The strategic importance of long-duration energy storage in the global shift to renewables has been underscored again this week, with global investment bank Goldman Sachs putting its financial weight behind the compressed air technology of Canadian company, Hydrostor.

Hydrostor said on Monday that it had secured a preferred equity financing commitment of $US250 million from the Private Equity and Sustainable Investing businesses within Goldman Sachs Asset Management (“Goldman Sachs”).

The investment, the company said, would go towards Hydrostor’s 1.1GW, 8.7GWh of Advanced Compressed Air Energy Storage (A-CAES) projects in Australia and California, that were “well underway,” as well as the expanision of its global development pipeline.

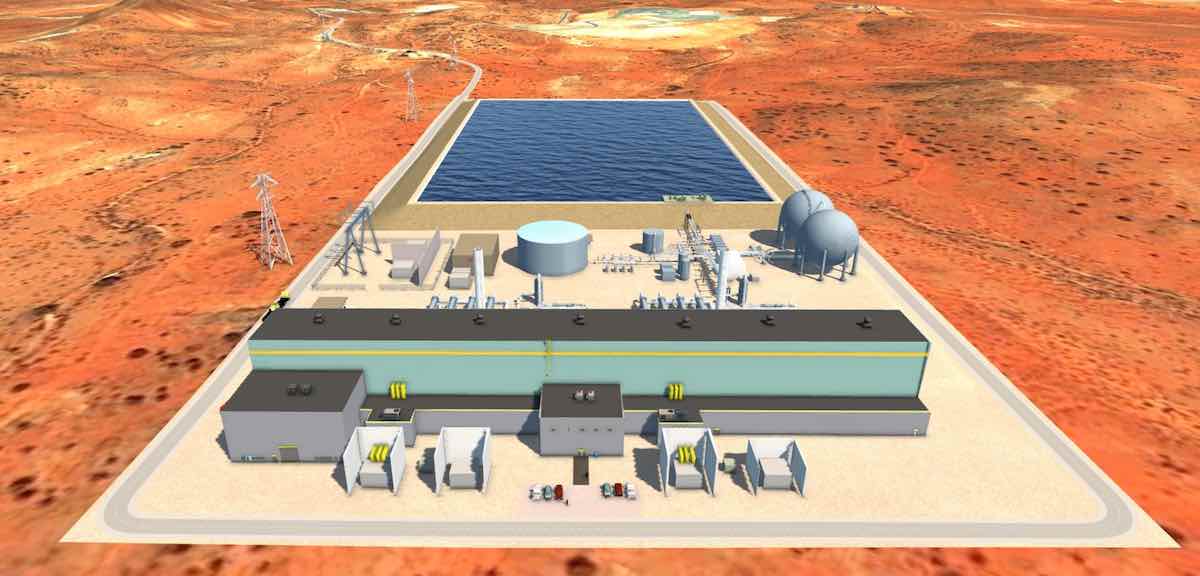

In Australia, Hydrostor has been working in partnership with local outfit Energy Estate on a proposed 200MW A-CAES facility near Broken Hill, in New South Wales, which would be the largest of its kind in the world.

Hydrostor was chosen for the job in 2020 by NSW transmission company Transgrid, favoured over other bidders as the right technology to to replace ageing gas turbines that currently supply the emergency back-up in Broken Hill.

In June of last year, Hydrostor and Energy Estate released a bullish economic impact study of the proposed Broken Hill project, which said it could provide eight hours of storage, cost around $560 million and deliver significant benefits to the region.

Compressed air storage works on a similar theme to pumped hydro, using times of low prices to “charge up” and store significant amounts of energy. Instead of using water, rare in remote areas, it compresses air in suitable caverns, the type that can be found in old mines.

Hydrostor’s A-CAES technology claims to be able to deliver vast amounts of storage – in the case of the Broken Hill project up to 1,500MWh – enough to supply the town for days or even weeks.

Questions remain, however, around the commercial viability of the technology, which is a valid concern given Hydrostor’s failure to secure funding offered by ARENA for a smaller project at an abandoned zinc mine in South Australia.

The investment from Goldman Sachs appears to address at least some of those problems directly, by supplying the funds in tranches tied to project milestones to match Hydrostor’s capital needs.

The companies said the money would also support Hydrostor’s global development and marketing initiatives, including expansion of its project pipeline and capabilities in markets with significant near-term demand for flexibly sited long-duration energy storage.

Curtis VanWalleghem, Hydrostor’s CEO, described the investment by Goldman Sachs as “transformational” for the company.

“[This investment] …validates the competitiveness of our proprietary A-CAES solution as well as the strength of our pipeline of potential projects,” he said.

Charlie Gailliot, partner and head of energy transition private equity investing within Goldman Sachs Asset Management, said the need for utility-scale long-duration energy storage was clear.

“Hydrostor’s A-CAES solution is well positioned to become a leading player in this emerging global market,” Gailliot said.

“We look forward to working with the Hydrostor team over the coming years and leveraging our firm’s global platform to support Hydrostor’s growth, which will play a central role in the ongoing energy transition.”