Queensland is the second largest consumer of electricity in the National Electricity Market and is the State with by far the highest level of consumption growth. We think there are emerging signs of a generation shortage in Queensland particularly in the late afternoon, and over the next 10 years this situation can be expected to get worse.

In fact as soon as the next two big LNG trains start production, the Darling Downs gas fired generator will basically stop producing, likely sending tea-time wholesale electricity prices up another level.

This problem was completely and utterly foreseeable and has been years in the making. Part of the solution may be bringing Swanbank E (gas generation) back on line in 2018, but that’s the old way of doing it.

The more modern and in the long term better answer is to start making it easier for households and businesses in Queensland to put some battery storage in their homes and businesses. There will be (lots) more solar PV in Queensland and there doesn’t seem to be any plan on how to manage it.

There is already a strong and increasing price signal that there is a shortage of generation in Queensland, particularly once the distributed solar PV starts its daily decline.

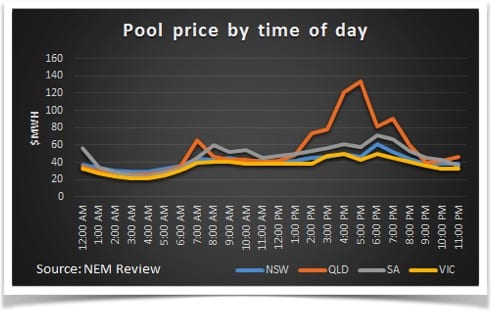

Thanks to Global Roam, publishers of NEM Review, and the magic of Excel’s pivot tables we’ve put together the Queensland pool prices over the past three years by time of day.

The data shows that prices spike strongly from about 3:30PM up to about 7:30PM and that this effect is increasing. In 2016, a generator dispatched in QLD over the 3:30 PM to 7:30 PM window could expect to average about $140 MWh.

At today’s spot gas prices even an open cycle gas generator could expect to make over $80 MWh gross profit every day over those four hours. This is the way the market is supposed to work. High prices provide a signal that demand exceeds supply and that there is an investment opportunity.

The elements of the problem are:

- Queensland is a bit of an island as far as power goes. Although generators can export from QLD, NSW Generators can only rarely be dispatched to Queensland.

- Queensland power demand is growing due to CSG production. It can be expected to grow at least another 200 MW over the next 12 months.

- Queensland gas generation is declining as the gas available for generation is siphoned off to CSG.

The problem is masked to an extent by the 1.5 GW of rooftop solar in Queensland but as soon as that stops generating open cycle (inefficient, carbon emitting and expensive) gas generation is required to fill the gap.

No amount of solar on it own can fix this problem, and there is only a very small wind resource in Queensland. Still, it’s quite clear that there will be more solar (utility scale) built in Queensland and this will tend to push down prices in the middle of the day, just as wind has negative correlation in South Australia.

Higher pool prices don’t generally affect the final prices consumers pay in the short term as retailers hedge out the pool pries. However the pool prices reflect underlying supply and demand and this feeds into Futures prices and they in turn feed into the allowance a retailer makes for buying power and therefore in the medium term pool prices do feed into final prices.

Potential answers

The obvious answers are:

- Increase transmission from NSW (that would take years and NSW is going to have its own problems soon enough)

- Reserve some gas and bring Swanbank E back online in 2018 (that will buy some time).

- We estimate it would take about 1000 PJ (lots) of gas to cope over the next 20 years.

- Swanbank E has 380 MW of efficient gas but its in cold storage because its owner sold the gas into the LNG industry (Pelican Point in South Australia is more or less in the same boat).

- Incentivise storage.

About 500MW of storage for three hours would do the trick. It’s more economic to build gas fired generation than to install storage and we think that would be the case even if there was a carbon price of $30/t.

But we think that the emerging problem in Queensland with the very predictable fall off in solar supply is a great opportunity for a progressive government to actually start moving towards the market of the future.

It’s hard to prove but we think some household storage would also start moving towards the network of the future. It would also require Queensland to start installing some modern communicating meters.

Background

According to the APVI, Queensland has around 1.5 GW of solar installed, the vast majority of which is in form of distributed, residential, rooftop PV.

When it is operating, the PV in Queensland has roughly the same output as gas fired power, probably more in the middle of the day.

It’s already quite noticeable that as the PV drops off in Queensland power prices tend to spike. Its actually far more noticeable than in South Australia. Because Queensland doesn’t have any wind generation or hydro, when the solar dies off the increased demand is met by gas and coal.

Gas prices all over the NEM have picked up over the past 12 months (more than 100% up year on year in Queensland) and are presently significantly higher than in the USA.

That said (i) they are not yet at the heights expected when oil was $US 100 a barrel, (ii) prices will almost certainly go higher when the final two trains of LNG in QLD (train 2 at APLNG and train 2 at GLNG) are commissioned over the next 12 months.

We estimate those two trains will require a further 500 PJ of gas per year at the upstream fields. The extra gas demand will also increase electricity demand by about 200-250 MW.

Gas prices are highest in South Australia because gas and interstate transmission are the only source of power for South Australia at night when the wind drops. Even so, Pelican Point one of the most technically efficient gas generators in Australia doesn’t operate, because its owners Energie has also sold its gas to someone else.

As has been publicly disclosed, both ORG’s Darling Downs unit and the Queensland Goverment’s Swanbank E unit have sold their gas resource to supposedly higher value uses (LNG). Darling Downs remains as by far the largest gas generator in Queensland but Swanbank stopped operating some time ago.

The main point to notice is that even in May (i.e. footie season, i.e. winter) gas generation is still having to work hard. Darling Downs is providing 450MW in the early evening and Braemar and Braemar 2, which are both open cycle power stations, are operating virtually every day.

As the gas best scarcer these guys will require still higher prices. Prices have been getting up to $180 MWh for an hour or two every evening for only modest increases in demand.

Allowing for all that gas generation in Queensland is quite profitable at the moment variable costs even for Braemar (open cycle) are no more that $64 MWh and that price is almost available 8:30am through to 6:30 PM. In fact, the chart shows how the price is just below the Braemar profit level in the middle of the day.

Queensland does have some relatively new coal fired generation, Kogan Creek and Milmerran are about the newest coal units in the NEM, but it also has some very old units, particularly Gladstone.We won’t be in the least surprised if there is a major forced outage at one of the Queensland coal generators over the next couple of Summers.

David Leitch was a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.