The strangeness of last Sunday …

Has there ever been better times for our electricity utilities?

Sunday is typically pretty subdued in terms of electricity demand. Consequently Sunday market prices are at the low-end of the weekly range, even with the extra demands of a chilly winter day.

Since the beginning of 2008, the Sunday market price in Victoria averages about $23 per megawatt hour, factoring out the carbon tax component. That is about half the average weekday price of $43.

Sunday prices do vary across the year rising slightly in the winter months. Between 2008 and 2015, June Sunday prices have averaged about $31 with a high of $50 on Sunday June 1, 2008.

So what can we make of last Sunday (26th June 2016), when the volume-averaged price in Victoria was a staggering $120, almost four times above the long-term?

Last Sunday was not just a once off, as the price for every June Sunday this year topped $75 – more than 50 per cent higher than any previous June Sunday in the last 8 years.

And Victoria isn’t alone. Right across the National Electricity Market (or NEM), prices have been stratospheric. Last Sunday, South Australia topped the class at $158, closely followed by New South Wales at $133.

As pointed out in my post a week ago, in historical terms these prices are simply staggering, and it’s not very obvious why.

If these prices remain, they will have widespread consequences. So it is important to get to grips with what is going on.

Last Sunday was Melbourne’s coldest morning of the year, with several coldest-day records set across Victoria. So we might expect some extra heating was stretching the power system, helping drive up prices.

However, while the Victorian demand was higher than average for a Sunday, it was about 10 per cent lower than the Victorian average weekday demand. So we really can’t pin Sunday’s extreme prices on unusual demand. Moreover, last Sunday net Victorian exports amounted to about 15 per cent of its electricity production (see note 1). So there was no shortage of supply to meet local demand.

Why are prices so high?

Rather than originating locally, the reasons for the strange pricing events on Sunday morning in Victoria, seem to reside elsewhere on the NEM. They point to the emerging issue of the inter-regional coupling, the tangle of energy policies across the NEM and other energy sectors such as gas, and the power of industry incumbents.

In comparison to Victoria, Queensland demand last Sunday morning was significantly above expectation, slightly exceeding even the weekday demand average. Demand has been growing strongly in Queensland, partly because of the commissioning of its gas export processing plants. Still, at not much more than the weekday average, it is hard to understand why last Sunday’s demand in Queensland would be sufficient to drive prices to $115. At the time coal generation was running at around 75 per cent capacity.

As with Queensland, New South Wales demand was close to the highest recorded for a Sunday. But while New South Wales was importing furiously, paying what would seem to be over the odds prices, its coal generators were only running at 68 per cent capacity. Why?

In South Australia demand was not exceptional in terms of recent history, but the recent closure of Northern coal-fired power plant has significantly tightened supply settings there and made it more sensitive to the cost of marginal gas generators. Meanwhile its cleanest, most efficient, and one of its largest gas generators, Pelican Point, sits idle. Why?

Sunday was not only cold in South Australia, but it was also not very windy. As a consequence output from wind generation averaged only about 25 per cent of installed capacity. With only modest wind output, and with no coal, South Australia generation was dominated by gas, the price of which is surging on the back of increased LNG export pipeline flows (see also). In addition, South Australian consumption was heavily augmented with Victorian imports.

The important point is that, for whatever reason, prices are being signalled right across the NEM, from Queensland and South Australia through to Tasmania.

This price signalling is having some paradoxical effects. Just last week, the Office of the Tasmanian Economic Regulator approved an increase in retail prices of 3.43 per cent, effective this Saturday, on the back of the high market prices in Victoria. The surprise is that Tasmania has just emerged from its own energy crisis with recent rains together with the re-connection of Basslink allowing exports for the first time in almost 10 months. Just as supply constraints relaxed for the time being and security restored though Basslink, long-suffering Tasmanian consumers are the first to be hit with price-hikes.

And in Victoria, where prices are responding to distant drivers, brown coal generators must be laughing at their good fortune.

Hazelwood’s super-profits

Across the last 4 weeks, prices in Victoria have averaged $98 per megawatt hour when weighted by volume. In Victorian market terms the total value of dispatch was worth about $370 million. That is almost three times higher than the equivalent period last year, when prices averaged $35.

It is boom times for the owners of Victoria’s brown coal stations, like the French energy utility Engie that operates the Hazelwood power station.

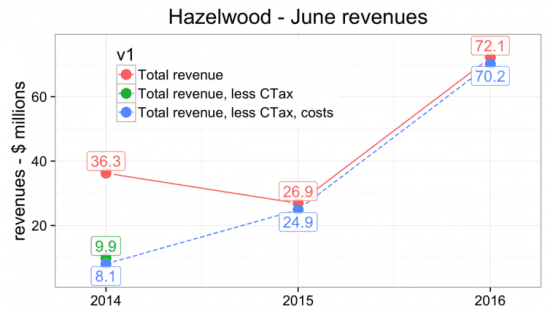

In Victorian market terms, the value of Hazelwood’s dispatch over the last 4 weeks is around $70 million.

That compares with the market value of around $25 million in June last year, and around $10 million in June 2014 when the carbon tax liability is factored out.

On an annualised basis, Hazelwood’s latest returns amount to around $900 million, a truly phenomenal turn-around from 2013 when the Commonwealth Bank sold its 8.3% stake that it had previously valued at just $1 million (see note 2).

Hazelwood is Australia’s most contentious power station – a proverbial lightning rod for the debate about our energy system. As Victoria’s oldest, most emission intensive coal fired power station it has been plagued by community concern. At around 1.56 tonnes per megawatt hour it produces about three times the CO2 of a modern gas plant such as the super efficient combined cycle Pelican Point gas plant in South Australia,Engie’s other main asset in Australia. Already it is some 10 years over its use by date.

But, in terms of its balance sheet, Hazelwood has probably never had such good times as the last few months. Meanwhile Engie reportedly disputes liability for the $18 million costs incurred by the Country Fire Authority for fighting a month long fire in Hazelwood’s mine in early 2014.

While Engie enjoys remarkable “super-profits” from Hazelwood, should we ask at what cost. With Victorian electricity exports to South Australia and New South Wales averaging around 1000 megawatts, Hazelwood arguably exists to underwrite those exports (see note 1). Meanwhile Engie’s Pelican Point Power Plant in South Australia sits idle, its gas contracts reputedly on sold presumably to the export market. If Engie were to fire up Pelican Point, it would reduce our national emissions by several million tonnes each year, and arguably put downward pressures on South Australian prices that would then be signalled across the country.

But perhaps that is exactly why. Oh what a tangled web our national energy policy is.

The headache for next Sunday

I doubt next Sunday, on the morning after the federal election, many will be watching the electricity prices. But some will, hoping the electricity market magically returns some normality. After all, it will not just be the first day of the new government, it is also the start of a new financial year.

Could it be that the current market prices are being manipulated by our electricity oligarchs to improve their bottom lines before the end of the financial year? Or will the high prices persist, reflective a fundamental shift in market dynamics, as the various threads of national energy policy tangle more tightly.

Surely we can understand that it is just not right to let the market dynamics encourage the likes of Engie to operate in Australia as if there is no tomorrow, rewarding it handsomely to dump some 15 million tonnes of CO2 into our atmosphere each year leaving Pelican Point idle. Would Engie be given license to do that in France. I doubt so, so why here?

But it is not so much Engie that is the problem, or any other player, as it is the whole tangled web of our national energy policy that is tightening at each turn. Either way, next Sunday will present the new government with the massive headache of untangling this web.

We are in desperate need of a bipartisan approach with a sharp focus on how we rebuild our energy system fit for the challenges ahead, adding environmental concerns as an equal to the existing priorities of security and affordability.

After all, last Sunday highlights that our existing energy system is not looking particularly affordable. And, like Hazelwood, much of it is beyond its use-by-date, so probably it is not that secure. And for sure it is an environmental disaster.

Mike Sandiford is a Professor of Geology, University of Melbourne. He receives funding for low emissions energy research, including integration of renewables and CCS, as well as from the ARC for geological research into plate tectonics. Source: The Conversation. Reproduced with permission.