In my opinion, gentailers don’t have the willpower to fully replace their coal fired generation. They mostly don’t see how they have the balance sheets to do it either.

The lack of balance sheet capacity is interesting, partly reflecting that the coal generation was mostly bought cheap (old limited second hand equipment), partly reflecting that dividends have been prioritised over reinvestment and partly reflecting that balance sheets come with selling the story.

But by far the biggest problem has been willpower.

The announced but generally vague plans of new renewable energy projects are typically to build capacity to supply say 50% of the energy. However, that’s not news.

Gentailer traditional retail volumes will be zero down the track

What has been less remarked upon is that gentailers have traditionally made most of their retailing profits from selling electricity and gas to households. The net volumes in both those segments are going to decline to vanishingly small amounts in the next 20 years.

Gentailers will need to find new business models to earn the return on capital that valuers such as Grant Samuel model.

Because gentailers are big integrated businesses – and because ultimately intermediaries are needed in a big market – then stakeholders may think there is a good chance that gentailers will be able to successfully adapt. But in my view it’s a new risk and perhaps warrants a higher cost of capital.

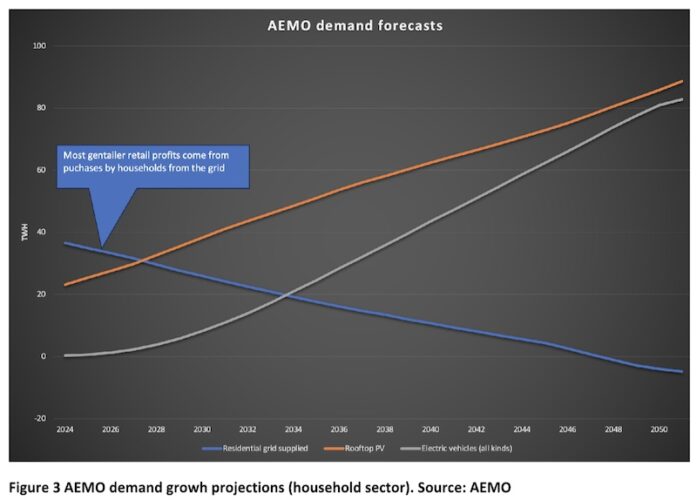

AEMO models that grid supplied energy to households will go from around 47TWh today to zero or even negative by 2047. Residential gas volumes will also decline and possibly quite quickly.

At the same time electrification of households will increase household consumption, but much more of it will be self supplied. If households install batteries, or if EVs end up being used by households to supply energy overnight then the role of the gentailer will need to evolve.

Specifically, gentailers will become insurance providers. This future is already possible today as households like mine need the grid but end up not paying much for the privilege of being connected.

Gentailers will need new business models but – as Grant Samuel points out in its assessment of Origin Energy, and correctly I think – the strength of a big gentailer is its diversification. There are revenue streams from supplying industrials, VPPs (loss making right now according to Grant Samuel) and various other segments.

Still, as an investor I’d be nervous about moving away from vertical integration and from this need to find new profit models.

Gentailers are focused on firming

Each of the gentailers is building batteries and potentially pumped hydro and telling stakeholders that energy storage is equivalent to generation. It is not. Batteries and pumped hydro are an essential and wonderful part of the future energy system but they are net consumers of energy, not producers.

If that was all there was to the changing energy system the conclusion would be that gentailers were likely to become more risky.

Historically, it’s been established in the Competition Tribunal that there is a natural tendency for generation and retail to be put together. That’s simply to reduce risk by guaranteeing that the retail arm can supply and the generation arm has a load.

Historically when retailers aren’t sufficiently vertically integrated they become exposed to hedging risk.

A good example was AGL which was taken to the cleaners in New Zealand in 2002 when it went big without hedging and was caught out by a drought. Small retailers in Australia regularly go broke when electricity prices rise due to inadequate hedging.

Generally, big gentailers in Australia, by virtue of careful portfolio management including some firming (gas) generation, have avoided some of those risks.

However, Origin itself did poorly in Queensland some years back due to Queensland government-owned generators who found a way to exploit constraints in Queensland to rort the electricity price.

The point, basically, is that when generators are separated from retail they are incentivised as a class to try and exploit the system to maximise price. By contrast, when generators and retailers are integrated the incentive is to exploit the consumer.

So in my opinion, the fact that AGL/Origin/EnergyAustralia are basically abandoning the generation development field increases the cost of capital. It also increases the cost of capital for the generation developers as well.

This is one of the reasons I thought the piece commissioned by the ACCC and supplied by Frontier Economics which argued that there was no need for businesses to have any strategy for decarbonisation because all that was needed was government policy was a complete load of nonsense.

Policy alone is never likely to be enough. If you fight a war and the soldiers don’t believe in the cause you won’t get much of a result. Fortunately the ACCC, in the end, must have seen how weak that argument was and has allowed the Brookfield bid to proceed.

And the result is that the ACCC has essentially accepted that Brookfield bid should be allowed because on balance they were likely to cause more wind and solar to be built and more quickly and that this outweighed any issues around Brookfield having an interest in wires and poles as well as gentailing.

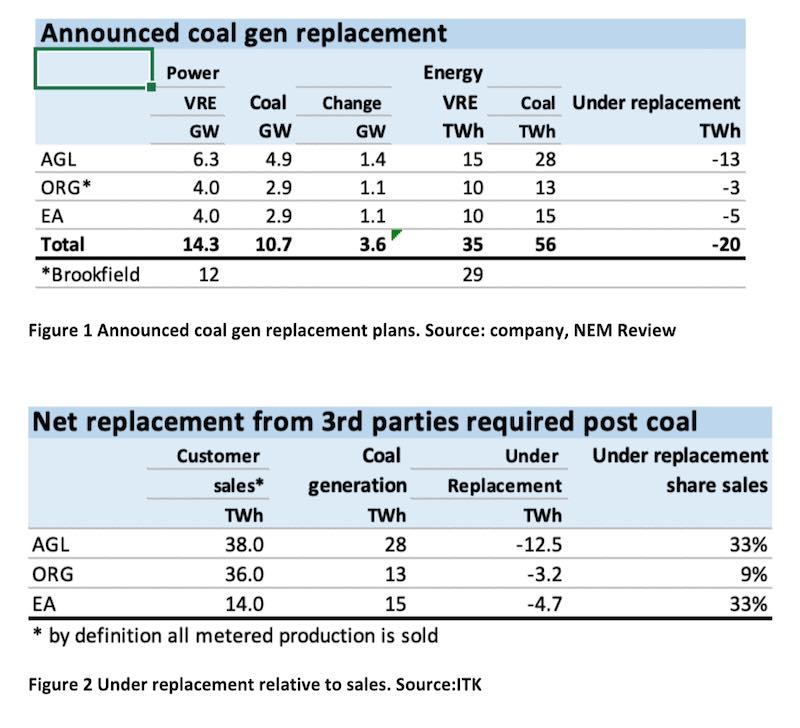

On plans announced to date, AGL and Energy Australia will lose coal production generation net of replacement variable renewable energy (VRE) investment equal to around 33% of sales.

Again this is only sketching things out of a complicated situation. For instance, there remains a strong risk that aluminum smelters will close.

In aggregate, they are responsible for 10% of Australian consumption. What about Loy Yang B (presumably replaced at ruinous cost to Victorian consumers by offshore wind) or Vales Point replacement?

In my opinion there is no chance of the current owners of Vales Point getting into Australia renewables. In short, from an overall supply and demand perspective the situation remains anyone’s call.

That said, I can agree with Frontier Economics to this extent: A smart operator/investor would bet on policy continuing to be ever more supportive of decarbonisation. That’s because the scientific necessity to decarbonise only grows more urgent every year.

Policy will inevitably follow because, no matter how stupid the Queensland National party is, in the end if something should happen it generally does. In the end, throwing sand in the gears will be a losing position. But the fact that there is lots of policy does not negate the need for good management.

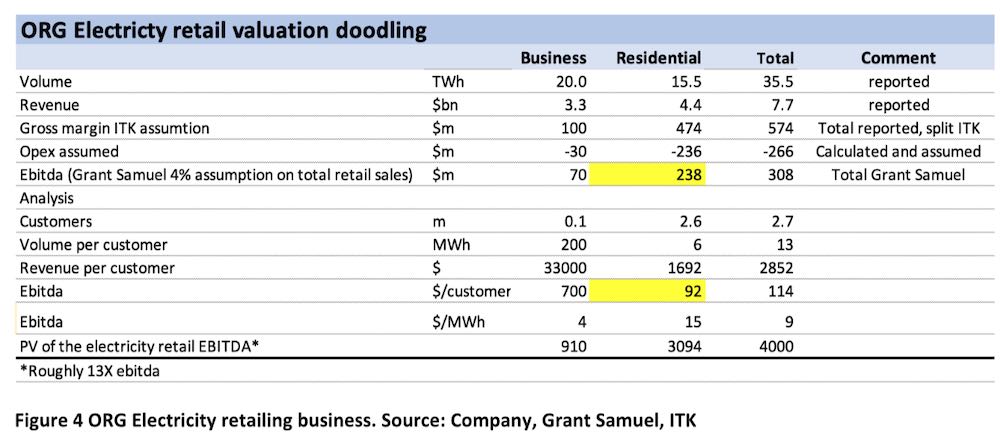

Grant Samuel likely thought carefully about whether the “continuing business” paradigm was appropriate when valuing Origin gentailing.

One of the underlying assumptions in the Grant Samuel valuation of Origin was that, except for Eraring, the future of electricity retailing will be more or less the same as the past.

Grant Samuel’s valuation of Origin’s energy markets business

Grant Samuel, in its independent experts report on Origin Energy, estimated a discounted cash-flow (DCF) of $9-$10 billion for the energy markets business, which includes gas retailing and generation as well as electricity retailing.

However, I focus only on the electricity retailing. Understanding Origin Energy, and what the right share price is, is a big topic and you can know a lot of stuff and still be quite wrong.

All DCF valuations are simply opinions expressed as numbers. The numbers are the outcomes of assumptions which are uncertain (because the models are of future cash flows) and in general reasonable people could use other reasonable assumptions and come to a different valuation.

Grant Samuel’s value of Origin’s Energy Markets business is based on a projection of cash flows until 2040 and then something is added on for the assumed value of the business post 2040. The nature of DCF valuation is that the near-term cash flows carry greater weight than the longer-term forecasts.

In this case a summary of Grant Samuel’s assumptions for the electricity retail (not including generation) model is that revenue grows by 2.5% per year and the ebitda margin is 4% per year in the period 2025-2040.

For the period beyond 2040 a terminal growth rate of 2.5% is used, that is there is no growth in real terms. In fact the valuation is essentially that, once margins recover to 4%, that’s the end of the “real” profit growth.

This is, of course, a very simple model. Simple is generally good, as a disadvantage of nearly all NPV models is that the only person who can truly “drive” the model and knows its strengths and weaknesses is the person that wrote it.

In many respects the Grant Samuel model is reasonably conservative but there is one big assumption that was not much discussed.

Retail volumes supplied by the utility sector are going to decline

AEMO models grid supplied electricity to households to go net negative by about 2047 but in any case to decline steadily between now and then.

Historically, gentailers make money in retailing by supplying households with electricity. They generally charge based on consumption (by time of use) plus a fixed component, typically a bit over $1 a day, and some allowance for rooftop production sold back to the grid.

Origin, for instance, shows a cost of $1600 for a 4MWh customer and includes about $370 of fixed charges. So more than 75% of the cost to household is based on consumption.

When you do the sums, and the sums require a lot of adjustments, you will typically find that such customers seem to be valued at between $1000 and $1500 each.

In fact, this is a honey trap because it’s not the individual household that has value but rather the collection of households; in Origin’s case about 2.7 million of them. There are lots of economies of scale available to businesses with 1 million plus customers that are not available to smaller retailers. Again, let’s not go down that rabbit hole.

The next point is that large business and industrial customers consume a lot of volume but generally profits are low, in the order of say $4-$5/MWh.

Putting this together and making enough assumptions, call them educated guesses, as to make the conclusions unreliable, the following picture of the electricity retail business emerges.

Most of the electricity retailing value is tied up in selling grid electricity to household, but that business is under strong and likely unrelenting pressure on volume.

So what Origin, and for that matter AGL and EnergyAustralia, need to do if AEMO is on track with the forecasts is to replace the revenue and profits it gets from selling electricity to households, with revenue and profits from EV charging and from managing customers’ rooftop production.

Or to greatly increase fixed costs (the daily supply charge). That’s because, if AEMO is right, gentailers aren’t going to be supplying energy to households, they are going to be supplying firming power, and overnight power. Even the overnight power will be reduced if households end up putting in batteries.