When the reliability and emission guarantee policy (the “NEG”) was announced recently, my immediate reaction was that the thrust of this policy was to secure the continued production from “dispatchable” generation.

When the reliability and emission guarantee policy (the “NEG”) was announced recently, my immediate reaction was that the thrust of this policy was to secure the continued production from “dispatchable” generation.

Thermal (coal) generation accounts for the vast bulk of such generation. In the context in which this generation is imperilled by technology change, age and emission reduction priorities, the policy amounted, primarily, to a scheme for the protection of coal generation.

President Trump’s Energy Secretary came up with much the same thing a month ago.

This is Type 1 – immediate, visceral – thinking. It reflects judgment on many things, not least the political imperatives and consideration of the factors that impeded the progress of every other form of emission reduction policy debated in Australia over the last decade.

Now with the passage of time it is possible, for me at least, to engage in a little Type 2 (contemplative, inquiring) thinking.

The document that explains the Government’s NEG is an “advice” letter to the Minister from the Energy Security Board, dated 13 October 2017. The meat of this 8-page letter occupies about 4 pages, with the rest given to niceties and explaining that this new policy is little more than the implementation of Dr Finkel’s report (which it most definitely is not).

At the core is the idea that retailers will be required to demonstrate to the Australian Energy Regulator (AER) that they have firstly purchased a defined amount of “dispatchable” electricity and secondly that the emission intensity of the electricity they buy (or produce) will be better than a defined level.

Both of these obligations are about as clear as mud, but that does not matter too much yet in the early task of properly characterising this scheme.

The letter implies that this new scheme is merely a slight extension of the existing arrangements where retailers enter into contracts to hedge their spot prices.

But this is also not true.

Existing contracts, most of which are traded through the ASX and some are bi-literally negotiated or traded through brokers, are financial contracts.

They hedge spot prices but they do not specify which generator is used. They are just financial transactions – it matters not a jot how the entity that enters into this contract meets it, as long as they are good for the money.

Meeting the dispatch and emission reduction guarantees described in the letter will require physical contracts.

In other words, the contracts will require the delivery of electricity from specific generators whose dispatchability and emission intensity properties will need be defined (by the AER) so that in aggregate the retailer meets the defined dispatchability and emission intensity targets that the AEMC sets and AER administrates.

The AER’s administrative task will be to keep the numbers by checking that the electricity that the retailers buy (and then sell) meets the required targets.

The letter says there is no financial penalty if the retailers do not comply with these obligations. But there is some sort of threat that if they repeatedly do not comply with whatever the requirements for dispatchability and emission reduction are, they will be banned from the market.

In reply to questions, John Pierce, ostensibly the designer of this arrangement (and chair of the AEMC), said that with this scheme there is no emission price.

That is also not correct.

It is true that if there is no defined penalty for not complying (besides a vague threat that the government will ban you from the market) then there is no transparent price either for “dispatchability” (whatever that is) or emission reduction.

But if you are required to buy something that you otherwise would not then of course there is a price even if it not visible.

The letter suggests that retailers can buy international emission permits to meet their emission reduction targets. If this stops the AER from breathing down their neck, they might bother, but if there is no financial penalty for not complying why bother if you can keep the regulator at bay in some other way.

This proposal is a drastic change from the current arrangements. It is the end of the electricity market as we know it. Effectively it puts the regulators (Australian Energy Markets Commission for design and AER for enforcement) at the centre of the industry.

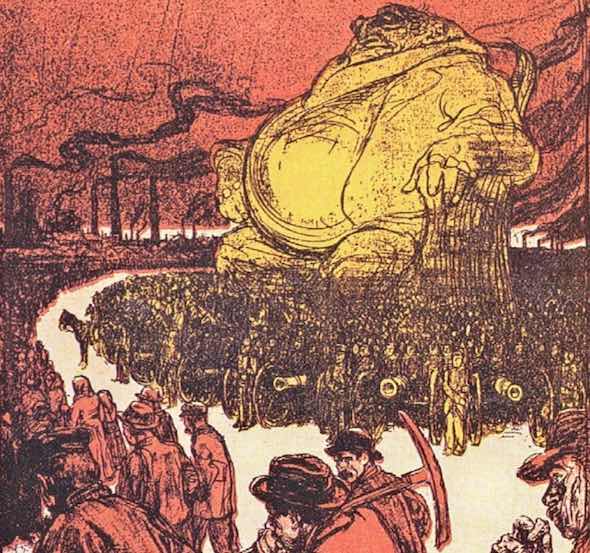

This is the Australian energy equivalent of “Gosplan” (the State Planning Committee) who decided who produced how much in Soviet Russia from 1921 until the dissolution of the Soviet Union in 1991.

The whole thing brings to mind, the edict issue by the All-Russian Central Executive shortly after the 1917 Leninist revolution, that ordered the Commissariat of Finance “to endeavour to establish moneyless settlements with a view to the total abolition of money.”

In revolutionary Soviet Russia, “prices” were the root of all evil. Ditto in Australia in emission reduction policy.

The government has been unable to convince its members to establish a price on emissions. So faced with investment strikes, ageing and increasingly uncompetitive coal generation and international emission reduction commitments, the Government is resorting to command and control to achieve whatever it is that it wants to achieve (which I understand to be the mutually inconsistent objectives of keeping the coal generators going and reducing emissions).

The deceit with this, as with the Commissariat’s attempts to ban money, is that you think by hiding a price there is no price.

The price is there and it will be baked into the instructions arising from the legion of accountants, engineers and lawyers that the AER will need to employ to check over the retailers’ contracts to make sure they tick whatever dispatchibility and emission intensity boxes the AEMC determines.

If the emission reduction obligation is slight the price will be low and all you will have done, besides trashing international commitments, is wasted money on unnecessary bureaucracy (who would like to wager the first draft of the “rules” on this will be more than 200 pages?).

But if the emission reduction obligation is meaningful the price to be paid by emission-intensive plant will not be slight.

To the Machiavellian in our midst that might be the elegance of this approach: here is a way to be all things to all people. It is so ambiguous and internally inconsistent you can read whatever you like into it.

In his marvellous Nobel Peace Prize speech explaining the origin of Perestroika, President Gorbechev explained that Russia’s leadership tired of deceiving themselves and their people. We should avoid getting ourselves into this sort of position in the first place.

So to my mind this NEG should be given a wide berth. But evidently the Government, some market participants (Powershop and Infigen), unnamed other retailers who say they like it the more they look at it, influential analysts (Kobad Bavnagri) and some newspaper editors think this approach is great.

In the popularity contest that is Australia’s energy policy development process today, we might well find that the NEG (whatever it really is) will be our new policy.

In the Socratic tradition, I put this note up for dissection and discussion. If you think I have it all or even partly wrong, please shoot it down and set it right. As balmy as this whole process is, at least it is open and therein lies some hope of maybe arriving, ultimately, at something sensible.

Bruce Mountain is director of CME, Carbon Markets and Economics, an energy consultancy.