The Australian CleanTech Index recorded a gain of 2.0% for the month of December and 3.9% for the second quarter of the 2017 fiscal year.

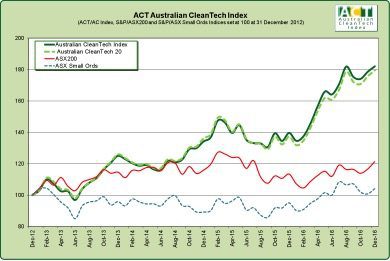

Whilst these figures were behind the wider market, the six and twelve month performance remains well ahead of both the ASX200 and the ASX Small Ordinaries.

Over the last 12 months, the Australian CleanTech Index recorded a gain of 30.4%, 23.4% ahead of the ASX200 and over the last 3 years, the Australian CleanTech Index leads the ASX200 by 40%.

The market capitalisation after its rebalance of the 62 stocks in the Australian CleanTech Index is A$32.0 billion setting a new record for the sector.

The month’s performance was driven by 7 companies with gains of more than 15%. The greatest percentage gains were recorded by Australian Vanadium (AVL), Sterling Biofuels (SBI) and Intec (INL). The greatest gain in market capitalisation over the month was from Cleanaway Waste (CWY).

The quarter’s performance was driven by 8 companies with gains of more than 25%. The greatest gains were recorded by Carnegie Clean Energy (CCE), Actinogen (ACW), Sterling Biofuels (SBI) and Intec (INL).

The best performing sub-sectors for the three months to December 2016 were the Australia Waste Index, led by Sims Metal Management, and the Australian Efficiency and Storage Index, led by Galaxy Resources.

The 2016 performance of the Australian CleanTech Index strongly outperformed the China CleanTech Index that tracks all 162 Chinese-based listed cleantech companies with a combined market capitalisation of US$306 billion. The Chinese market fell 19% over the year significantly underperforming the 30% gain in Australian cleantech companies.

The full quarterly performance report can be downloaded from the Australian CleanTech Index webpage.

John O’Brien is director of Australian Cleantech.