If you read mainstream media this week you may well form the view that the so-called capacity market – touted as the key to keeping the lights on in the midst of a green energy transition – is widely supported, even if there is a question about the inclusion of coal and gas.

The reality is quite different. Apart from a few key players in the Energy Security Board, there are only a handful of energy companies that think that this is a good idea. Even the states aren’t particularly keen.

The push for a technology neutral approach is all too familiar to the political dog fights over climate action, the carbon price and the renewable energy target, where a powerful minority succeeded in either repealing or diluting widely supported policies and mechanisms.

“Technology neutral” – as innocent as it may sound – makes absolutely no sense if the problem being tackled is to cut emissions down to zero, as quickly as can be done.

That’s why many in the industry are astonished that a pure capacity market is still being proposed, given the intense opposition, and they wonder why key institutions are not moving forward – at pace – in designing credible alternatives, such as “availability” or “flexibility” markets that focus on new clean technologies.

The key proponent of the capacity mechanism – apart from the former Coalition energy minister Angus Taylor – has been the Energy Security Board, and its director and former deputy chair Clare Savage, which has been working for nearly five years on proposals that have had little support, and still no detailed design elements.

As The Australian newspaper reported on Saturday, when the ESB surveyed stakeholders in its technical advisory group in April on whether they supported a capacity market, the resounding response was NO!

RenewEconomy understands that many in the technical working group were annoyed on Monday when the ESB chose to push ahead regardless. “There was some robust feedback,” said one.

Energy analysts Tristan Edis and Johanna Bowyer also note – in their column that we publish today – that when a similar proposal was presented to the same stakeholders a year earlier, 75 per cent of the more than 100 respondents said No! Yet still the ESB persists.

On Monday, after the ESB released its latest “high level” design paper, which more or less repeats the same proposals that were rejected previously, the Australian Energy Council, the main lobby group for legacy energy utilities, came out and said it supported the proposal.

“We welcome the emphasis on any capacity mechanism being technology neutral so it can deliver the best outcomes,” CEO Sarah McNamara said in a statement.

“The AEC believes any capacity mechanism needs to support existing plant, as well as new plant. Our preference remains for neutrality between the two, but we will consider the draft proposal. ”

That statement has infuriated some AEC members, who point out that it contradicts its previous submissions on the issue, where it said “a capacity market isn’t well suited to managing a future grid”, and because the last internal survey of its members showed little support for a capacity market per se.

Most of its members were either dead against, or lukewarm at best, and – unlike the proposal from the ESB now endorsed by McNamara – wanted it focused only on only new capacity, and did not want it to be technology neutral.

According to an internal AEC document seen by RenewEconomy, only three of 12 member companies that responded to that survey supported an explicit capacity mechanism – Alinta, EnergyAustralia, and Engie.

Alinta is the owner of Loy Yang B brown coal generator in Victoria, and EnergyAustralia is the owner of Yallourn, already scheduled to close in 2028 after striking a deal with Victoria, and Mt Piper in NSW. Alinta made its views clear in this interview we reported on last week.

Loy Yang B and Mt Piper are currently scheduled to be among the last coal generators standing in their respective states. Little wonder they are keen for whatever payments they can get.

French company Engie is the one which controversially closed Hazelwood in the blink of an eye in late 2016. Other solid supporters not included in the survey done by the AEC include Delta Energy, owner of Vales Point in NSW, and a biomass generator.

But not all coal generators are supportive. Many, such as Origin and the Queensland government owned generators, have more nuanced views, insisting that it be open to only new investment.

That’s not the view put forward by McNamara, a former energy policy advisor to then prime minister Tony Abbott when he repealed the carbon price and tried to kill the renewable energy target. McNamara had previously worked at AGL, Australia’s biggest polluter now poised to be transformed by Mike Cannon-Brookes.

ESB chair Savage is a former senior executive with Energy Australia and before that was head of the main electricity body, then known as the ESAA, the predecessor to the AEC. She is supported by Jamie Lowe, an executive with Engie, and formerly head of regulation at Alinta and Loy Yang itself.

Critics of an explicit capacity market make it clear that they are not saying the grid doesn’t need new storage and dispatchable generation, they just think that there are smarter, cheaper and less ideological ways of going about it.

The newly formed Blueprint Institute, for instance, says the capacity mechanism could make the grid less reliable, by keeping online coal generators that can no longer be relied upon, as the market has found to its cost in the last few weeks.

And the likes of Iberdrola, Flow Power and Tesla, whose designs were most favoured by the ESB technical working group – point out that if you try to jam old coal fired power stations into a broad mechanism, then it will be compromised and less efficient and less able to match the capabilities of new technologies.

They say there are other ways of managing the exit of coal, either through separate mechanisms such as “bonds” or proposed “closure auctions” favoured by Blueprint.

By separating the issue of closing old kit and encouraging new investment, this will allow new “flexible” or “capability” signals to be properly designed around new technologies.

They also say that the ESB’s proposal to allow some states to choose which technologies they want simply adds complexity, confusion and weakens the market design. But as the old energy market saying goes: “Confusion is profit.”

It’s just the consumer who pays. Or, as Ariel Liebman described it on LinkedIn: “A steam age hammer for a digital age problem. The unintended interactions with current and future mechanisms such as fast frequency response, inertia, and system strength markets is very risky.”

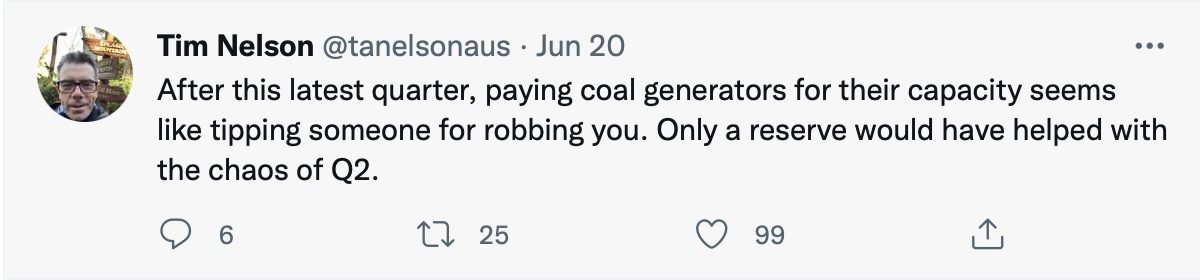

Tim Nelson, formerly of AGL and the Australian Energy Market Commission, and now head of markets at Iberdrola, which owns renewables and gas generators, tweeted this week that the best way to avoid the chaos of the last few weeks was a reserve mechanism, not a capacity market.

“After this latest quarter, paying coal generators for their capacity seems like tipping someone for robbing you,” Nelson said in another tweet. “Only a reserve would have helped with the chaos of Q2.”

Simon Corbell, the head of the Clean Energy Investment Group, and former ACT energy minister, agrees:

“If the objective is decarbonisation, you can’t be technology neutral,” he says. “We should be designing an approach to capacity that incentivises zero emissions technologies.”

And, as Edis and Bowyer note, there really is not time to waste, and if the federal and state energy ministers are not satisfied with the ESB’s offerings, then the ESB should really be disbanded, and the task handed to others more focused on the future.

See also: Chris Bowen needs flexibility to avoid capacity market trap set by fossil fuel lobby

And: ESB’s capacity market proposal could cost billions, more than the carbon price