In opera, the internet tells us, the tenor is the one with the highest male voice, known for a bright and powerful sound, and is often used to portray heroic or romantic characters. Among the most famous of them are Luciana Pavarotti and Placido Domingo.

In the renewables industry tenor has a different meaning – it refers to the length of a loan or contract. And while some wind and solar people may have delusions of heroism, romance and influence on a big stage, for the most part they just want to make money.

Tenor is important to wind, solar and battery projects because it has a major influence on the ability of developers to land sufficient finance to go ahead with their investments. The longer the tenor, the better.

But many utilities and customers are reluctant to commit too long because of long term uncertainties. And that creates uncertainty which affects bank appetite for long duration finance. The more certainty, the cheaper the finance.

Providing some certainty been the central thinking behind the renewable energy target and the new Capacity Investment Scheme.

There is no such problem for a large part of the energy industry, the infrastructure. These are monopolies, and heavily regulated, and get a guaranteed return on their investment, paid for by the consumer.

There is no such guarantee for generation projects. But, as Jorn Hammer, the Australian head of Danish renewable giant Copenhagen Infrastructure Investors noted last week, the assets he is looking to invest in have a 40 year life.

In that time, those assets will experience at least 13 federal election cycles and countless state ones. And with the lack of a bipartisan approach to the green energy transition and climate policy in Australia, that creates a lot of if, buts and doubts.

“We need a scheme where some of the volatility is shared with the policy makers,” Hammer says. “So I think the market is very capable of assessing the next five to 10 years and making a decision around that.

“So adjustments to the CIS (Capacity Investment Scheme) that we would like to see is more focusing on the back end of the investment timeframe than the front end.”

Tim Nelson, the head of the panel looking at changes to Australia’s electricity market to make them fit for purpose for a grid transitioning rapidly to wind, solar and storage, a shift from centralised power to distributed energy, and from “baseload” to flexible and dispatchable resources, says the issue of “tenor” is one of his major considerations.

Source: Tim Nelson, Griffith University.

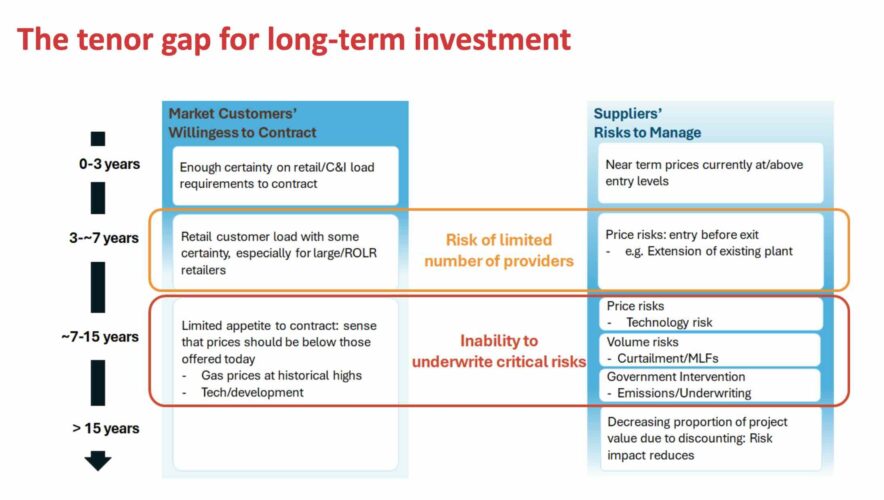

At the moment, contracting over the short term is no problem, because there is enough certainty in the market for retailers and commercial customers to sign up to contracts.

The medium term – from three to seven years, the situation is OK, particularly from big customers, but policy uncertainty around issues such as the closure of coal plants raises price risks, and increases uncertainty.

The biggest headache is over the longer term – seven to 15 years – because of the multitude of risks around technology, price, volume and the extent government intervention on key policies such as emissions and underwriting.

He presented the above graph at the forum last week.

“You have heard me talking on the Renew Economy podcast with David and Giles about this tenor gap,” Nelson said. “And we’ve tried to synthesize this on this particular slide, where we’ve got on the left hand side the market customers’ willingness to contract in terms of time frames, and some of the issues that they’re thinking about as reflected in the submissions to the panel.

“And on the right hand side, we’ve got the suppliers and the risks that they’re thinking about how they have to manage over those same time frames.

“And just put very simply, there’s just a gap between the two customers and retailers saying, with all of those risks in place, they prefer to sign shorter term contracts generators and financiers, saying, to get that finance, we need some longer term contracts.

“So that’s an obvious example of a problem that the panel is trying to think through, what does that that look like on the term?”

Tilt Renewables CEO Anthony Fowler agreed.

“I think is we have three horizons, kind of short term horizon, the medium term horizon or long term horizon. Short term horizon is the spot market. The spot market demand works pretty well.

“Sometimes we don’t like what it’s telling you, particularly if you’re a wind producer and the price is negative, and you shut up for your wind farms, tells you something you don’t like, but it’s factual. It’s telling you the systems in oversupply. It works very well.

“The medium term is more of a derivatives market. Generally, those work quite well as well. There’s enough, there’s sufficient liquidity. Most of the risk that you want to manage for the long term horizon has worked okay.

“But I think (the issues) have been obscured in more recent times by the constructive actions of a number of very progressive businesses like the Rio Tinto and the Telstras and the Coles and Woolworths that have written long term PPAs for companies like ours, and they’ve done a fantastic job of helping the renewable energy builder and God bless them.

“But I don’t I think that market is quite saturated now. There’s not much more capacity available for business like like ours to sell, so we need to be able to find a way to pay off assets which might have a 30 year old life and the market stand alone doesn’t provide that signal very well.

“We do have an effective stock gap, which is the CIS scheme that is incredibly valuable for businesses like ours. It’s not a perfect scheme, but it’s very, very valuable. We’ve got one in the bag for the Palmer win farm, and we’d like to have many, many more, but those are great for investors like ours, and we are owned by infrastructure investors, and

“Ultimately, a lot of that money comes from superannuation funds and pension funds, and for them to know that there is a collaring to the amount of risk that their equity is exposed to is incredibly helpful.

“So I think something like that is going to be required for some years to give the investment signals for businesses like ours to have the confidence to invest.”

Some, of the issues, of course, are being addressed by state bodies, such as the newly created SEC in Victoria and the ESC in NSW, which are focused on getting some key projects over the line, including in NSW for harder to do technologies such as pumped hydro.

Both are working to tight deadlines, as both states have fleets of ageing coal fired power generators that are getting expensive to run and maintain, and are becoming increasingly unreliable, and are the main threat to grid reliability, according to the market operator.

Victoria is working to meet its legislated target of 95 per cent renewables by 2035, while NSW faces the reality that at least three, and possibly all four, of its remaining coal fired power stations will be shuttered by that time.

Simon Corbell, the chair of the new State Electricity Commission in Victoria, notes that the company has already backed a major battery project, and bought (some would say rescued) the Horsham solar project and added a battery. It plans to support 4.5 GW of new capacity.

“These (state investment companies) are all working to enable more private investment, and certainly in Victoria, we want to invest with private investors, because we want to close some of those system gaps and help more projects get delivered because we have a more patient view around our return expectation compared to a private investor.”