A new report has made the case for a renewed focus on the “forgotten giant” of clean electricity – hydropower – and calls on market regulators and governments to provide the right investment signals and market mechanisms to unlock the full potential of the renewable resource in Australia.

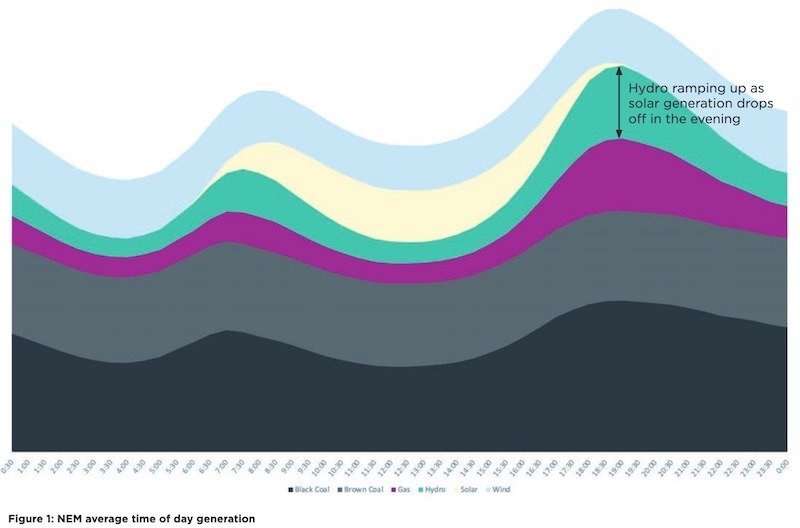

The Clean Energy Council report argues that hydropower, “probably the oldest form of renewable energy generation,” has a unique role to play in the new energy landscape, by supporting grids increasingly dominated by wind and solar power generation.

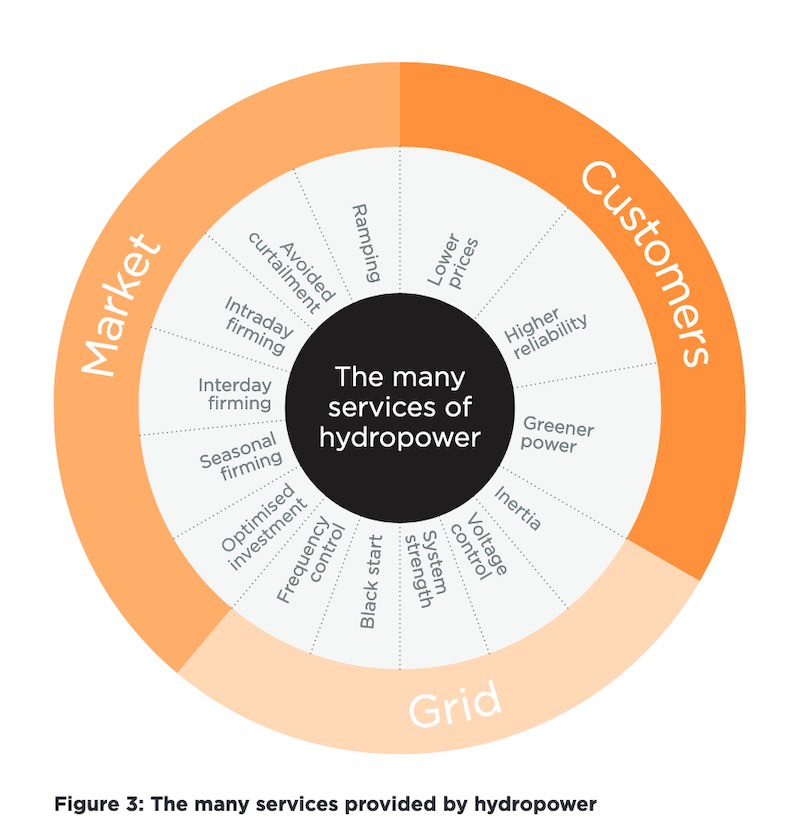

In particular, hydropower is currently cited by the International Energy Agency as the only low-carbon electricity-generating technology that can provide system flexibility within a range of sub-seconds to hours while also cost-effectively storing energy for days to months.

And while these “deep storage” qualities of hydro-electricity generation and pumped hydro systems make them ideal partners to variable renewables, the CEC believes they are being overlooked by the market compared to other technologies – namely batteries.

While there is roughly 15GW of pumped storage hydro projects in the Australian development pipeline, only 2.3GW-worth have progressed to financial commitment since the beginning of 2017, the report says, compared to 27 battery storage projects with a capacity of 1.5GW.

This difference in deployment rates largely reflects the higher degree of complexity, the scale and costs of pumped storage hydro projects, relative to battery projects, but the report argues that a lack of clear market signals to value the services hydropower is also to blame.

As things stand, few, if any new hydropower projects are being developed in Australia without substantial government support, with the federal Coalition government’s pet Snowy 2.0 project in New South Wales offering the obvious example of this.

Snowy 2.0 will have a rated capacity of 2,000MW and storage of 175 hours, or 350,000MWh. The company, and its enthusiastic backers in the Coalition government, from Turnbull to current prime minister Scott Morrison and energy minister Angus Taylor, have argued that it is essential for a grid transitioning to renewables.

But there has been fierce debate about whether it offers the best value for money. Recent analysis has found that the combined cost of Snowy 2.0 is heading to $10 billion or more, with transmission costs of the Hume Link resulting in a “dead weight” loss of more than $4 billion and possibly more than $6 billion.

Critics of the project have argued it would have been smarter, more useful, quicker and cheaper to build alternatives such as battery storage and smaller pumped hydro projects elsewhere.

The other project under construction is the Kidston pumped hydro project in north Queensland, also heavily dependent on government support, this time through NAIF, and as RenewEconomy reported last week, there is only one large scale pumped hydro proposal left standing, but as yet still not committed, in South Australia.

CEC chief Kane Thornton says there are investors out there willing to finance the high up-front capital cost to build new hydropower and to refurbish existing assets – they just need to know that their projects will recover their investment and be duly rewarded for the services they provide customers and the energy system.

“Unlocking the full potential of hydropower, therefore, requires market reforms that incentivise these services as well as strategic investment that underpins new investment and critical network expansion and augmentation to ensure strong connection and access to the energy grid,” Thornton said on Wednesday.

Ironically, this is the same sort of argument developers of big battery storage projects have been making, in calling for market reforms to ensure that the full “value stack” of battery services is being recognised, fully utilised and adequately remunerated.

As RenewEconomy has reported, this is no easy task for regulators, because batteries straddle both network services and generation. In one millisecond they are providing critical grid services, the next they are storing excess wind and solar power, or injecting power back into the grid.

But change to market frameworks is happening to accommodate batteries and, the report argues, must to continue to evolve to reflect the true value of the particular services delivered by hydropower, such as medium- to long-period energy reserves and contributions to system security such as inertia and fault level.

Another recommendation the report makes to help drive investment in hydropower in Australia is the provision of mechanisms and support programs to lower the risks of investment in new and existing assets.

“Hydropower projects are highly capital intensive and involve long construction timeframes,” it says.

“The current contract market in the NEM only provides forward price visibility approximately three years in advance. With construction periods for hydropower assets reaching to over five years, there is no way for developers to know what revenue stream their investment will achieve between the time that construction commences and commissioning