− Volumes :. Volumes were basically flat during the week compared with previous corresponding period. Looking across the National Electricity Market and the major States volumes are up on calendar year to date, but only due to QLD. NSW is now flat and Victoria down 1%. Volumes in South Australia are up 1% for the CYTD. Looking at prices though you would think volumes had doubled. The volume performance over all is reasonably encouraging from a conservation point of view and higher prices at both the generation and network side of things should work to constrain demand and eventually boost supply.

− Future prices: Futures prices rose again during the week with the high light being the 14% jump in the time weighted average for FY17 in Sth Australia. This in turn was driven by a large increase in the Sep 16 contract which has more than doubled in price since April.

− Spot prices: Spot prices were once again dramatically higher than last year with South Australia seeing 3 days over $500 MWh including one at $1200 MWh. The highest price in South Australia was $8898 MWh and the lowest $13 MWh.

− REC Gas prices : REC prices were unchanged according to Mercari and as far as we can see the market is very thin and illiquid

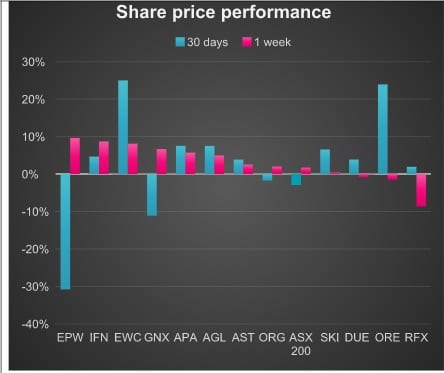

− Share prices: Despite AGL’s advice that gas profits would be down its share price actually rose over the week no doubt reflecting some optimism that electricity profits will more than make up for any gas declines. We share that view. In addition there may be a small amount of pricing out perceived risk of more climate change action had the ALP won power. By and large utility investors spent the week on the sidelines, with little clear direction in trading. The rally in oil prices has paused for the time being and we are now in “blackout” for June or December balance date companies. As ever during reporting season its mostly not the earnings themselves that are of interest but the management outlook statements.

Share Prices

Volumes

Base Load Futures

Keeping the focus on South Australia

The chart below is a summary of South Australia for the period Jun 1 2016 to July 10 2016, the average price received by gas generation (shown on chart as gas price) was $172 MWh and for wind $107 MWh. When gas demand in South Australia is over say 1GW the price goes through the roof.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.