It’s the politics, stupid

Although this note is about the modelling the Energy Security Board has commissioned to support the National Energy Guarantee, the modelling is basically a side show. The NEG always has been more about politics than electricity.

On the politics ITK’s read at the moment is:

Mark Butler has publicly stated Federal ALP wants a higher emissions target.

“Labor can’t agree to an arrangement that will tie the hands of future governments for at least a decade, arrangements that would see wholesale power prices higher than they should be, no cuts in pollution, and jobs and investment in this really important industry of renewable energy absolutely smashed,” Butler told the ABC.”

However, Bill Shorten has not come out and supported that.

Dr Anthony Lynham, the Queensland energy minister, has in an indirect way distanced himself from Federal ALP and, to our way of reading what he said, implicitly stated QLD will support the NEG. As reported in the SMH

“Anthony Lynham, the state’s energy minister, told Fairfax Media that backing for the National Energy Guarantee hinges on whether Queensland’s target of making 50 per cent of its electricity renewable by 2030 will not be affected.”

As we understand the NEG there is no obstacle to states pursuing their own additional targets. It does allow States such as NSW to underachieve but it does not stop other States overachieving. As such the comments by Dr Lynham are not a deal breaker.

We have always regarded QLD’s stance as critical since the QLD Government has no election worries and can deal to policy as it feels appropriate.

For Victoria, the question is whether there are votes to be gained or lost by opposing the policy. We suspect there may be a few votes to be won by opposing but maybe not enough.

The ACT is opposed, but it is very small.

Comparing ESB results to AEMO’s ISP modelling

Despite slightly over cooking the egg in our previous post we remain convinced that ACIL-Allen’s modelling for the ESB was agenda driven. Specifically, it’s politically critical to the success of the NEG negotiations that the NEG can be presented as resulting in lower electricity prices.

So no one can be surprised that’s what the modelling does show. We argue that a model which is agenda driven should be treated with caution. We also think that it costs, say $0.5m, to commission one of these reports and as such it’s worth getting full value from it.

Also, we are critical that the NEG document has been released/leaked without release of the underlying modelling document. In our view the graphs presented in the ESB document are selective and don’t allow for a proper examination of ACIL’s modelling.

We call for the ESB to release the ACIL modelling report as a priority, certainly well in front of the COAG meeting.

We unhappily note that the ESB document doesn’t make the ACIL modelling assumptions underlying its NEG and No-NEG cases clear.

Specifically, it’s unclear whether the ACIL modelling allows for all the Queensland 50% renewable policy by 2030 and Victorian 40% renewable policy by 2025. These are very important assumptions that so far are independent of the NEG but clearly influence real world outcomes.

An example of the selective reporting is that there is a graph in the ESB report showing what a forecast of new generation investment without the NEG but no graph of investment with the NEG.

We think the graph presented has little or no credibility but it’s more important to understand what the model shows if the NEG is implemented.

No graphs are provided in the ESB report of energy production by fuel in either the No NEG or NEG case.

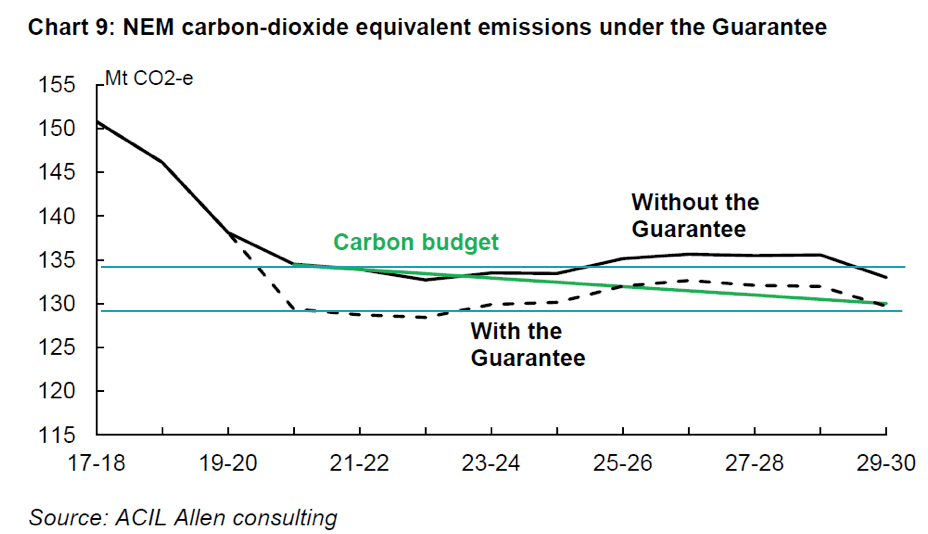

However, we can make an inference from the emissions graph. In both the no NEG and the NEG case emissions RISE between 2021 and 2027 by about 5 mt before declining at the end of the period.

The only plausible reason for emissions to rise is an increase in coal fired generation. It’s also clear that even in the NEG happens case, that no more than the target is achieved. This pretty much amounts to a statement the Queensland and Victorian targets have not been modelled. Is that reasonable?

ISP neutral case has a clearly different forecast

By contrast the year long modelling released only one week prior, that arguably was much less agenda driven, by AEMO for its “Integrated System Plan” had clearly different modelling outcomes.

It’s important to understand that AEMO neutral case assumes the NEG, QLD and Victorian policies are all achieved.

On that basis AEMO forecast a steady increase in wind and utility PV generation.

As a result of this increase in capacity AEMO’s neutral energy by fuel graph looks as follows:

Examination of this figure shows that combined brown coal and black coal generation declines reasonably steadily out to 2030 with a clear step down in black coal from 2025 and brown coal from 2029.

There doesn’t appear to be any year where coal generation increases over the previous year and as a result there will be no years where carbon emissions increase.

We would argue that these figures are somewhat inconsistent with the those of the ACIL modelling.

Conclusion – Two different models produce different results

At the very least we think COAG might ask for a reconciliation between ACIL’s forecasts as produced for the ESB and AEMO’s forecasts as produced for AEMO’s ISP.

Any reconciliation could only deal to generation, energy and carbon emissions because AEMO did not explicitly model price outcomes.

Our own view remains that we would not put $1 of investment into an AGL or Origin share based on the price forecasts in the ACIL model. We think the model underestimates the cost pressures in the coal and gas sector and the impact those pressures will have on price.

Time will tell. What we can do though is to look at the extent to which the AGL and ORG share prices incorporate expectations of the electricity prices forecast by ACIL.

Our bet is that AGL investors in particular will be needing an undies change when they read the report and starting to ask questions about how credible the forecasts are. We will turn to that in our next article.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.