Australian households and their consumer energy resources – rooftop solar, electric cars, heat pumps, and electric cooktops – will play a critical and central role in the accelerating transition to renewables, and that may mean less dependence on large scale projects.

There is a renewed focus on consumers and households in the draft 2024 Integrated System Plan prepared by the Australian Energy Market Operator, partly because of Australia’s love of rooftop solar, and also because they are going electric faster than anyone thought.

And also because the thinking round rooftop solar, consumer energy resources and their potential in the grid is changing rapidly – previously thought of as an indulgence and an annoyance, and even a threat to grid security, they are now regarded as essential asset in a future renewable grid.

“Rooftop solar is now three times as common in Australia as backyard pools, and is capable of meeting 48 per cent of underlying energy demand across the NEM in the middle of a sunny day,” AEMO notes in the draft ISP that was released on Friday.

AEMO says rooftop solar contributed 12.1 per cent of the total generation in Australia’s mai grid in the first quarter of 2023, which was more than utility-scale solar (7.5%), wind power (11.6%), hydro (6.1%) and gas (4.6%).

“This is the first wave of consumer investment in their own energy transition,” the report says.

“All-electric homes with batteries and rechargeable electric vehicles are gaining popularity. Early adopters are taking control of both their energy costs and their emissions footprint.”

It notes, too, that governments are encouraging these changes, with the ACT and Victoria both phasing in bans of new residential connections to the gas system.

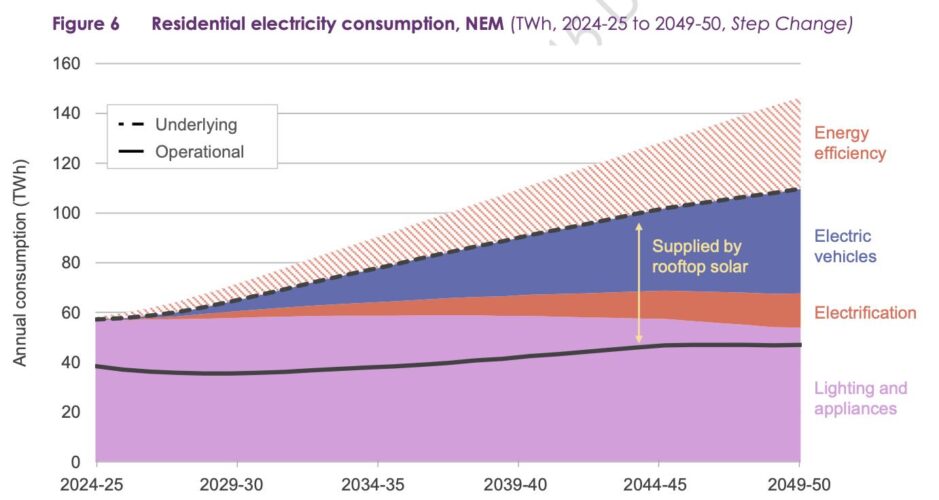

The embrace of EVs, and electricity for heating, cooling and cooking will likely mean that household electricity consumption will soar nearly four-fold to 150 terawatt hours a year by 2050.

But the combination of more efficient appliances, and the fact that households will have so much solar on their rooftops, and battery storage, means that their consumption from the grid will remain at around 40 TWh a year, little changed from today.

“Taken as a whole, households are forecast to draw about as much from the grid across a year in 2050 as they do now,” the report says.

“Their EVs and appliances will drive up underlying consumption, and be offset by their investments in rooftop solar and energy efficiency.

“Individual households will differ in how they rely on the grid. Many will continue to be without rooftop solar and draw electricity from the grid, while those with solar may export excess energy during the day and import from the grid overnight.

AEMO says Figure 6 (above) shows how electricity use for existing home lighting and appliances currently makes up almost all residential consumption.

As households charge EVs and use more electricity for heating, cooling and cooking their total consumption increases to 150 TWh by 2050. However, uptake of energy efficient buildings, appliances and behaviour will offset this increase, resulting in underlying consumption of 110 TWh.

Rooftop solar further reduces reliance on the grid to only 40 TWh across the year by 2050 – about the same as what it is today.

There will be some complications, and challenges to be overcome as the management of the grid switches from a focus only on centralised power stations to distributed and consumer focused resources.

“Households can draw electricity either direct from their rooftop solar, from the grid, from their household or community batteries, or even from EVs that are able to discharge their batteries,” the report says.

“Many consumers are taking more direct responsibility for their energy needs, particularly as they rely more and more on electricity. Increasingly, they are investing in solar systems, batteries,EVs, and other energy management solutions.

“Virtual power plants (VPPs) are starting to aggregate those assets into larger systems, trading energy between them and the grid, and maximising the system benefits that these resources can provide.

AEMO says one third of detached homes in the NEM have rooftop solar, and this is expected to jump to 50 per cent by 2034 in its core Step Change Scenario, and reach 79 per cent of detached homes in 2050, driven by mostly by the ever-falling costs of rooftop PV.

That will lift total rooftop solar capacity of all homes to around 72 GW.

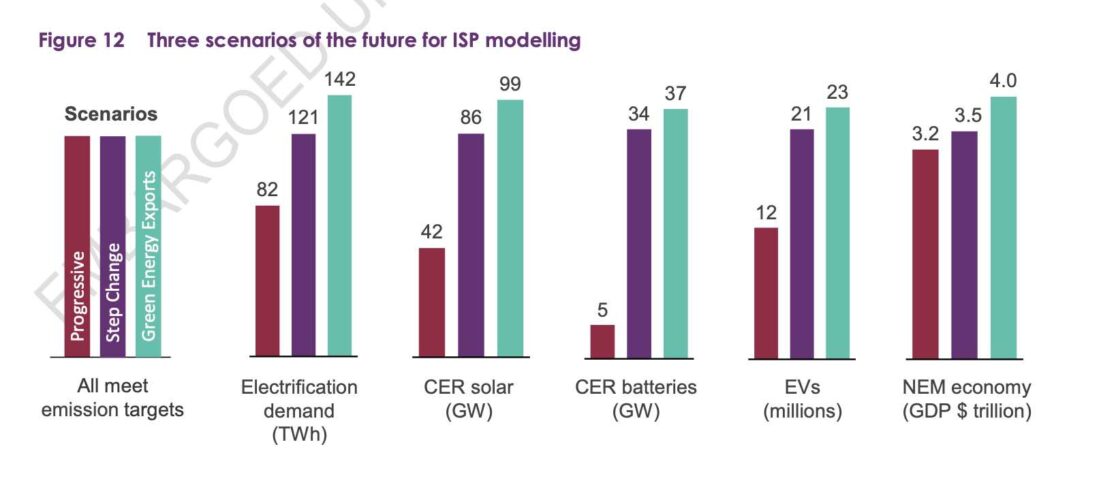

It notes that residential and commercial batteries are becoming more numerous as costs decline, with adoption forecast to grow strongly in the late 2020s and early 2030s. The Step Change scenario forecasts growth in capacity from today’s 1 GW to an estimated 7 GW in 2029-30, and then 34 GW in 2049-50.

EV ownership is also expected to surge from the late 2020s, driven by falling costs, greater model choice and availability, and more charging infrastructure. By 2050, between 63% (Progressive Change) and 97% (Step Change) of all vehicles are expected to be battery EVs.

It says this growth in consumer energy resources will reduce the need for utility-scale solutions, particularly if the assets can be coordinated or ‘orchestrated’ to complement and support the grid most efficiently.

“An increasing proportion of rooftop solar, EVs, household and community batteries and even household hot water and pool pumps are expected to have the ‘smarts’ to help manage the import and export of power, it says,

It will also change the patterns of usage on the grid, and squash the so-called “solar duck” that is causing headaches for the market operator.

AEMO says that for the NEM as a whole, the three charts in Figure 20 show the rising impact of consumer-owned solar and batteries on forecast hour-by-hour grid demand. They help smooth out the NEM operational demand curve considerably.

“As the sun rises, rooftop solar starts to meet demand, and then generates excess supply (the yellow ‘belly’ of the ‘duck’-shaped demand profile),” the report says.

“That excess may be stored for later use during the evening peaks and into the night, or shared with local consumers to reduce the community’s need from the grid at that time.”

Consumers may take advantage of financial incentives to add smart functionality and coordinate their batteries through VPPs, so that they can help balance supply and demand across the grid. The success of trials such as Project EDGE will help build consumer confidence to do so.

The capacity of these coordinated CER storages is forecast to rise from today’s 0.2 GW to 3.7 GW in 2029-30, and then 37 GW in 2049-50 – by then making up 65% of the NEM’s energy storage capacity.