The New South Wales Coalition government and its newly created energy agencies are gearing up for the start of a series of auctions designed to transform the country’s biggest and most coal dependent state grid to one dominated by renewables and storage.

“This is an exciting and pivotal moment,” says Paul Verschuer, the head of AEMO Services, which as the newly appointed “Consumer Trustee” is managing the process for the state government.

“It will fundamentally change the energy system to produce a cleaner, cheaper and more reliable system for consumers.”

The scale of energy minister Matt Kean’s planned transition – replacing the bulk if not all of the 10GW of ageing coal fired generation with wind, solar and storage and other firming capacity – is enormous, and the timeline, to do this within a decade if needed, is also ambitious.

It is also devilishly complex. Apart from the physical and engineering task of building the new infrastructure and managing a new energy system, there is also the challenge of getting the right amount of the anticipated tens of billions of dollars of investment in the grid at the right time.

The program outlined by the NSW government agencies and AEMO Services is designed to solve this conundrum, and involves a complicated system of auctions and tenders that will kick off later this month, when registrations for the first tender round are due, with first bids required from October 4.

This first tender will seek around 1GW of new wind and solar and 600MW of storage (of varying durations) and will be the of what will become a twice-yearly event.

NSW has laid the foundations of its renewable infrastructure requirements with the creation of five renewable energy zones, and possibly more, including potentially in offshore wind, to host the bulk of its new capacity.

On top of that it is proposing a unique mixture of new financial products that are still being progressively refined and finessed. The primary purpose is to prevent the “free-for-all” that blighted recent investment surges and to ensure that it is co-ordinated.

This might look like central control to some investors, and the jury is still out on how successful the NSW plan will be. It is unlike anything that has been proposed till now.

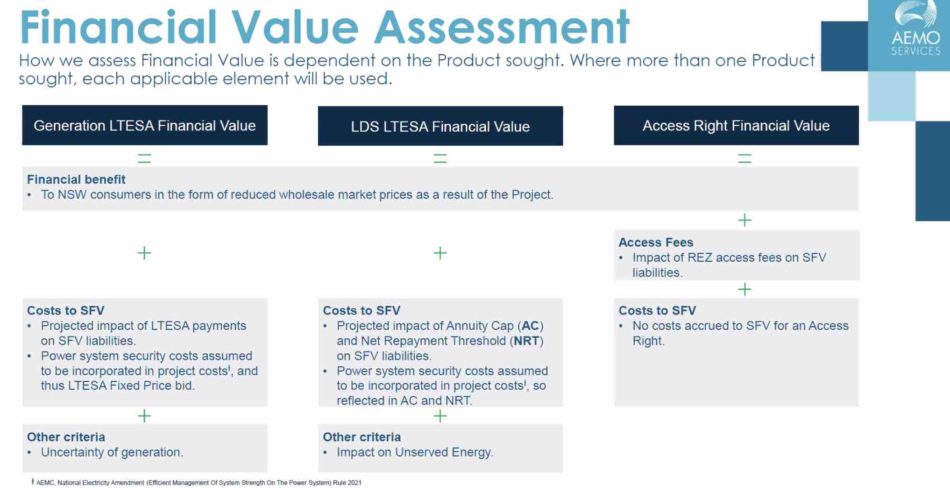

Essentially, two new products are being created that are designed to provide a pricing floor to generation and storage projects to lower the cost of equity and finance and to attract more bankers, and to avoid a repeat of the grid congestion problems that have plagued the industry.

The first product, long-term energy service agreements, or LTESAs, are designed to provide a price floor that is roughly equal to the break-even price for a new wind or solar project, and storage projects such as pumped hydro and battery storage.

It comes in the form of a type of put option that a developer can exercise if market prices fall unexpectedly, but it also allows the developer to sign more lucrative contracts with third parties, or source higher prices from the open market.

In a briefing on Tuesday, AEMO Services says it is designed to deliver certainty that will lower the cost of capital and debt, and encourage more banks to enter the market that were previously fearful of the market volatility.

“There’s a whole range of banks that haven’t been able to lend into the Australian market under merchant structures, who can suddenly now lend to your projects because they’ve got a floor (price),” said Brad Hopkins, the head of financial markets at AEMO Services.

“(This puts) projects within their merchant exposure limits and (means) they’re suddenly allowed into the Australian market in a big way.”

The second financial product is more complex, and still earlier in its evolution, and comes amid a problem on network access and pricing that has stumped the country’s major regulators and rule makers over the last decade.

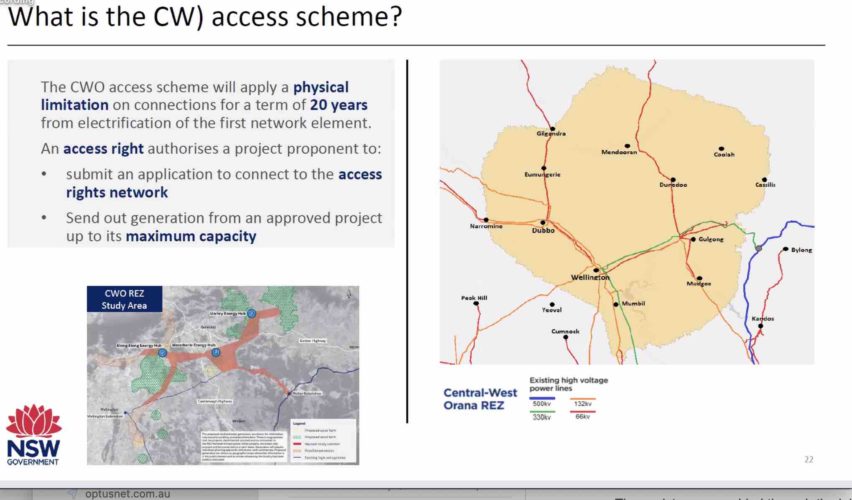

The NSW solution is to auction access rights to the REZs that are designed to put a physical limit on the number of projects within a renewable zone, and will award a maximum output capacity to each project.

It is designed to help project developers understand the risk of curtailment of their wind and solar projects, and avoid some of the problems encountered across Australia’s grids, and particularly in the south west of NSW and north west Victoria where a part of the grid became known as the “rhombus of regret” for the severe restraints on output and new connections that occurred.

The auction assessments will be judged not just on the potential maximum output, but also the timing of it and the potential load.

In the Central West Orana REZ, the minimum capacity sought is 3GW, and the maximum is 5.84GW, although that could change. There will also be maximum time of day capacities.

The program won’t allow a project to connect if it pushes the transmission curtailment in the zone beyond 4.37 per cent (which is actually four times higher than the curtailment reported in the last quarter across the main grid).

The scheme is sill being finessed.

Recent changes include ensuring that existing projects are not penalised or squeezed out by the new access rights, the removal of contract “shapes”, the inclusion of short term storage (because of its value in soaking up excess output), and the extension of contract duration to 20 years from 15 years.

The first auctions will offer LTESAs to wind and solar projects located anywhere in NSW (but not those unveiled before November 2019), and access rights to the first of the REZs to be opened up, the Central West Orana zone.

There will be multiple hurdles to overcome for the bidders. Their offerings won’t be just based on lowest prices. AEMO Services says projects will be judged on their impact on the grid, their impact on market prices, and other key metrics such as consumer engagement.

Social licence, it says, is a key ingredient. “We think that what’s good for generators can also be good for consumers,” says Jennifer Radford, the manager of the REZ process.

“What we’re looking for is an efficient utilisation of the network that meets both of those requirements. But we can’t do any of it without community support.

“We’ve kind of reached this kind of golden, magic point in time where we’ve got broad government support for a renewable energy transition. We’ve got industry well on board, but we need to bring communities on that journey.”

Radford says the access fees will go largely to fund community and employment programs.