It’s a brave company that would build a new gas generator in NSW. Or a government owned one.

In ITK’s opinion, the federal government’s attempts to force new gas generation into NSW is sign of just how badly it’s running energy policy. The requirement for 1000MW of new dispatchable power to replace Liddell has not been backed up by supportable modelling.

The federal government is “threatening” or standing over the NSW gen-tailers by saying it will cause its wholly owned Snowy Hydro to build the generator if the private sector doesn’t.

How can any developer be sure there won’t be a carbon price in the future? What about the NSW state government or other state government policy interventions? We don’t even know if there will be some revised form of capacity system in the post 2025 world.

There is still plenty of coal generation and, in ITK’s opinion, Vales Point and Yallourn and even Eraring could all close and there would still be enough firming power around. But certainly that’s a debate the federal government could contribute to.

The federal government, if it doesn’t like the modelling produced by AEMO for the ISP, or by the NSW government for its roadmap, could commission its own model by a respected forecaster that would examine the need for firming power in a world of early coal closures and where battery economics are strong.

It would need to be credible and not be a “Fisher” model, but such things do exist.

Concurrent with that it could have processes to manage the coal closures, perhaps as Blueprint Institute suggested last year.

This would be an open and transparent process that would build confidence in the conclusions and provide industry guidance.

But that’s about as far away from how the federal government operates as it’s possible to imagine.

To the extent there is any policy development at all, it’s done by a biased group of gas executives and to the maximum extent possible behind closed doors and in secret. But in truth, there is no real policy.

Consider these comments from the VW CEO in Australia:

“Managing director of Volkswagen Australia Michael Bartsch says he cannot convince his German head office to supply Australians with the company’s top-selling mid-range electronic vehicles because of “embarrassing” local laws.”

And Angus Taylor office response:

“A spokesman for Energy and Emissions Minister Angus Taylor said the Morrison government would not be lectured about vehicles emissions by a car manufacturer that has a track record of deceiving motorists and violating clean-air laws.”

How can any reasonable person be happy with the federal government so at odds not just with the electricity industry but also the auto industry? There is no attempt to be reasonable, it is just straight opposition, denial and denigration.

I have been following politics since JFK was assassinated and growing up in the country where the local newspaper would carry headlines referring to the Whitlam government like “They are just a bunch of top commies,” and never have I seen a Coalition government so at odds with business, and so bereft of good policy development. Never has the bureaucracy been so politicised. Ah well, back to gas.

The economics are also tough

On the economics side of things, what we see is that the private sector is investing in batteries. AGL, EnergyAustralia and Origin, each of which is a substantial player in gas generation, are choosing to announce battery investment.

In this note we look at some of the factors that might influence that decision. But the point is that, even though the investment track record of the big gen-tailers is terrible, they are the professionals in the industry.

Paul Broad, CEO of Snowy, also supports gas. But he hasn’t got any money and even though I can see the case for Snowy 2 as a public good, the consensus within the broader energy industry is that Snowy 2 has a lot to prove in terms of earning a return on capital.

And that’s to put the industry consensus opinion very kindly.

All that said, there is – or there will be – a need for some long duration firming power once most of the coal has closed. But earning a return will be hard and the generation won’t run that often, so it won’t use much gas. How much will be needed is uncertain. There is no rush, at least not in our opinion.

Squadron to build 635MW gas plant in NSW operating by 2023?

According to the AFR, Squadron has so far proposed building a 1000MW gas generator one day, 635MW the next.

Squadron has no customers, no retail base, and there is no visible price signal.

The proposed station will run partly on analyst-driven, spreadsheet-sourced green hydrogen from either Tasmania or West Australia where facilities will use yet-to-be built ships to transport the hydrogen to Port Kembla.

The natural gas will be imported from the yet-to-be built LNG import terminal at Port Kembla. That LNG import terminal is, in our opinion, arguably the best way to get more gas into NSW. It’s a great plan.

Nevertheless, it hasn’t got the final go ahead and hasn’t announced much in the way of customers, despite three years of marketing.

Transgrid will come to the party for transmission access and no doubt Squadron will be able to build its station much quicker than anyone else has been able to do.

Who knew power development was so easy? Certainly Trevor St Baker, who typically took 5-10 years to develop a gas peaker and get the ducks to line up enough to finance it must be in total awe of Squadron’s development skills.

Everything is subsidised, the supply and the demand

In a world where the renewable energy is subsidised, the competing coal generation is subsidised [Yalllourn], the demand [Portland Smelter] is subsidised and where most of us have yet to face up to Jobkeeper coming to an end, the subsidy of a fancy new gas power station by a novice new entrant should it qualify for the “Audit committee referred UNGI scheme” hardly raises an eyebrow.

Let’s look at the economic case.

Costs

For comparison, here are some parameters taken from a relatively recent consultant study done for AEMO.

These estimates exclude a bunch of costs relating to transmission, gas pipes, hydrogen proofing steel, let alone all the business development and support costs.

Using the above table we can estimate the SRMC of running at full and minimum capacity:

We estimate the gas cost using imported LNG sourced from Henry Hub at around A$ 8/GJ. I wouldn’t argue if someone said A$7 /GJ or $9/GJ

Figure 3 Source: ITK based on Origin presentation

If we used $8/GJ and a humble open-cycle turbine (because the idea of hydrogen proofing all those reciprocating engines is a bit beyond my analytical background) that suggests, for an MLF of 1.00, that the plant will need an electricity price of at least $100/MWh to run and up to $200/MWh if it spends much time at minimum operating rate.

ITK believes that in the daily balancing load batteries will likely be able to undercut this.

The need for firming power is more likely to be in winter evenings. In ITK’s opinion, at least until more coal generators have closed, this is likely to be a crowded and competitive space.

For what its worth, ITK forecasts that very, very little gas generation is required in NSW prior to about 2030. Even to 2035 in our model NSW only requires less than 1TWh a year of gas generation in energy terms.

It may need a lot for power for brief intervals, but how to get paid for that.

I will say that this is one part of ITK’s model that we are not particularly confident about, since there will be so much new firming technology about. But perhaps Squadron understands it better.

A glimpse at battery vs gas four-hour market

The costs of gas power plants are well understood. For a battery there are four vaguer parameters.

The capital cost, the fuel cost, the lifetime of the battery, and the associated maintenance capex.

Regarding capital cost the fact is that disclosure is limited.

For instance, the brownfields expansion of the Hornsdale Power Reserve completed in about Sep 2020 was reported as $71 million for a 50MW/64.5 MWh. That’s about $1.08 million a MWh.

Part of the reason for the high cost is the low duration. The longer the duration the more you can spread the inverter and infrastructure cost.

We estimate the unit cost of a four-hour duration 100MW battery at about 65% of the one-hour duration equivalent.

Even so, we would have estimated a materially lower price for the Hornsdale expansion. We model a one-hour battery at $A0.7 m/MWh in 2020. In any case, this is how the “headline” numbers stack up on our desktop.

It’s natural to question the 20-year assumed life of the battery, and I do not think the individual cells can be charged and discharged that often. So probably there is a maintenance capex element to be added in.

The hours per year is about four hours a day. There is no revenue in this model, just costs.

So using those models and also ignoring MLFs and degradation factors (gas and batteries both have degradation) its about an 11 year payback.

Move the gas price to $9/GJ and the electricity charge price to $45/MWh and payback falls to 8.3 years.

That’s just the very first comparison. The other things I think about are:

The variable cost of the battery (fuel cost) is much lower than gas, so the battery will be dispatched first in the normal course of events.

Batteries in most respects are way more beneficial to the grid, they effortlessly provide reactive power, frequency, current and voltage services in time scales so much better than gas it’s not even close to being a contest.

The reality, in my opinion, is that batteries are THE enabling technology of a decarbonised grid. How this translates to extra revenue is a more complex question, but the simple answer is domination of ancillary services.

Even in 2020 batteries were dominating ancillary services revenue:

Figure 6 Source: Global Roam’s Generator Statistical Digest

With 5 minute settlement and development of synthetic inertia and fast frequency response, plus the grid forming ability of batteries and inverters, there will be very little room for gas in the ancillary services market.

It’s not a big market right now, but it may grow as coal generation goes away and new methods of grid control are incentivised.

Batteries can be ordered and built well within 12 months, gas plants take years, and that’s assuming no environmental issues (noise, emissions, permitting).

The one area that gas clearly has a big advantage is duration.

ITK has already demonstrated, to our satisfaction anyway, that in a 100% renewable grid, there will times when no amount of battery storage is going to be sufficient, at least not without ridiculous cost penalties and wasted capacity, and at those times gas, or hydrogen come into their own.

But that need for new investment in longer duration firming wont arise until there is much higher, say 80%, wind and solar share of bulk energy supply and simultaneously most of the existing thermal firming (coal) generation has gone away.

We are a decade away from that under even the most optimistic decarbonisation scenario.

A standard way of looking at the duration of prices is, amazingly enough, the price duration curve. Unfortunately history is not necessarily a good guide to the future where price duration is concerned.

However in NSW and since Jan 1, 2018, just 9% of the time has the electricity price been above the $110/MWh SRMC of a gas generator. That’s why there hasn’t been very much gas generation.

Figure 7 Source: NEM Review

If you are contemplating building a gas plant then you have to believe you will get plenty of opportunities to be “the last player standing.” That is where the coal has all been used up, the batteries and the pumped hydro have all been used up, but you Mr Jumping Jack Flash are still there with your gas plant. Not only that you have enough gas to run for hours and hours.

So even though the past is not relevant to the future, we are interested in the “persistence” of high prices. It takes a bit of work to do this and our back of the envelope method is only indicative.

What we did is to look at the “runs” in NSW electricity prices. That is, we calculated how many half-hours the price was continuously above a threshold price, in this case $110 the SRMC of gas. And then we counted the number of those runs.

So there were about 2500 times (out of 54,000 half hourly prices) when the price was above $110 for an hour or less. 85% of the number of the runs were of four hours or less (battery opportunity).

In the three-and-a-bit years studied there weren’t any runs where the price was over $110/MWh for more than 40 continuous half hours.

Figure 8 Source: ITK , NEM Review

Conclusion, don’t jump to one, but the gas opportunity might be small

So, by comparing figure 7, which shows that prices were above $110/MWh about 9% of the time, with Figure 8, which shows that batteries might capture 50% of that opportunity, and assuming hydro gets nothing, pumped hydro gets nothing, there is no coal and no interstate transmission, you might have seen about 5% of the time there was opportunity for gas.

However I again want to stress that this is not really the way to look at the data.

To do it properly you need to do a full simulation of every generator in the system, taking account of the many constraints and inputting in all the assumptions you want about how much wind solar, batteries, coal and competing gas there is. It’s a really hard exercise.

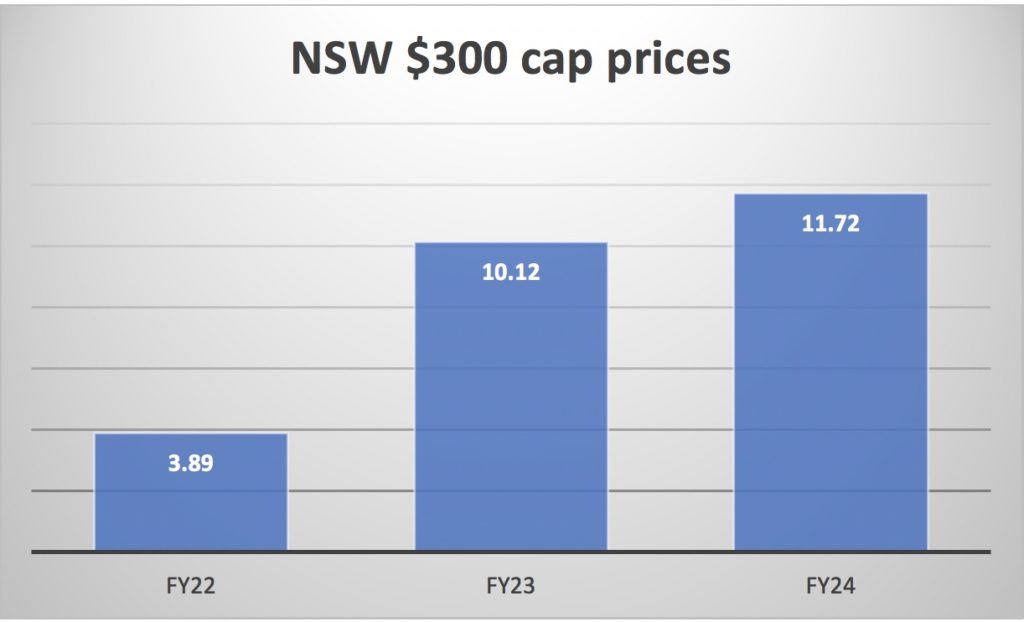

Background on NSW cap prices and gas generation in NSW

$300 electricity caps are options. The seller agrees that the buyer will pay the market price up to $300 /MWh and the seller will assume the price risk above $300/MWh during a given time period (they are quoted quarterly) and for the agreed quantity (caps are quoted per MW).

The buyer pays an agreed price for that protection.

Cap prices are typically much (say 4X) higher in the March quarter than for the rest of the year, reflecting the much larger probability of electricity prices in the March quarter being over $300/MWh

For instance March quarter 2022 caps are quoted at around $20.25, but other quarters in calendar 2021 are around $3 to $7.

Cap prices have been depressed in NSW, and everywhere else, recently due to the flood of new supply, and the collapse in electricity prices.

Figure 9 Source: ASX

Historically, before the influx of renewables and when gas and hydro were the only choices for peak supply, caps typically sold at say $15/MWh (12 months average). In general it was hard to justify a gas generator based on cap returns alone.

Caps are only quoted out to FY24, whereas we really need a view on average prices through the latter half of the 2020s and early 2030s.

Historically we’d have cared a lot more about the early years because the present value of returns in those years was much higher than the back end present value but with interest rates so low perhaps that’s less important.

We know coal generators are going to close but we also know 5 minute settlement is coming and batteries are going to be big. The federal government is building Snowy 2 and helping to build Marinus Link.

The NSW government roadmap, remember that, has a call for 2000MW of renewable firming to be built by 2030.

So for 635MW, and let’s assume an average price of $10, that’s around $55 million per year, even if you never generate. Also I expect batteries do compete in the cap market, although even then the battery owner may need some “reinsurance.”

And I think the word from the industry is that caps are not the way of the future.

Firmed power is the way of future, à la Infigen and Snowy. Still, even though history is a poor guide to the future the table below shows how much cost a retailer would have avoided by buying 635MW of NSW price cap cover for the past few years.

Figure 10 Source: NEM Review

In addition to cap revenue the gas generator would also generate for its own benefit when electricity prices were between the short-run marginal (fuel) cost and the $300 cap contract price.

Regarding fuel cost, it depends on whether Squadron builds open cycle, combined cycle, reciprocating engine or “aero derivative,” but the simplest assumption is a nice high-carbon emitting open-cycle generator.

In this brief note I don’t run that analysis but will just point to the fact that in NSW gas generation has averaged 157MW since the beginning of 2028 and there is already a lot more capacity than that.