Transgrid says it can do the network upgrade work required to “keep the lights on” in New South Wales as it transitions to renewables, but says it cannot afford further delays to progress as the state’s coal plants “become unreliable and retire.”

At the launch of the company’s 2023 Transmission Annual Planning Report (TAPR) on Tuesday, Transgrid CEO Brett Redman said additional capacity and network system security must be ready as early as possible to accommodate the state’s “high velocity” transition.

The TAPR is Transgrid’s annual planning review to identify – and make a case for – the level of transmission investment the company believes it will need to run the NSW grid in the best way and at the least cost for consumers.

“We are making good progress, but we need to do more to deliver AEMO’s plan for a rapid energy transformation – and make the NSW government’s Renewable Energy Zones – a reality,” Redman said.

According to the TAPR, this will mean the delivery of 2,500km of new transmission lines and supporting infrastructure to enable the connection of 17GW of new wind, solar and energy storage capacity in the coming decade out to 2033.

It also includes finding the best ways to operate the NSW power system at times at 100% instantaneous renewables.

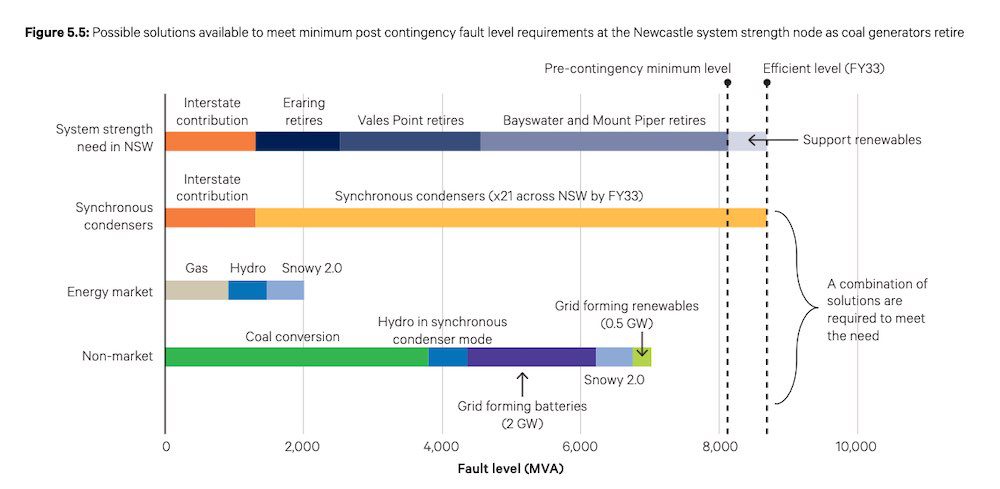

Transgrid says it also needs to deploy the equivalent of 21 synchronous condensers to replace system strength from retiring coal (at a cost estimated at $2.2 billion).

The TAPR says the progressive planned retirement of Eraring, Vales Point and Bayswater power stations in the next decade will create gaps in generation, system strength, frequency control and inertia.

At the same time, the NSW power system will also experience increasing voltage control capability issues in both peak demand and low demand periods in the transmission network, and system strength gaps will appear.

To address these gaps, Transgrid says it will “tap into a diverse range of existing and novel non‑network solutions, including emerging technologies like batteries, STATCOMs or renewable generation with grid‑forming inverters.

With 1,500MW of additional renewable generation and storage committed to join the network since its last TAPR was published, and 3,500GWh more rooftop solar forecast by 2032, Transgrid expects to see a further 29% drop in minimum demand by 2025 and at least 57% by 2032.

To this end, the 2023 TAPR explains how delivering a secure energy service also depends on having the right skills and tools to manage a complex energy system operating at up to 100% instantaneous renewable energy – and why delaying the closure of old coal generators probably won’t help.

“Between us we have an extraordinary breadth of energy experience and while we may disagree on some things, I believe most of us agree on the urgency needed to deliver the energy transition,” Redman told the industry gathering at the report’s launch on Tuesday.

“As the TAPR sets out our job is to get additional capacity and system security in place before coal-fired generators become unreliable and retire.

“We absolutely cannot let the transmission build get held up or derailed.”

On the more traditional towers and wires side, Transgrid has a number of major projects in the pipeline, including some of the most publicly contentious in HumeLink and VNI West.

The 2023 TAPR proposes speeding these projects up by rolling together the three that make up the southern end of the NSW energy superhighway – EnergyConnect, HumeLink and VNI West.

Redman says that making these projects into “a single procurement program” promises to shave up to two years off delivery times.

But also holding up delivery of some of the state’s big transmission projects are problems with social licence.

“Media narratives have depicted the energy transition as favouring urban centres at the expense of regional areas,” Redman said on Tuesday.

“But beyond the headlines are real people – families, farmers, landholders – who are confronted with the prospect of transmission infrastructure on their properties.

“While the benefits of such projects are set to be appreciated by millions, we must find a way to strike a balance that minimises disruption to landowners while keeping the lights on.”

“It’s imperative to chart a way forward, and avoid further impact to consumer power costs. Modelling shows every dollar spent on transmission is projected to return more than twice this in benefits to consumers and communities.”

The TAPR report also gives some insight into Transgrid’s thinking beyond 2033, when the renewable power system may need to expand by up to three to five times to support economy-wide decarbonation and the establishment of a green hydrogen industry.

Redman says this includes ideas for offshore wind, as well as for “remote inland” renewable energy zones – big build-outs of onshore wind and solar that could pipe energy where it’s needed through high voltage DC cables.

“The decisions we make now can keep our options open for future development – or narrow the field of possibilities,” he said.

“Transgrid is committed to positioning Australia as competitively as possible to succeed in a decarbonised global economy.”