The original Tesla big battery – aka Neoen’s Hornsdale Power Reserve – may have grown in size last year, but its earning shrank in the last quarter as a result of increased competition in one of the key network services market.

According to Neoen’s newly released revenue details for the fourth quarter of 2020, the Hornsdale battery – along with the company’s other smaller battery installations – pulled in just €5.5 million ($A8.5 million) compared to €6.9 million ($A10.7 million) in the same quarter of 2019, largely as a result of “unfavourable market conditions” in Australia for the sale of grid services (FCAS).

The fall is not unexpected, given the number of new batteries in the grid, and the increased competition in the FCAS market. Batteries are now seeking new revenues in other markets for the many different services they can offer to the grid, including “synthetic inertia” that is being trialled at Hornsdale as part of its government-funded expansion from 100MW and 129MWh to 150MW/194MWh.

Over the year, however, the Hornsdale battery did very well for Neoen, driving a jump in overall storage revenues to €32.7 million, up from €20.5 million in 2019, thanks to the bonanza from the major event in January last year when the main link from South Australia and Victoria was blown down by a storm, and the Hornsdale and other batteries played a key role in holding the South Australia grid together, for which they were amply rewarded.

Neoen has also completed the construction of the 20MW/34MWh Bulgana battery, co-located with the 194MW Bulgana wind farm, although this project was delayed and was not yet operating at full capacity in the last quarter. There is also little visibility over how it is performing.

Neoen has other big plans, including a 300MW/450MWh big battery near Geelong in Victoria that will receive a $12.5 million annual payment to provide increased capacity on the main transmission link to NSW at peak periods.

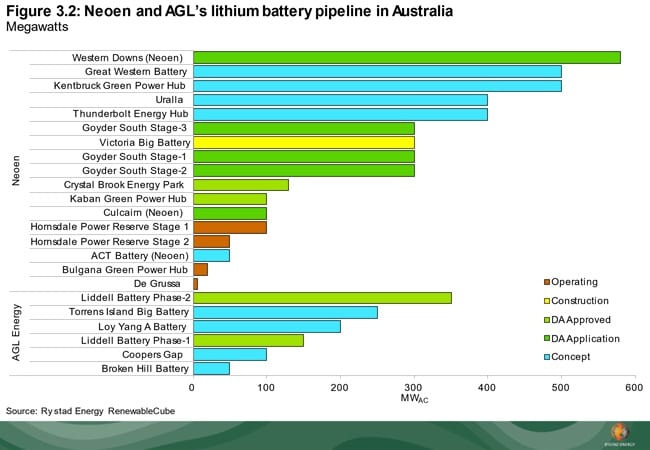

It is not stopping there. This table from energy analysts Rystad shows that Neoen has a battery project pipeline of 17 assets that total 4.1GW of capacity at various stages of development. That makes it the biggest battery storage developer in Australia’s main grid, bested in the country only by the ambitious Sun Cable project in the Northern Territory.

Neoen’s report, meanwhile, shows revenues from its solar plants were up 5% in the fourth quarter, thanks to new plants in El Salvador and Mexico, but it was undermined by relatively poor solar conditions and constraints on one unidentified plant caused by grid upgrades.

It owns the Numurkah solar farm in Victoria and the Colleambally, Griffith, Dubbo and Parkes solar farms in NSW, and is also building the country’s biggest solar farm – the 400MW Western Downs project in Queensland.

Overall wind revenues grew 17% compared to the fourth quarter of 2019, thanks to the contribution from projects commissioned during 2020, especially the Hedet wind farm (Finland), and the early-generation revenue recorded by the Bulgana power plant in Victoria.

It is also the majority owner of the Hornsdale wind farm in South Australia, and has landed contracts for a 110MW wind farm at Kaban in Queensland, and the first 100MW stage of the massive Goyder South hybrid project in South Australia.