Lyon Group, one of Australia’s most ambitious solar and storage developers, has become embroiled in an escalating court battle with US solar giant First Solar, just as it seeks to complete a mooted sale of some of its biggest projects.

First Solar, which has sought the winding up of a Lyon Group unit over an unpaid loan, has succeeded in obtaining an injunction against Lyon from selling certain assets pending a resolution of the dispute.

It is not clear which of the assets are affected, or if it includes the assets that Lyon last week described as one of the “biggest M&A plays unfolding in Australia right now”.

“Major global players are keen to purchase Australia’s only imminent dispatchable new renewables projects because they will deliver commercial returns, with no government funding,” the company CEO David Green said in a statement announcing the sales last week.

The projects for sale include:

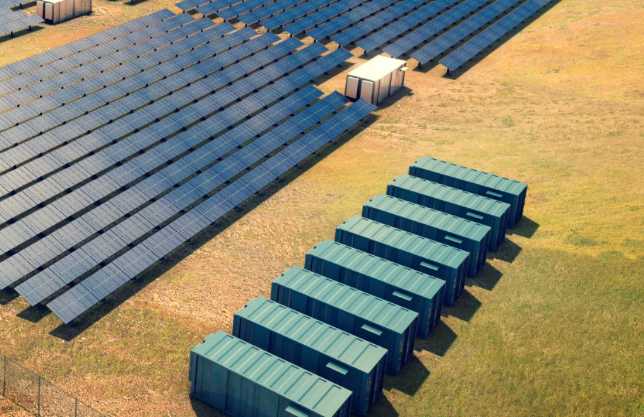

The Lakeland project in Cape York, Queensland (55MW solar + 20MW/80MWh storage); the Nowingi solar and storage project in Victoria (250 MW + 80MW/320MWh); and the Riverland project in South Australia (240MW + 100MW/400MWh, with up to 330MW solar including stage 2).

Lyon has played down the action by First Solar, describing it as a “garden variety” contractual dispute that would not affect the sales process.

“A Lyon entity is involved in a small change, garden variety contractual dispute with First Solar,” a spokesman said in an emailed statement in response to a query from RenewEconomy.

“The contract stipulates that it should be resolved by arbitration. Lyon has been seeking to resolve the dispute under the relevant clauses of the contract.”

A spokesman for First Solar said only that: “I’m unable comment on matters currently before the Courts.”

First Solar was named as preferred supplier of solar modules at the early stages of several of the Lyon projects, and the dispute appears to centre around a loan made by First Solar to Lyon of $280,000.

The dispute escalated in late October, when the Australian Securities and Investment Commission posted an insolvency notice advising that First Solar had applied to wind up Lyon Infrastructure Investments Pty Ltd.

First Solar also won a federal Court order for ASIC to reinstate the company, which had been de-registered.

The two parties returned to Federal Court last Friday, where a stay of proceedings was agreed, pending a further hearing in late December, and another Lyon group company agreed to “stand in the shoes” of the once deregistered subsidiary.

Amid all this, Lyon says it hopes to seal the sale of its first tranche of projects by mid-December.

It says it has the largest pipeline of solar and storage projects in the country – 1700MW of solar and 1000MW of battery storage, including the Kingfisher project near Olympic Dam, and other unspecified projects in South Australia, Victoria, NSW, and Queensland

“We are at the last stage of selling our three most advanced projects,” Green told the Large Scale Solar and Storage conference co-hosted by RenewEconomy in Sydney on Tuesday.

“The comments we are getting from bidders and bankers, is that they are seeing a major shift in sentiment and risk profile for stand alone wind and solar,” he said, before adding: “Banks are saying they don’t want to provide finance for those sort of (stand-alone) projects any more.”

Green also unveiled what he described as a “unique” contract – fast dispatch renewable power purchase agreements – that would allow buyers to contract dispatchable power at a far cheaper price than gas peaking plant.

He said this unique contract – able to deliver power within 300 milliseconds – was a “market disruptor” arriving several years before the implementation of 5-minute settlement periods.

He said the contracting would be able to be delivered to market in the first quarter of 2019, presumably when the first of the mooted projects was completed.