HumeLink is a transmission link that, in my opinion has three main functions:

- It greatly assists with alleviating constraints on the shifting of power from Victoria to New South Wales and vice versa. It is only part of the NSW solution and needs the Sydney Ring upgrades to fully realise the solution.

- It enables the efficient transfer of power from the under construction South Australia NSW interconnector to efficiently get to Sydney. On the one hand this will provide NSW with access to SA gas fired firming generation and on the other enable South Australians to avoid having gas setting the price about 40% of the time.

- It will enable Snowy 2 power to get to Sydney.

Below I outline what I learned from reading the report of the NSW upper house inquiry into undergrounding HumeLink.

The most important thing I learned is that HumeLink is not only extremely likely to go ahead, but that essentially construction is already well underway even ahead of formal approval. Along with that the easement process is well advanced, although of course the hold-outs will take longer.

In saying the above I am not ignoring the lessons about social license, and there are many, but simply forming an opinion about the outcome for HumeLink.

The messages and learnings about the need and the how of selling the benefits of investment to regional Australia are many.

Unsurprisingly, the inquiry concluded that undergrounding would cost at least double and would delay the project by maybe four years.

I learned that other than community opposition, the substantive issue with transmission is that it’s ugly. In terms of safety, high voltage transmission has not so far resulted in any fires. Maintenance and use of the land impacted by the easement is not that different whether above ground or underground.

In fact, Transgrid would earn a HIGHER return for shareholders if the line was undergrounded, because the regulated asset base would be higher.

Yet Transgrid argues against undergrounding. And rightly so, in my opinion. To start with, even if Transgrid and other stakeholders thought undergrounding was a good idea, it’s unlikely the Australian Energy Regulator (AER) would agree. And they have to approve the capex.

The NSW upper house inquiry into undergrounding Humelink

Recently the NSW Upper House held an inquiry into the potential for Humelink to be undergrounded.

As was widely expected, the inquiry concluded that undergrounding would cost way more and take considerably longer. In this note I summarise some of the key findings of the inquiry.

Of course, those who want Humelink undergrounded will never accept the inquiry results. Like American Republicans who can’t accept the election result, if the inquiry doesn’t find in their favour then the inquiry is rigged and the result cannot be accepted.

For myself, like an auditor, I generally approach all such reports with two concepts front of mind. The first one is “what is the agenda” and secondly “what is the value add;” that is what can I learn.

As regards the agenda, I don’t really know, but I suspect it was to give the topic a good factual airing, come up with the inevitable conclusion and then get on with it.

As for what I learned, well that was plenty.

“Facts” and figures

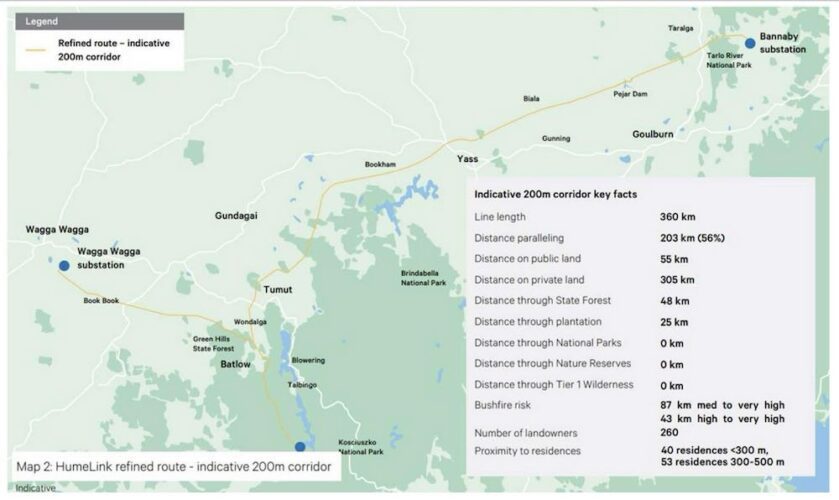

Humelink is 360km long and has a capacity of 2.2GW.

Construction is expected to cost about $5 billion, commence in 2025 and conclude in 2026. The reason why construction is so quick is because close to $400 million of early spending has been done, including ordering 16 high voltage transformers and, I think, the construction steel.

The line consists of 850 towers strung 300-600 metres apart and with each tower 50-72 metres high.

Community opposition has been strong. It’s widely accepted that initially Transgrid did a very poor job acquiring social license. However, more recently at least, according to some observers, things have improved.

Most of the line will be built on private land and will require a 70 metre easement corridor.

According to evidence presented to the Inquiry:

Currently Transgrid has Consents to Enter for approximately 249.9km of the total alignment of 328km or 76% of the line. Approximately 40.747km of this is public land or approximately 16% of the 249.9km where we have Consents to Enter.

According to evidence presented in 77% of cases where a route deviation has been requested (but presumably in the same property) it’s been accommodated.

If the landowner and TransGrid cannot reach agreement then TransGrid can compulsorily acquire. So, of course, TransGrid has the bargaining power but, as history in any relationship shows, gross exercise of power rarely leads to a happy relationship.

Cost and time comparisons

As mentioned, the overhead cost is estimated at about $5 billion and the construction time, once formal notice to proceed is made, is estimated at no more than one year.

Estimates of the undergrounding cost vary from Transgrid’s estimate of $15 billion for a DC line to $17 billion for an AC line. Community supporters of undergrounding believe that TransGrid overestimates the cost. However in my opinion they have likely underestimated it.

TransGrid also stated it would take five years longer to underground, a figure that is again disputed by community groups. However it’s hard to see that community groups have any real way to satisfactorily estimate how long it would take to build 300km of line underground. Even TransGrid would, in my view, struggle to do a good estimate.

The Inquiry Committee concluded:

A core issue for the committee was the cost of undergrounding HumeLink. While we received many different figures about how much it would cost, the evidence was nonetheless clear that it would be more expensive – at least double the cost.

I have no reason to doubt this conclusion, however it’s the delay that is the more fundamental thing in my personal world view.

For anyone who cares about decarbonising electricity in NSW and Australia, a four to five year delay in building this line would be quite unreasonable.

It would also impact the benefit of connecting South Australia.

Other points made

Maintenance

No clear view emerged as to whether maintenance cost of an underground line would be higher or lower.

Land use around easement

Generally speaking, cropping and husbandry activities can continue around above ground lines. Equally, many but not all activities can continue on top of underground lines

Bushfires

Residents complained that transmission faults were the cause of bushfires. However this was directly contradicted by TransGrid CEO, Brett Redman

In fact, Mr Brett Redman, Chief Executive Officer, Transgrid, reported that Transgrid could not find any instance of a bushfire started by any transmission line more than 66kV.

Professor Andrew Dyer, Australian Energy Infrastructure Commissioner reported that the risk of a 220kV or higher transmission line causing a bushfire was ‘virtually zero’, and that the risk is higher from the distribution network, from things like ‘pole-top fires and fuses that jump to the ground that are red hot’.

Similarly, Councillor Ian Chaffey, Mayor, Snowy Valleys Council, said that the risk of fires was from lower voltage lines, from 22kV to 66kV, saying ‘they’re basically the ones that cause the fire.’

REZ evidence

Although the inquiry was about the merits of undergrounding Humelink, evidence was also presented in regard to community opinion about REZs.

The opinions bout REZs were assisted by public forums held in Deniliquin and Armidale.

The overall community opinion was that EnergyCo had done a poor job. I think this has broadly been accepted by the current government and addressed as part of its response to the recent Jacob’s report.

See my note: https://reneweconomy.com.au/hearts-and-minds-is-more-than-just-a-slogan-as-nsw-manages-coal-exit/

A sample of the community concerns was, for instance, shared by by Dr John Peatfield:

There has not been a proper cumulative impact study done for the New England REZ which is what we require. The terms of reference should be environmental, particularly for land clearing and its consequences; agriculture; resources; traffic, remembering that all infrastructure has to come via the New England Highway from Newcastle; social impact; visual impact; rental affordability; waste management and landfill; Indigenous cultural landscape; noise; compliance with wind and solar guidelines; and social licence. This, we believe, should have been done before the designation of the REZ.

This accords with my view that, although it has its own difficulties, a “Masterplan” approach to REZs would benefit virtually all stakeholders.

Planning delays can be reduced by reducing the number of duplicated EIS studies, e.g. soil studies as mentioned by Llew Owen’s on our recent podcast. Maybe the connection studies can be minimised if the REZ capacity is modelled up front, road access studies and planning, council role, etc.

Without diminishing the failures by EnergyCo and the NSW government, it’s fair to say that when NSW went down the REZ path no one had any real idea what it meant or how the concept was to be operationalised.

Although time presses on it’s not too late to fix it up. In my opinion, this includes a better job of identifying and marketing the benefits.

Much is heard of the problems but little about not just the construction jobs, road upgrades, increased regional GDP from payments to landowners, payments to community funds, skilled employment increasing the ability to attract more skills.

Compare Walcha (no renewable projects underway) with Uralla (big solar farm) and to me it’s clear. And that’s just one project.