With the most comprehensive international agreement to combat climate change set to take effect next month, investment in the global clean energy sector has slumped to “worryingly low” levels, according to the latest data from research group Bloomberg New Energy Finance.

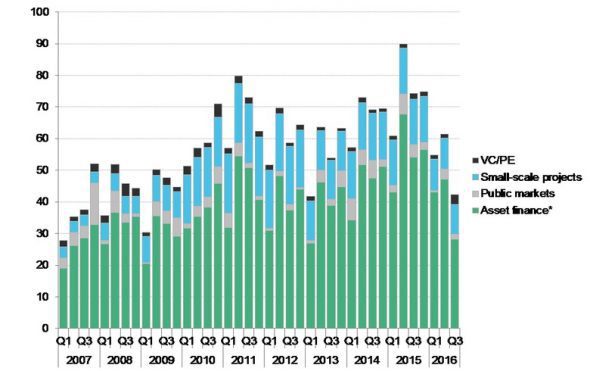

The Q3 BNEF data, published on Monday, shows that a total of $42.4 billion was invested globally in renewable energy and smart technologies during the period, marking a 31 per cent drop on the spend during Q2 2016, the weakest quarter since 2013, and a spending slump of 43 per cent, year on year.

BNEF said the investment lull was partly seasonal – summer in the northern hemisphere means fewer big deals in Europe’s offshore wind sector – but that this effect had been compounded by a 51 per cent year-on-year fall in clean energy investment in China and a 56 per cent fall in Japan.

Most notably, the research firm said there was a 49 per cent year-on-year plunge in the asset finance of utility-scale renewables to $US28.8 billion, mostly due to a 67 per cent drop in large-scale solar investment as policy changes in China and Japan suppressed activity in these segments.

BNEF’s chairman of the advisory board, Michael Liebreich, said the Q3 numbers, while “worryingly low”, could also be explained by two converging trends: the record-low cost of solar PV components, and last year’s investment rush, which have seemingly triggered this year’s “pause for breath.”

“These numbers for Q3 are worryingly low even compared to the subdued trend we saw in Q1 and Q2,” Liebreich said. “A vital point to bear in mind is that there have been sharp reductions in the cost of PV systems, so that much more solar capacity can be added this year than last, per million dollars.

“However, it is also clear that, after last year’s record investment levels, some key markets such as China and Japan are pausing for a deep breath,” he said.

“Also, in many countries, electricity demand growth is undershooting government forecasts. My view is that the Q3 figures are somewhere between a ‘flash crash’ blip, and a ‘new normal’.”

China saw one of the largest slumps – a 51% tumble in investment in the space of a year, down to$14.4 billion in Q3. In Japan’s, the $3.5 billion 2016 Q3 figure was some 56 per cent below 2015’s Q3 investments.

Another notable weak point was a 35 per cent drop in small-scale solar PV project investments to $US9.3 billion.

The largest Q3 deals included $US1.8 billion for the 396MW Merkur offshore wind farm in the German North Sea and $US1.2 billion for the UK 299MW Tees biomass project.

On a more positive note, BNEF said there were reasons to believe the final quarter of the year would see increased investment, given the traditional seasonal rush to meet bank lending targets and beat clean energy subsidy deadlines.

The analysts also stressed that Q3’s figures could be revised upwards if more transactions came to light.

But BNEF warned that all signs pointed to a 23 per cent year-on-year drop in global investments, making it increasingly likely that 2016 would see far less invested than 2015’s record amount of $348.5 billion.