – if well coordinated contribute to the smoothing of demand patterns, even if overall grid demand is highly influenced by the weather.

But the biggest changes in Transgrid’s demand forecasts come in rise of data centre demand and the rapid demise of green hydrogen forecasts.

Demand forecasts for data centres alone have leaped 20-fold since last year’s report, and are now estimated at 6,723 GWh more by 2035, up from 307 GWh forecast a year ago.

Transgrid says NSW network service providers are currently considering around 10 GW of connection enquiries from various data-centre projects, many of them in western Sydney. “Even if a fraction of that capacity goes ahead, it will add significant load to the network,” it says.

The growth in data centres more than offset the radical downward revisions of renewable hydrogen production, now forecast to account for just 817 GWh of annual demand in 2035, less than one sixth of the 5,300 GWh forecast a year ago.

Transgrid, of course, insists that the growth of wind, solar and storage can only be supported by reinforcing transmission lines, and building new ones, to boost the backbone of the grid.

Its operations, however, have been under intense scrutiny because of its stewardship of a number of landmark transmission projects, including Project EnergyConnect, linking South Australia, and HumeLink and the proposed VNI West, which links Sydney to the new Snowy 2.0 scheme and provides a new link to Victoria.

All have suffered delays and blow out in costs, blamed on labour costs and supply factors, which have in turn forced the Australian Energy Market Operator to flag a rethink of future transmission needs beyond those targeted in its most recent Integrated System Plan.

Beyond the power lines, Transgrid also says system security needs must be addressed through a combination of synchronous condensers – spinning machines that do not burn fuel – and battery grid forming inverters that will together require more than $5 billion of investment.

Transgrid is also looking further afield, fleshing out details of plans first flagged in last year’s transmission report to target new lines to remote regions rich in wind and solar – what it describes as remote inland renewable energy opportunities, and to reinforce the main links into Sydney.

“We are processing more applications than ever before from new generators and energy storage facilities wanting to benefit from connecting directly to our transmission network,” Redman said in his statement.

“Since 2024, more than 6.6GW has progressed through key project connection milestones. Connection interest from Battery Energy Storage Systems (BESS) has surged, with more than 3GW achieving or progressing towards commissioning.”