The Clean Energy Regulator has secured contracts for only a modest volume of Australian Carbon Credit Units (ACCUs), despite offering its highest ever price for the carbon offsets in the latest auction under the Emissions Reduction Fund,

The CER announced on Tuesday that it had signed “optional delivery” contracts for 7.6 million tonnes of abatement through the 14th auction of the Emissions Reduction Fund, worth a potential $131 million.

The regulator said the abatement would be sourced across 25 projects, involving emissions reductions through revegetation, soil carbon, industrial efficiency, and landfill waste gas projects.

The Emissions Reduction Fund is the flagship climate policy of the Morrison government, and low contractual volumes raise further doubts about whether the scheme can deliver the emissions cuts the government needs to meet its already modest targets.

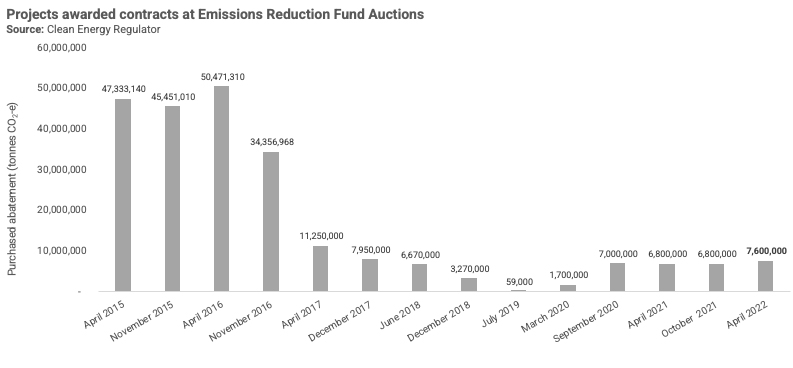

The results of the April auction represent a slight increase in volume on the last auction – held in October last year – of about 11 per cent, but it is substantially below earlier auctions which regularly secured contracts for more than 40 million tonnes of abatement at a time.

The regulator has struggled to attract new carbon abatement projects to participate in the Emissions Reduction Fund – despite getting a $2 billion injection of funds through the Climate Solutions Fund.

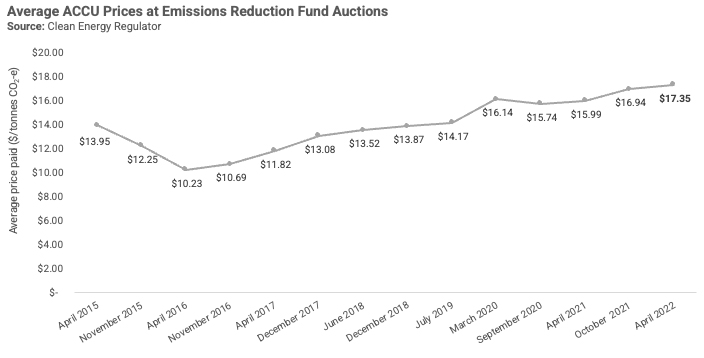

It has also reflected a reluctance to increase the price offered to match those available in the open market.

ACCUs currently trade in the open market at almost twice the price offered by the regulator – around $30 per ACCU – albeit well below prices seen earlier in the year.

ACCUs traded as high as $57 each before global market instability and a surprise policy intervention from the Morrison government saw prices fall almost 40 per cent overnight.

The average price offered by the CER at the most recent auction was $17.35 per ACCU, the highest average price the CER has offered at an Emissions Reduction Fund auction to date and a 2.4 per cent increase on the price offered at the previous auction held in October 2021.

All of the contracts offered by the regulator will be for “optional delivery”, meaning projects will have the ability, but not an obligation, to sell their ACCUs to the government at their agreed price.

It was the 14th auction held under the Emissions Reduction Fund since its original conception under the Abbott government.

Chair of the Clean Energy Regulator, David Parker, said he expected that most of the optional contracts signed through the latest auction would not actually lead to the sale of ACCUs to the government.

He said they were more likely to merely provide a price floor for projects that will otherwise sell ACCUs into a more lucrative open market.

“The shift to optional contracts highlights how Australia’s carbon market is evolving with increasing demand from the private sector for Australian Carbon Credit Units (ACCUs),” Parker said.

“We expect very few ACCUs under optional contracts to be delivered to the Commonwealth with most being sold to private buyers at higher prices available in the private voluntary market.”

“To date, only a tiny fraction of optional contracts have been delivered to the Clean Energy Regulator. This illustrates that optional delivery contracts are not primarily a means for the government to purchase abatement but rather act to underpin supply.”

The Clean Energy Regulator has been forced to respond to significant questions raised about the integrity of the Emissions Reduction Fund, with one of the scheme’s key architects making significant allegations that most of the carbon offsets issued under the scheme were not backed by genuine emissions reductions.

Both the regulator, and federal emissions reduction minister Angus Taylor, have defended the scheme.