In the past week we added another 650MW of projects to the pipeline of “under construction” utility-side variable renewable projects, consisting of the two Innogy PV farms in NSW and 115MW Granville Harbour wind in Tasmania.

Excluding the now “old hat” 800MW of Hornsdale, Ararat, Kiata and White Rock wind and Kidston PV, ITK’s spreadsheet still has 3.3GW of wind and 3.4GW of PV as either commissioning, under construction or certain to proceed.

And there is still, at a minimum, another 650MW from the VRET auction. Without listing the individual projects, Fig 1 shows a total of 7.1 GW. Of course, these numbers also exclude the behind-the-meter PV, probably 3GW between say Jan 2018 and Dec 2020.

It’s incredible how little attention this gets from the mainstream media. And yet, on the other hand, it’s also fair to say that the new projects are mostly fairly slow coming on line.

Frankly, here at ITK, we significantly underestimated how long it takes a new PV plant to go from initial energisation to full production, and to some extent the same is true for wind.

And this is a typical problem in forecasting – it’s the difference between what you can observe today and what you know will happen in the future. New capacity casts a long shadow.

Converting the above capacity into energy, assuming about a 38 per cent capacity factor for wind and about a 28 per cent for PV, coal at 85 per cent and the gas reciprocating firming power at say 15 per cent, what I get is about a 10 per cent increase in energy supplied.

In NSW, this still won’t replace Liddell, let alone the other coal stations, but everywhere else there will be a net increase. A short-hand assumption is the increase in behind the meter cancels energy demand from ongoing population growth.

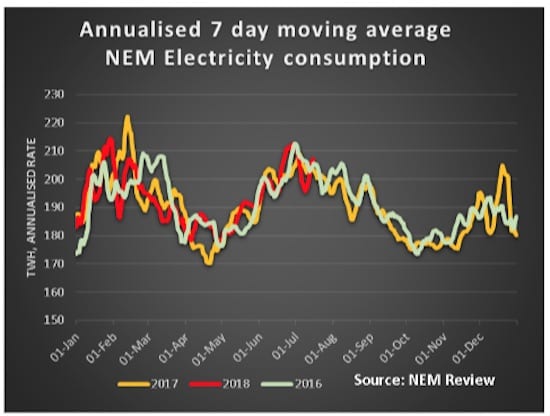

So, in front of the meter demand is basically flat. Lower prices will increase demand, and that’s another reason why a carbon price is a good idea. … I’ll get my hat.

At zero marginal cost and with the exception of some potential wind curtailment, the new supply will find its way into the market and impact price. Keep watching this space. All that said, the impact of new supply on spot prices today is largely invisible. And that’s the crunch.

The market action –

Spot prices spiked heavily in South Australia, gas prices rose and electricity futures fell.

Internationally it was a quiet week, but coal prices continued to rise. Utility shares negatively exposed to the ACCC report took a hit – and that includes wires and poles shares which also received a blow from the AER’s WACC review.

The AER’s decision that beta is 0.6 and the Market risk premium is 6 per cent are entirely reasonable choices. We’ve been using a market risk premium of 6 per cent for more than 20 years and lower interest rates if anything would drive it down.