The downward trajectory in Australia’s electricity sector emissions, achieved before and during the brief existence of the carbon pricing scheme, has effectively been reversed under the Abbott government, a new report has found, as the nation’s coal-fired generators power up to meet increasing consumer demand.

The latest Cedex report from carbon emissions analysts pitt&sherry has also confirmed that the “historically unprecedented” era of falling electricity demand seems, after four-and-a-half years, to be coming to an end, under a government that has done little to encourage energy efficiency, and even less to support the addition of renewable generation capacity.

According to the report, released on Monday, total electricity emissions in the NEM increased by 6.4 Mt CO2-e – or 4.3 per cent, and a little over 1 per cent of total national emissions – in the year to June 30 2015, compared with the year to June 2014.

As the report notes, and the table below illustrates clearly, the latest Cedex data reinforces what it has been reporting for most of its three years of emissions updates: “that the carbon price had very little direct effect on demand for electricity, but a very big effect on emissions from the generators supplying demand.”

And now, the removal of the carbon price – it was abolished by the Abbott government almost exactly a year ago – is one of the factors supporting a return to increasing electricity demand; particularly, as you can see in the second graph, from black and brown coal generators.

According to the report, the black coal share of total sent out generation increased by 1.1 percentage points to 51.5 per cent and the share of brown coal by 2.1 percentage points to 24.3 per cent. The total coal share in the year to June 2015 was 75.8 per cent, well above its share of 72.7 per cent in the year to June 2014, but below the 78.1 per cent level in the year to June 2012, on the eve of the carbon price.

As the graph shows, and the report notes, the emissions reduction during the carbon price period was mainly due to hydro generation replacing brown coal generation – a trend that was driven by the commercial strategies of Hydro Tasmania and Snowy Hydro.

But over the next year, the report says, coal seems certain to increase its share at the expense of gas, while wind generation “will inevitably stagnate” due to the lack of new construction over the past two years, due to extended policy uncertainty.

Over the past 12 months, it says, the share of gas generation fell slightly, to 11.9 per cent, and seems almost certain to fall further. Hydro, meanwhile, fell very significantly over the past year, while wind generation increased steadily by 0.5 percentage points, to 5.4 per cent.

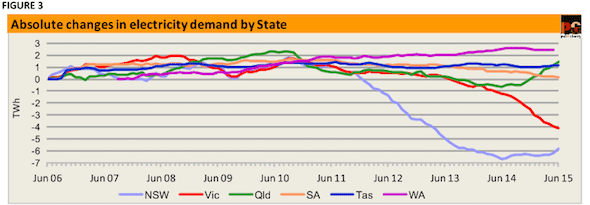

Meanwhile, general business and residential electricity demand in each of Queensland, NSW and Victoria, was higher in 2014-15 than in 2013-14, after falling in each of the previous four years in succession, the data shows (see chart 3, below).

“These figures understate the rebound in what AEMO calls “underlying consumption” of electricity, because they do not include electricity supplied by embedded generation, most particularly rooftop PV,” the report notes.

“When these figures are added to demand supplied through the NEM, the turnaround in the total quantity of electricity being used by general business and residential consumers becomes sharper. According to AEMO’s figures, underlying consumption in the NEM fell by five years in a row, from 2009-10 to 2013-14, the last year by 2.1 per cent, but in 2014-15 is estimated by AEMO to have increased by 1.4 per cent.

“AEMO expects the new trend of slow growth in this demand to continue,” says the report, “and we see no reason to disagree with this assessment.”

This demand growth, the report adds, will likely provide a further stimulus to coal generation – in particular, black coal-fired generation in NSW.

“In summary, therefore, it seems as if the historically unprecedented era of falling electricity demand is, having lasted for four and a half years, now coming to an end,” the report concludes.