Intersolar North America was my first solar conference since Solar One on Queensland’s Sunshine Coast fed solar electricity into a state power grid for the first time in 1993. In the ensuing years, the lack of interest by government and utilities forced me elsewhere, but now the tide seemed to be turning with 900,000 PV residences in Australia alone. That, by the way, is a compound annual growth rate of 100 per cent.

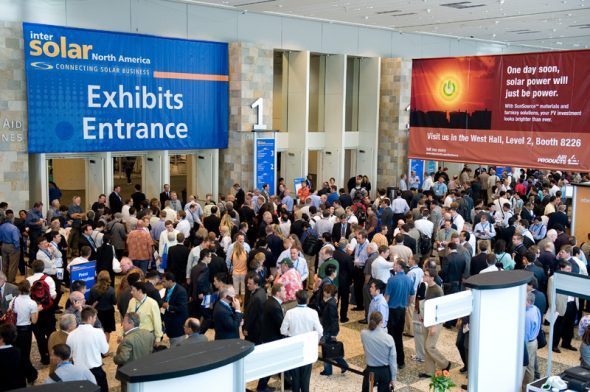

The first impression of Intersolar is somewhat like a grade school student walking into the New York Stock Exchange. This is a place for grown ups, and there is the heavy smell of money. The corporate armour of suits and ties dominate, while blond, shapely women – some dressed as German fraulines strait out of Octoberfest – stand at many of the 800 exhibitor booths and smile to lure the 22,000 attendees with the standard giveaways of pens, bags and a ‘flower’ that tracks the sun. Wow.

Three giant halls of the Moscone Center in San Francisco with its 675kW PV array, herald that mainstream solar is here to stay – on the surface, at least. Dig a little deeper and all is not well in the kingdom. These are tough times, particularly for PV where supply exceeds demand. The euphemism is ‘consolidation’, but it’s really the same tech story – bigger be better. Minnows are just the next meal for bigger fish, and the biggest fish are just noticing how much food there is.

At it’s best, the consolidation underway is the ‘creative destruction’ that is at the core of the grand capitalistic bargain. Typewriters give way to computers. Fixed line to mobile. Wires to wireless.

But there are consequences – some very unintended. Chinese panels dumped onto the US market have been slapped with import duties ranging from 31-250 per cent. Smaller companies who could not afford the bond required for panels imported since last September have had to exit the market and send their panels to other markets, including Australia.

The Exhibition was dominated by PV, but there was a distinct lack of building integrated PV products. Stacie Campbell from PV panel manufacturer, Hanwha says unlike Europe, the US market is still maturing and most product is roof mounted. Because BiPV is most cost effective in new construction, the lack of demand can also be traced to the US economic woes. Even so, the US is poised to become the fourth largest PV market this year.

The economic slowdown has also created opportunities for small metal fabrication companies. An entire floor of the exhibition is reserved for companies selling mounting structures and components, including an increasing range of suppliers of extruded plastic and ballasted mounting structures for commercial roofs that require no roof penetrations.

For module manufacturers, the current situation can be summed up in an overheard conversation by two execs: “it’s getting harder to differentiate”. One bright spot (no pun intended) is the evolution of smart panels with optimisers built into the junction box, some with wireless capabilities that can easily communicate failing panels. The Tigo Energy maximiser, for example, is being integrated into Yingli, UpSolar, Trina, Astronergy and Hanwa panels. At a cost of roughly $0.20 per watt, Tigo sales manager, Jacqueline Tash, says the technology can increase output by up to 15 per cent as panels age and string mismatch increases. Integrating the technology directly into the panels will cut this cost by roughly half, she says.

Suntech is one panel manufacturer not following this trend. Dr Stuart Wenham, the company’s chief technology officer and Director of the Centre of Excellence for Advanced Silicon Photovoltaics and Photonics at the University of New South Wales in Australia, told RenewEconomy the analysis ‘isn’t that simple’, particularly as the price of panels has come down by a factor of 4 in the last four years.

“Panels are so reliable with 25 year warranties, but electronics don’t match that,” he says, adding it’s questionable whether the cost and reliability of electronics is worth the extra gain. “We don’t like to compromise our systems in this way.”

As for those 25-year warranties, Wenham points to several 30-year old panels that have come in from rough Australian environments and are still generating 95 per cent of the rated output. When asked about thin film technology, the Australian scientists was quick to point out that “99 per cent of the people in the industry today weren’t around in 1980 and don’t know their history.”

“In 1980 when I was establishing the first module manufacturing operation in Australia, I was told thin films would dominate in five years. In 1985, I was told it would be in another five years. In 1990, experts from ARCO Solar said it would be another ten years before thin films displace silicon wafers.”

Every type of thin film developed in last 20 and 30 years, he says, has durability problems and can’t survive in hot environments for more that 10 years. “The efficiencies don’t match and no technology comes close (to wafers) on durability”.

Wenham believes thin films will ultimately be successful, but not for 20 years and not using current materials like copper indium gallium selenide or cadmium telluride.

In San Francisco style, the conference ‘dinner’ event was a battle of the solar bands that featured musicians from their own company. The standard playing songs such ‘Midnight Hour’ was so good, the bands could take comfort in the fact that if the industry does go pear shaped, they can still make a living. Then again, the alcohol was free to the 1000 or so ‘fans’. Thank you SMA.

The final day was, understandably, subdued. Walking out of the exhibition on the last day, the overall impression was of an industry acting a bit like teenagers, a lot of promise but still a LOT of developing to do. Many companies and money will go swirling down the drain in search of profit, but there is an unstoppable force.

As Jari Pedersen from Xtreme Power put it: “You can’t stop this. There is too much momentum. This is going to happen.”

Peter Fries is a journalist, filmmaker and solar investor. He coordinated and funded the Solar One Project

Copyright 2012 Peter O Fries. All rights reserved