The hottest topic in energy circles right now – apart from dealing with the sheer absurdity of the federal Coalition’s nuclear power plan – is battery storage, the plunging price of battery cells and its implications for a future renewable-dominated grid supported by flexible capacity.

The CSIRO and the Australian Energy Market Operator earlier this month noted in their draft GenCost report that battery storage has been the biggest mover in the last 12 months in terms of price – down 20 per cent from where it was just 12 months ago. An annual assessment from Bloomberg NEF supported that assessment.

Since then, an auction in China – the country’s biggest for energy storage – suggests that the price decline in battery cells, thanks to intense competition, technology and efficiency improvements and boosted manufacturing capacity, may be even more dramatic than that.

According to reports out of China, the Power Construction Corporation of China (PowerChina) has attracted 76 bidders for its unprecedented tender of 16 GWh.

The bids were opened on December 4, and according to PV Mag, has attracted prices ranging from $US60.5/kWh to $US82/kWh, with an averaging of $US66.3/kWh. It said 60 of the bids were below $68.4/kWh.

The tender is for the supply of energy storage systems – specifically lithium iron phosphate (LFP) battery cells – that will be built in 2025-2026. The winners will be announced after another series of round that will clarify supply chains, equipment quality and delivery ability.

The price reportedly includes a comprehensive range of services beyond the delivery of storage equipment, including system design, installation guidance, commissioning, 20-year maintenance, and integrated safety features.

“(These are) mind-blowing numbers,” said Marek Kubik, a co- founder of US-based battery technology company Fluence, and now a director of Saudi green energy project Neom. “(This is) system pricing, not cells,” he wrote on LinkedIn.

This, of course, has great significance for the transition to renewables in the main grid, and potentially the shift to EVs in the transport sector. Battery project prices in Australia have already fallen to new lows – albeit still at a cost of around $A300/kWh, which would include local costs such as planning, labour and balance of plant.

Just last week, new data from BNEF confirmed the CSIRO and AEMO estimates that battery storage prices had fallen 20 per cent in the last year.

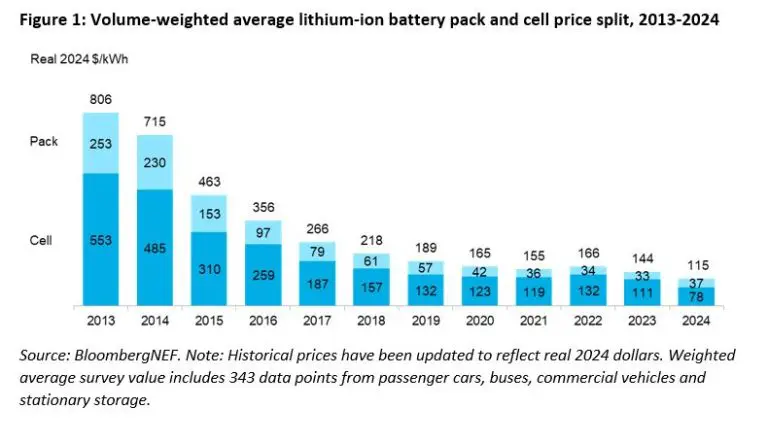

Its data showed that the price of lithium-ion battery packs had seen their largest annual drop since 2017, dropping to $US115 per kilowatt-hour – down from $US806 in 2013 and $US144 in 2023.

BNEF cited a number of factors in the ongoing decline, including cell manufacturing overcapacity, economies of scale, low metal and component prices, adoption of lower-cost lithium-iron-phosphate (LFP) batteries, as well as a slowdown in electric vehicle sales growth.

Overcapacity, in particular, is high, with 3.1TWh of fully commissioned battery-cell manufacturing capacity around the globe, put in place ahead of what battery manufacturers expected to be increased demand for EV batteries.

BNEF says the EV market remains the largest source of battery demand – although it has slowed this year – while the stationary storage markets have “taken off”, according to BNEF, with strong competition across both cell and system providers, especially in China.

“The price drop for battery cells this year was greater compared with that seen in battery metal prices, indicating that margins for battery manufacturers are being squeezed,” said Evelina Stoikou, the head of BNEF’s battery technology team and lead author of the report.

“Smaller manufacturers face particular pressure to lower cell prices to fight for market share.”

BNEF noted that the $US115/kWh price point is a global average. It cited then that battery pack prices were lowest in China, coming in at around $US94/kWh. The latest tender results suggest another 20 per cent reduction is already in train.

However, BNEF noted it is unclear what the future will bring. While low raw material prices have also helped push down costs, these prices could rise in the next few years, with the threat of increasing geopolitical tensions, tariffs on battery metals, and low prices stalling new mining and refining projects.

“One thing we’re watching is how new tariffs on finished battery products may lead to distortionary pricing dynamics and slow end-product demand,” said Yayoi Sekine, head of energy storage at BNEF.

“Regardless, higher adoption of LFP chemistries, continued market competition, improvements in technology, material processing and manufacturing will exert downward pressure on battery prices.”

The China tender is part of PowerChina’s broader equipment procurement plan that were announced on November 13. These includes 51 GW of solar modules, 51 GW of inverters, 25 GW of wind turbines, and 15,240 prefabricated 35kV substations.