Andrew Forrest’s Fortsecue Metals expects a $US1 billion ($A1.6 billion) revenue windfall from its massive electric truck deal, but says its timelines for bigger green energy and green hydrogen projects could be impacted by the uncertainty created by the new Trump administration.

The iron ore mining giant and emerging green energy player says its targets of “real zero” for its Pilbara mining operations by 2030 remain intact, but international projects – particularly its Pheonix, Arizona, green hydrogen play – are facing delays because of the changes wrought by the new US government.

The real zero plan for the Pilbara is the truly ground-breaking initiative. Forrest has argued that if Fortescue can achieve it, then it will show that the rest of the world can and should follow. He has dismissed “net zero” targets, which allow for the burning of fossils mitigated by “offsets”, as a con against the climate.

The Pilbara net zero plan involves the massive $US2.8 billion ($A4.6 billion) deal with Liebherr to supply 475 green mining machines, including about 360 autonomous battery-electric trucks, 55 electric excavators and 60 battery-powered dozers. It has also signed a deal with Maclean Engineering for a fleet of 30 electric road graders.

The Liebherr mining trucks will use huge electric power systems built by Fortescue Zero in the UK, a contract the company says would deliver revenue of more than $US1 billion ($A1.6 billion) to supply the trucks destined for the Pilbara mines and to third parties.

“A significant amount of that (contract) value will come back to the company,” Fortescue Zero chief executive Mark Hutchinson said in the company’s interim earnings call on Thursday. “There is a huge value in the IP we have created, and this presents a significant commercial opportunity for what we’re doing at Fortescue zero.”

The first of those power systems has been sent from the UK factory, and the first of the fully electric, 240-tonne haul trucks will be delivered to the Pilbara by the end of the year. The company has been trialling the “Roadrunner” battery electric prototype in the meantime.

Fortescue is also developing a 6 MW “fast charger” for the giant electric trucks and it says the sheer scale of the charging machinery will be a “revolution” for heavy vehicles.

Battery electric trucks, and the electric excavators, need to be charged and powered by green energy. Fortescue last year opened its first solar farm, the 100 MW North Star Junction project, and plans a total of 1.5 GW of new wind, solar and battery storage by 2030.

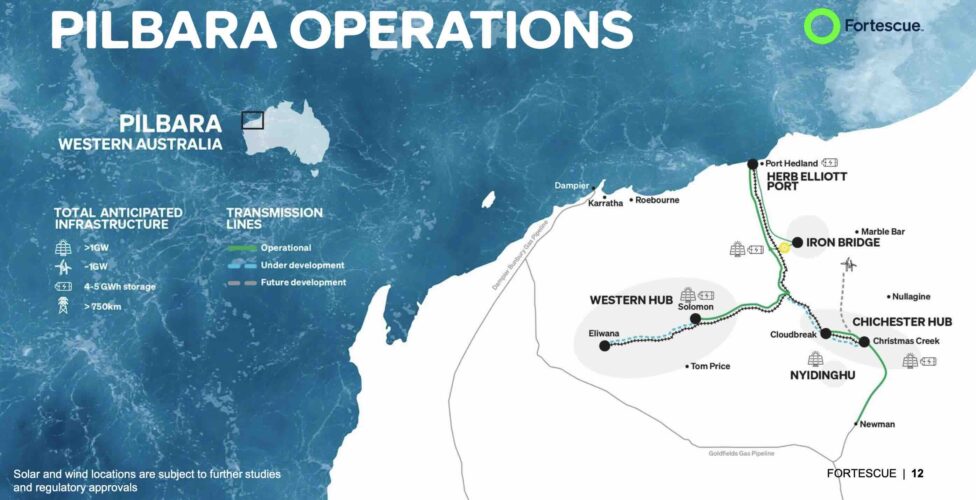

Its longer term goals, including for the development of green iron and green hydrogen, include more than two gigawatts of large scale wind and solar, and 4.5 gigawatt hours of battery storage in the Pilbara region (see map above), which will help power its goal of 100 million tonnes a year of green iron metal.

But, while the Pilbara decarbonisation plans remain largely within Fortescue’s control, its broader green energy and green hydrogen ambitions remain hostage to political uncertainty, and particularly the new Trump administration and its attempts to de-fund Joe Biden’s Inflation Reduction Act and its billions of grants and tax credits.

It has already had to walk back on the timeline of Forrest’s grand plan to deliver 15 million tonnes of green hydrogen a year by 2030, and Hutchinson says one of its key early projects, in Pheonix Arizona, is also facing delays.

“The US is in an interesting place,” Hutchinson said. “With the Trump administration, we’re really analysing what that means for projects in the US at the moment, and it may impact the timeline on the Arizona project.

“Our firm belief is that the world needs an enormous amount of green energy, and … we will not be pulling back from our ambitions. To be clear, our timelines may change, but our ambitions will not,” Hutchinson said.

That uncertainty was flowing through to potential customers for other green hydrogen projects in Norway and Brazil. “We’re having discussions with off-takers … there’s uncertainty globally for them too. And until we have a project which is economically viable, we won’t be taking those to the board.”

To support independent journalism and Renew Economy’s efforts to fight disinformation and misinformation about climate issues and green energy, please consider a one-off or monthly donation. Click here if you can. And for more news and analysis about the green energy transition, you can sign up to our free daily newsletters here.