If you ever want a clear summary of some of the major data points in climate and energy, probably the best place to start is the annual slide-show put together by former Bloomberg NEF journalist and now analyst and consultant Nat Bullard.

The latest edition contains 200 slides, every one of them worthy of being highlighted in a “graph of the day”. But today, we are going to focus on battery storage, mainly because it has been biggest game changer on Australia’s and the world’s grids in the last couple of years, and the last 12 months in particular.

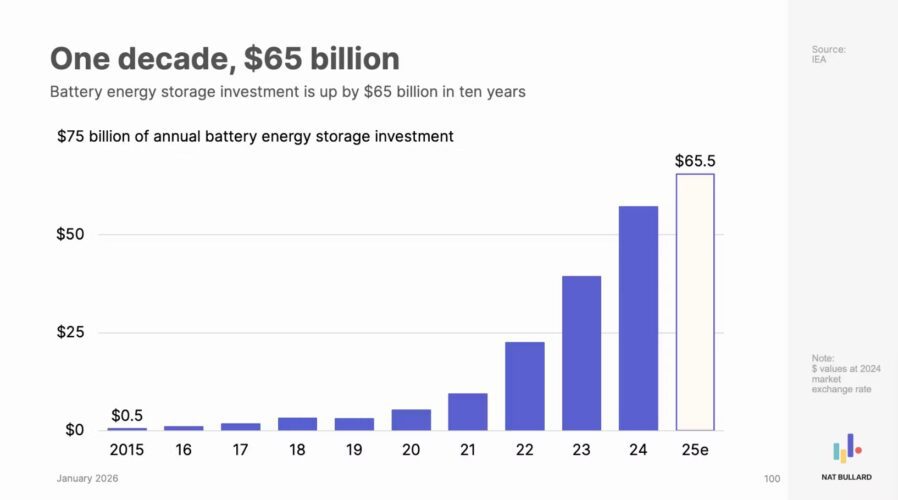

Battery storage, as we have learned over the past year, has been enjoying a plunge in manufacturing costs, similar to those that made solar PV and wind energy ultra competitive over the last decade.

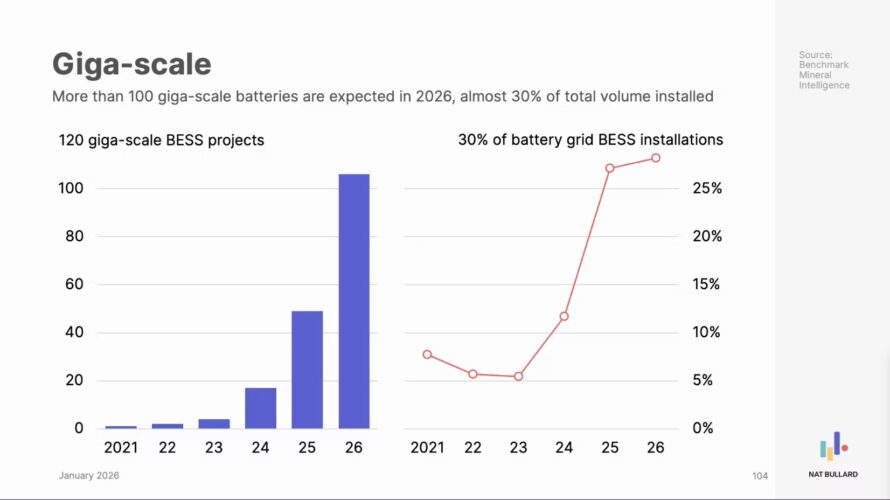

That is the focus of the first graph from Nat Bullard’s presentation. And that in turn has led to a massive increase in the number of expected giga-scale battery projects in 2026 – more than 120 according to Bullard’s numbers.

That is more than double the number delivered in 2025, and will account for 30 per cent of all grid-scale installations across the globe in the current year.

Let’s remember that the first gigascale project was only delivered in 2021, and the first large scale battery of any sort was only switched on – at Hornsdale in South Australia – in late 2017.

The speed and scale of that growth is amplified in the next graph, which shows the growth of spending in battery storage over the last 10 years.

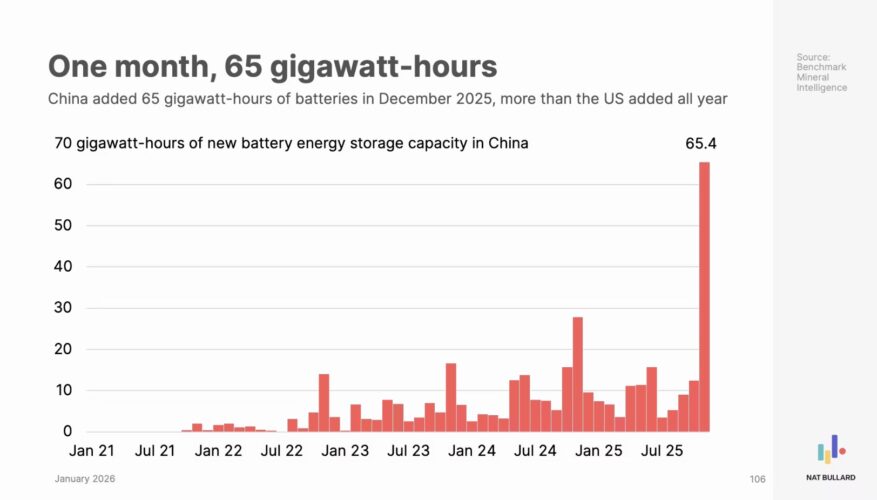

And, of course, a lot of that is happening in China, where much of the battery capacity is made. As Bullard points out, China added more in the month of December than the US added all year.

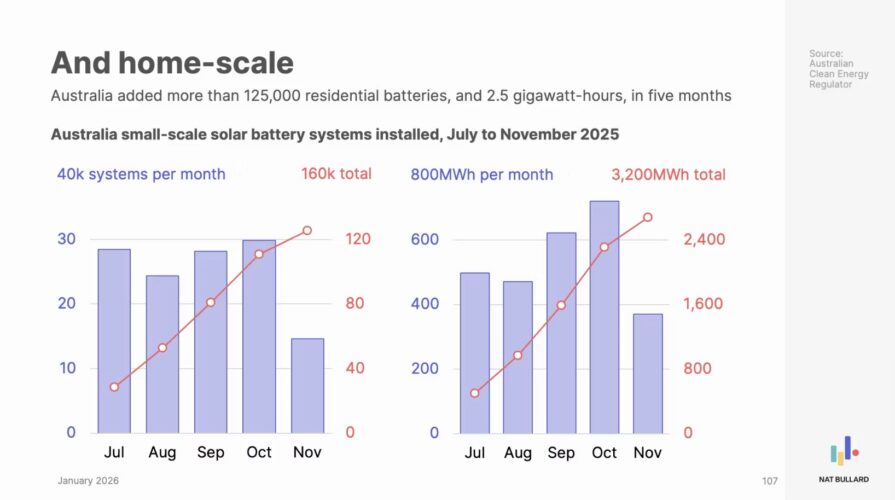

Australia also gets a mention, thanks to the phenomenal success of its home battery rebate.

The Bullard presentation notes that 125,000 installations totalling 2.5 GWh was added in just five months, but that has since jumped to more than 200,000 installations and more than 4.6 GWh since then.

And that brings us to the final graph, and another mention of Australia and the two other grids – Texas and Great Britain – that are leading the transformation to battery storage in terms of grid impact and grid share.

What’s interesting to note about these graphs are the changes from a focus on ancillary services as a source of revenue for battery storage, to a focus on the energy supplied. This is particularly the case in Australia although the extent to which that happens depends on local conditions and market design.

You can find the entire Bullard presentation here – it’s worth a look.