Something has happened in the state of Queensland. The state that led Australia’s dramatic surge to an automatic price cap, and then a suspended market – thanks to being the state most dependent on expensive fossil fuels – has suddenly become the calmest market in the country.

It could just be that the sun has returned to the Sunshine State, underlying the point that high renewables output does break the power of fossil fuel generators to set high prices.

When Queensland’s wholesale electricity price surged into the stratosphere early last month it was largely because of multiple coal plant outages, soaring demand, and because the output of the state’s country-leading rooftop solar capacity and its 35 large scale solar farms were diminished by cloudy weather.

The reduction in solar, and the multiple outages that sidelined nearly a quarter of what was once called “reliable baseload coal” allowed unimpeded power by the fossil gas generators, mostly privately owned, to take advantage and set the price of their choosing.

That sent the wholesale price to the trigger point of more than $1.3 million, a level that was soon followed by other states and which then forced the Australian Energy Market Operator to intervene and suspend the market because it had become impossible to manage as generators with-held capacity.

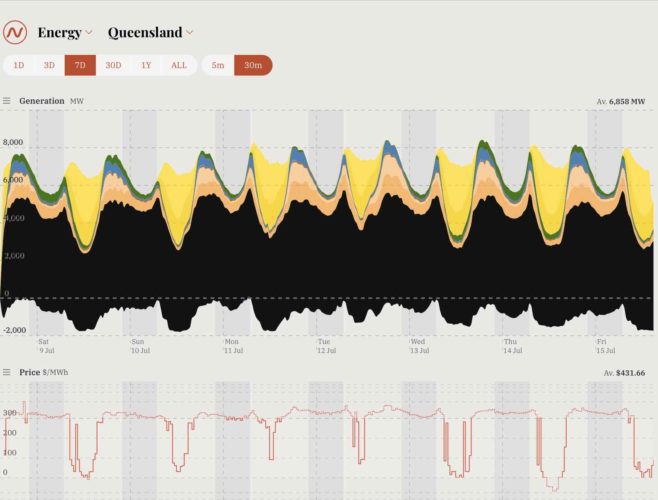

Queensland threatened once again to trigger the price cap early last week, but then something changed, and the market price has been relatively stable – bar the midday slump when rooftop and large scale solar provide more than half the state’s demand, breaking the pricing power of the gas power plants.

This graph above shows how solar has pushed the wholesale price to low levels, often to zero and some times into negative territory in the middle of the day.

On almost every day in the last week, solar has met more than 50 per cent of local demand in Queensland, although the state has also been exporting regularly to NSW.

It should be noted that Queensland’s share of renewables in the past week has remained at a low 21.6 per cent.

That’s actually high for Queensland, despite its 50 per cent renewables target due to be met by 2030, but the lowest of any state grid in the country, although the other coal dependent state NSW is not much better.

The cumulative pricing levels for all states in the National Electricity Market shows the history of the past two months, and how Queensland has suddenly become the lowest cost of the mainland states.

What is also interesting – in the top graph – is the lack of big market spikes seen in the preceding weeks.

That has triggered speculation that the state minister may have intervened to have a quiet word with the state owned generators about their bidding patterns, much like they did on a more formal basis back in 2017 when a similar change of pricing behaviour was achieved.

RenewEconomy is told that that is not the case, although one source suggested the minister did let it be known to rail operators that he has emergency powers that could be enforced if enough coal is not delivered to the coal generators, rather than exports.

That, we are told, helped to free up some deliveries and ensure the coal plants were not fretting about having enough fuel.

The improved weather conditions has also meant that flooding that had hit some coal production and transportation was resolved, and coal plants did not have to fill in for the solar that was not producing. And some of the plants that had been offline for planned or unplanned maintenance came back on line.

However, the market is not yet out of the woods.

Queensland’s cumulative price is now well below the trigger point for an automatic price cap, but the other mainland states are now above $1 million and facing a potentially tight weekend in supply terms that could cause more price spikes and another push towards the trigger point.