There was quite a bit to take away from the CEC Energy Storage webinar last week. In the past I have found CEC events to be “glossy” rather than content rich, but this time it really seemed focused on adding value to the audience instead of the speakers.

The webinar covered a range of issues. Some of the things I took away included:

AEMC policy approach, and not just to storage

Kate Wild from the Australian Energy Market Commission (the rule-maker) stated that the AEMC is moving in general from an “asset type” rule making approach to a “service provision” approach. Although I am not sure exactly what this means in practice it seems to be the current business philosophy of seeing things “as a service”.

You can have “sales as a service”, “storage as a service”, “rent your house as a service” and so on. In all seriousness, it is interesting to note a change of philosophy. And to me the AEMC’s current direction seems more focused on ensuring there is a “good game” rather than blowing the whistle constantly.

More specifically the AEMC noted that the Energy Security Board has recommended that the National Electricity Market design be based around a “trader-services” model and that the “two sided” market rules will be designed to:

“Better reward value provided by flexible demand and supply”;

“Facilitate new types of participation”;

“Work out how best to incorporate price responsive supply and demand into the the operation of central dispatch and the forecasting that leads into real time”.

Although not discussed, transactive energy is, to me, one of the interesting theoretical approaches in this area, that may become more important as the “modular grid” develops.

I owe a debt of thanks to Sean McGoldrick, the new CEO at Tasmania Networks, for giving me my new favourite buzzword. A readable academic article on transactive energy for the Monash University microgrid can be found at Transactive Energy Market, Monash.

Transactive energy becomes relevant once “modular” grids i.e, linked microgrids become a thing.

Meanwhile, and of more interest to the many would-be battery developers currently looking for a few dollars and a contract, the AEMC has a rule change that will create a new service provider: “The Integrated Resource Provider.” Such a service provider would have:

- Single registration category for standalone and hybrid storage;

- Hybrids can manage their own energy behind the connection point;

- Small generation aggregator [MSGA] but I think VPP participate in this category allowing them to provide ancilliary services;

- Grid scale batteries move from two DUIDs (connection identifiers) to one with 20 bid bands (10 for buy and 10 for sale) and,

- Batteries negotiate their DUOS and TUOS (network chargers) at the point of connection. Apparently, and news to me, this is the existing situation and in practice if connected to transmission, by negotiation,batteries typically don’t pay transmission use of system;

Utility scale battery costs and value streams – ARENA view

According to Dan Sturrock, from ARENA, only two batteries, the AGL Torrens Island 250MW/1 hour battery and the AGL contracted Vena-owned 100MW/1.5 hour battery at Wandoan in Queensland have so far been committed without requiring Government support.

Nevertheless it’s quite clear that market confidence is growing because the size of the batteries has increased considerably. Neoen has a 300MW/1.5 hour battery in Victoria. (Neoen has an excellent execution track record to date). Also EnergyAustralia has a 350MW/4 hour battery planned near Yallourn.

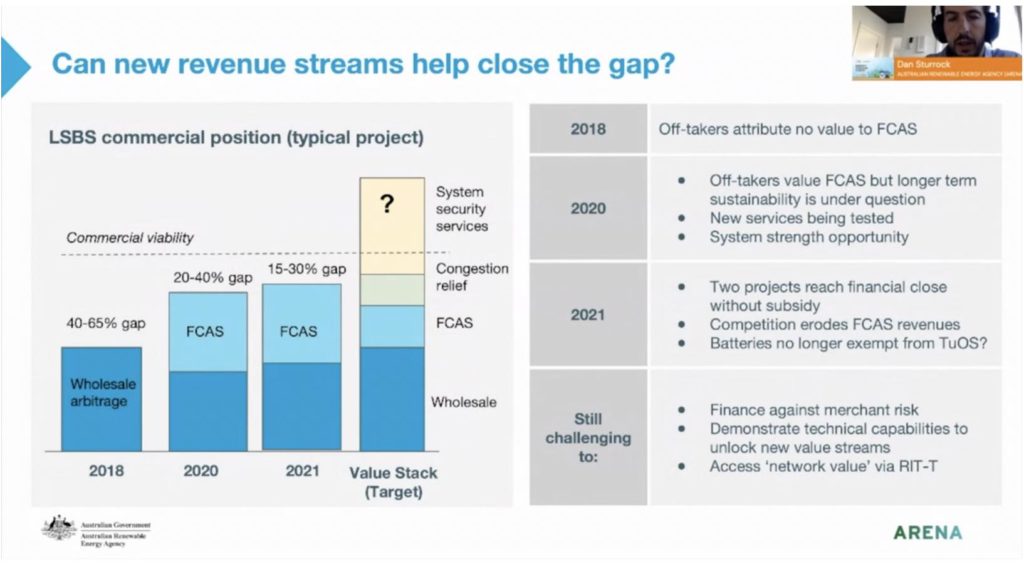

Sturrock presented an interesting slide looking at the developing revenue stack in batteries which I take the liberty of reproducing.

I actually also made a presentation on batteries to a SmartEnergy Council presentation the previous week, and cited some interesting research from NREL, one of the best resources for analysts in the energy space, They presented a similar battery development concept in the USA:

EnergyAustralia, perhaps the most interesting presentation

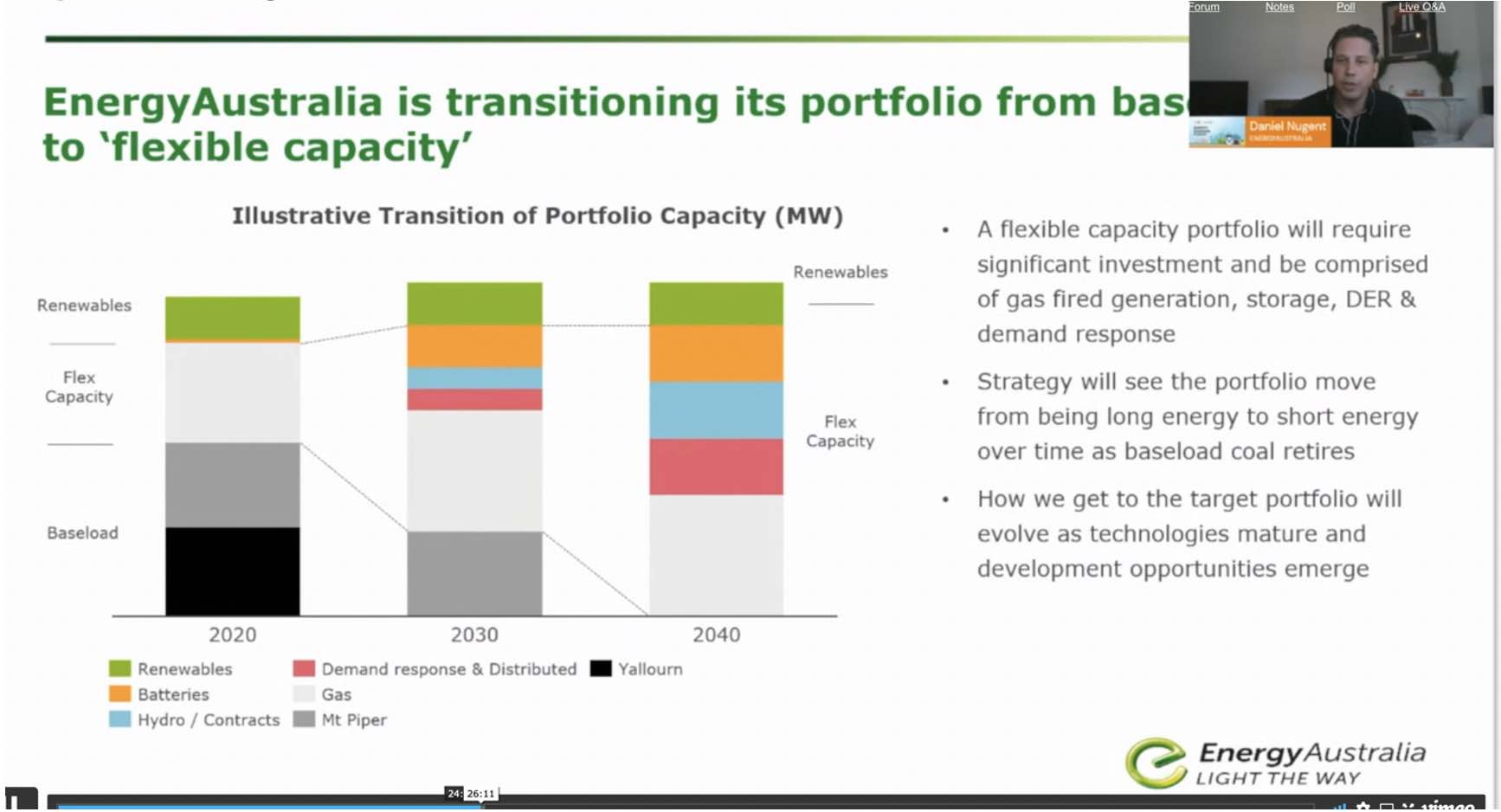

Daniel Nugent from EnergyAustralia, a subsidiary of CLP, gave a great presentation, but for me the interest was only partly about batteries. In fact the most interesting thing was the implied view of EA’s market positioning.

As a reminder EA is the third of Australia’s big three gentailers, currently operating two coal generators, Yallourn in Victoria and Mt Piper in NSW, and some gas generations as well retailing electricity and gas across the entire market.

EA recently changed its CEO, and I might add, disclosed in the CLP annual report it had been on the expensive and significantly wrong end of the settlement of some litigation around the sale of its gas storage asset in Victoria.

So what I took from EA is that it isn’t going to participate in the supply of bulk energy longer term. EA sees its role will be as a firming supplier of power and that, to a declining but nevertheless always material extent, that power will be partly sourced from carbon intensive generation.

I’d like to applaud EA for setting its strategy out in this way. It is far more transparent about its longer term approach than either AGL or ORG. Again I take the liberty of showing a slide:

In my often wrong, foot in mouth first, opinion, I’m not sure this will prove a successful strategy.

Speaking as an in investment analyst the world view is as the share of wind and solar continues to increase firming cedes revenue to the wind and solar providers. And I don’t think the firming price will be high enough to make up for the loss of energy.

Equally, I would be nervous about gas in a decarbonizing world. Gas is the third largest source of carbon emissions and complaints about it are increasing. Still when your focus is power and not energy, then the actual emissions cost may be less relevant.

Be that as it may, EA went on to outline its 335MW/8 hour Lyell Lake pumped hydro project located just south of Bathurst. Unlike EA’s first go at Cultana in South Australia this is on EA land and uses the existing dam.

EA states there is enough head to get a round trip efficiency of 78%, still not as good as batteries but pretty good. EA already has strong interests and connection in the Lithgow community and transmission is close by, albeit not in an REZ.

You’d have to rate this project as having reasonable prospects for a pumped hydro project.

For myself I continue to question the merits of pumped hydro compared to battery. But this is where I am an analyst and the actual developers understand the relative costs much better.

I’ve used some numbers on a slide that EA showed to demonstrate NPV gaps. It wasn’t completely clear but I think its for batteries this year. None of the batteries produced a positive NPV, similar to the analysis of ARENA and the gap grew with duration.

The first thing is that the economy of duration drops off very sharply beyond 4 hours. The numbers are A$ which I mention because they are the quotes EA sees.

In the alternative from a USA perspective, we can go back to a storage technology cost comparision from NREL. There is a slightly updated version of these numbers but this is close enough to their modelling.

So starting with a power estimate, in the USA NREL sees that by 2024, the very earliest any new pumped hydro project could possibly be built, pumped hydro will be competing with batteries that have a lower power cost up to say 10 hours.

Similar to EA, NREL shows a declining marginal benefit of duration, but still better than what EA estimates.

Four hours is likely, in my opinion, to become the predominant duration, because its ideally suited to the daily balancing market, and provides some room for errors in dispatch/charging from imperfect look ahead algos and has a nice cost advantage over 2 hour.

Still if you want to compete in the NSW 2 GW of dispatchable capacity auction, 8 hours is the minimum. I suspect that 8 hours was chosen to exclude batteries, because its still not really long duration but never mind.

The inflection point in the cost decline curve is in 2025 according to NREL, and they can’t see the future better than anyone else, but I like their work. I translated the NREL numbers into A$ @ 0.75.

So clearly NREL sees lower cost in 2025 than EA is using.

I don’t doubt the EA numbers, after all EA comes to the same conclusion everyone else has; in Australia only short duration is justified just now and even then it’s a stretch. But neither do I think the NREL numbers are that wrong.

There could be several reasons for the difference. One of them maybe that there are actually not that many suppliers right now of utility scale batteries together with all the associated bells and whistles. The European market has been dominated by Fluence. (Fluence presented that its global total market to date is 2.9 GW) The USA market is mostly Tesla.

In Australia its been all Tesla, at least within the NEM until recently when both Fluence and Doosan have gained a foothold. I expect the South Koreans to eventually have a go, particularly Kokam which was acquired by Israeli headquartered Solar Edge. SolarEdge will likely go for smaller scale to start with but the urge to go big will likely prove irresistible. Still that be speculatin.

Other bits of interest

Coming back to the webinar but running out of space, so a few other things to catch the eye.

- Neoen is presenting/developing a virtual utility battery. Fluence provides the battery, connected to the grid and clients can buy the right to charge and discharge it. Minimum capacity is 5 MW/ 2 hours. Clients can charge/discharge anytime over 5 minute intervals. Settled against the prevailing 5 minute spot. I like the concept here, for buyers it’s a simple question of economics, all the development hassle goes away. How the price looks remains to be seen, but I am guessing if Neoen is presenting the product, its probably a fair way down the track to selling it and therefore, for at least some clients the price is right.

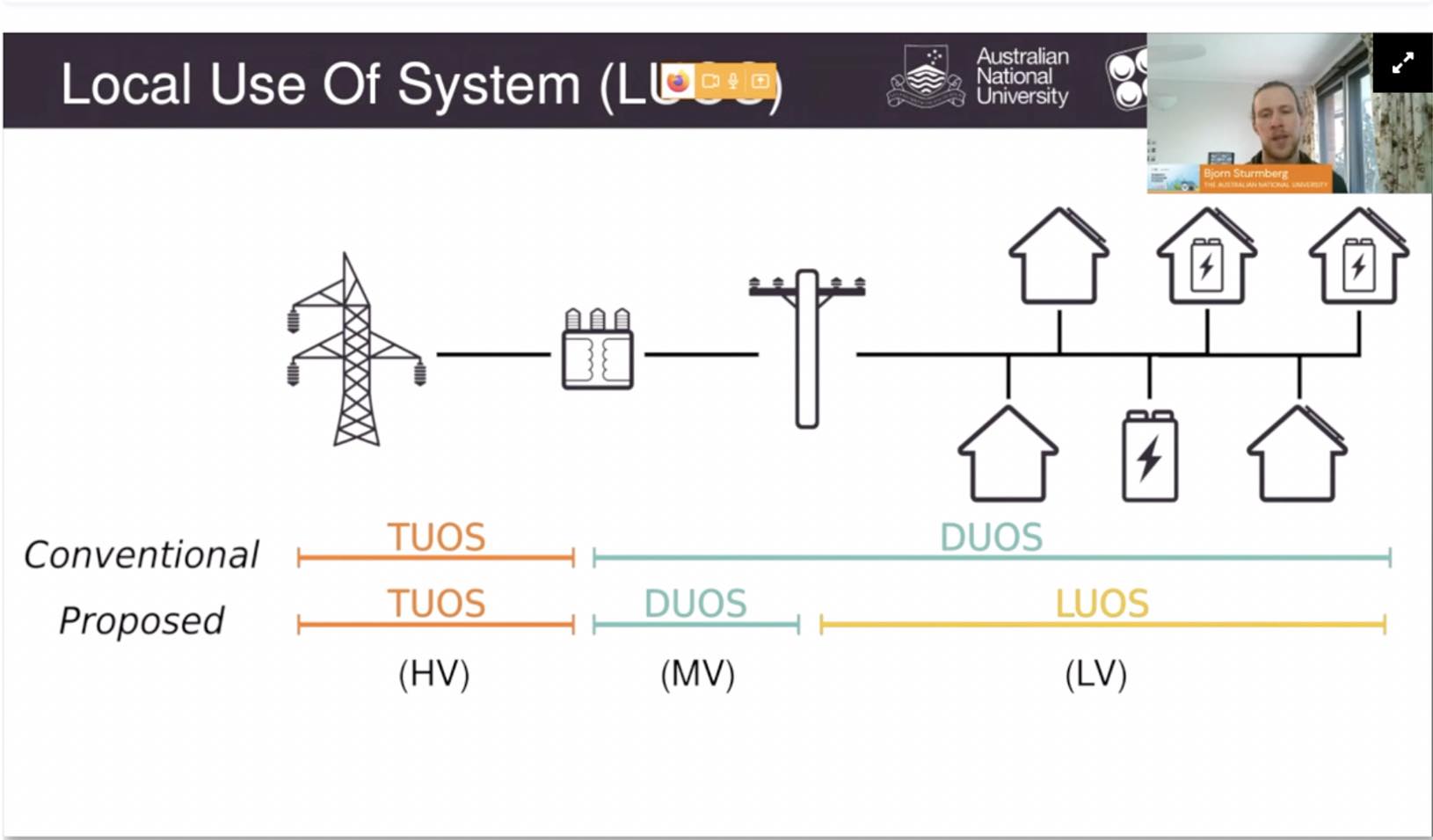

- Bjorn Sturmberg presented the ANU local use of system [LUOS] tariff design. This boils down, as far as I could tell by skimming, to keeping revenue to the distributor the same by doubling volume as a compensation for halving the local tariff. It doesn’t, in my opinion, and as presented improve the relative economics of a community battery compared to a battery installed in the house. In addition because it’s a volume based tariff there is no real concept of how tariffs should be charged within a, here we go again, “modular” network. The network may get the same or more revenue, the customer gets to access the battery, so it does work that way. LUOS as presented doesn’t really address the question of whether households should be charged for energy, or capacity or for being connected. Still, it’s very early days in the consideration of this concept.