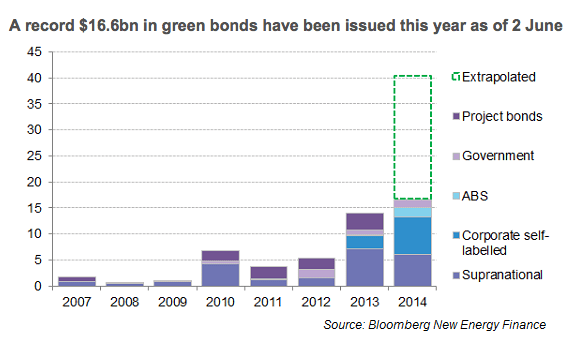

Less than two months after the World Bank made its first green bonds issue into the Australian market, Bloomberg New Energy Finance has released a report predicting that the global market in the debt securities for environmentally and socially minded investors was on track to surpass $40 billion in 2014, as more companies issue the debt to finance clean energy projects.

In fact, it’s already half way there; soaring past the total of $14 billion issued last year – as the chart below shows – to a total of green ‘labeled’ bonds issued in 2014 of $19.67 billion – as at time of writing.

This puts the market well on track to surpass the targets called for by World Bank Group President Jim Yong Kim at this year’s World Economic Forum in Davos: a doubling to $20 billion by September; and to at least $50 billion by the time of the UN climate negotiations in Paris in December 2015.

In Australia, a market analyst Sean Kidney from the Climate Bonds Initiative has predicted a domestic market of at least $1 billion by the end of 2014, after the April launch of the market saw 15 investors take up UniSuper’s offer of access to a $100 million share in the $300 million “Kangaroo” bonds issue.

World Bank vice president and climate special envoy Rachel Kyte recently described the role of green bonds in low-carbon investment as crucial, but says their broader role – “to move the finance fulcrum in a cleaner direction, away from traditional fossil fuel investments” – is even more important.

In January, a coalition of banks, including Bank of America, JPMorgan Chase & Co., Credit Agricole SA (ACA) and others created a common set of criteria for green bonds, to act as a catalyst for the development of the market.