The Australian wind energy industry has moved quickly to take advantage of renewed investment certainty, with contracts for a 240MW wind farm in Victoria announced within a day of the reduced renewable energy target bill passing the Senate, and others poised to announced similar financing deals in coming weeks.

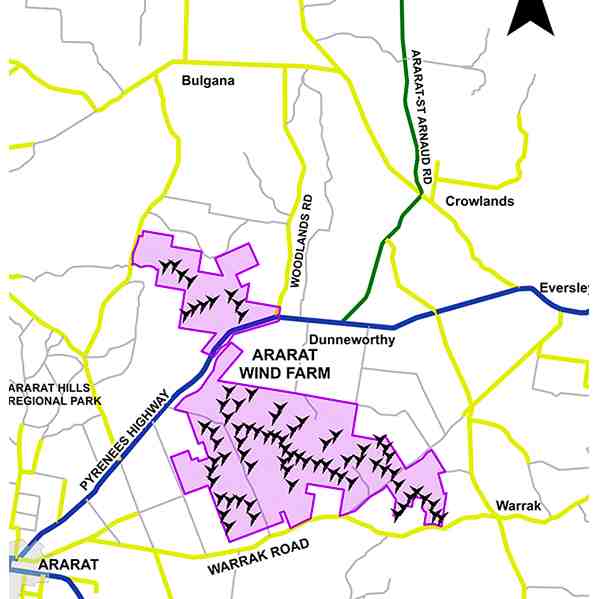

Contracts were signed on Thursday for the 240MW Ararat wind farm, to be built in western Victoria by a consortium including RES Australia, GE and Downer, with financing also coming from shareholders Partners Group and Canadian pension fund OPTrust.

Part of the $450 million Ararat wind farm would have been be built anyway, because it was contracted to do so after winning an auction under the ACT government’s 90 per cent renewable energy target in February. Tenders for early construction works closed on May 15, with construction already slated for the third quarter of the year.

That ACT government contract was for 80MW of capacity, but the developers were keen for the whole project to go ahead because of the economies of scale. They say that the RET bill passed by the Senate this week, despite cutting the 2020 target from 41,000GWh to 33,000GWh, will deliver that certainty.

Around 40 per cent of the output from the 75-turbine wind farm will earn a price of $87/MWh from the ACT, while the remaining output will be sold into the wholesale market at whatever price can be obtained.

With renewable energy certificates currently trading at near record levels of more than $52/MWh, and Victorian energy prices averaging more than $30/MWh so far this year, the wind farm should be able to match the prices guaranteed by the ACT.

The Hornsdale project in South Australia, another winner of the ACT wind energy auction, is also likely to reach financial close in the next few weeks. Its contract with the ACT is for 100MW of capacity, which will begin construction later this year, but the project could expand to its full potential capacity of 300MW.

However, while Ararat’s partners were prepared to go without a long-term power purchase agreement, sources close to Hornsdale said it was seeking a PPA before committing to the bigger project, which would be a separate transaction. It hopes the RET deal will help accelerate that process.

So far, however, it seems there had been little interest from major retailers. PPAs will be essential for most wind farms to secure financing.

Meanwhile, despite all the hullabaloo from the anti-wind MPs in the Coalition and the cross-bench Senators, and the Prime Minister himself, the government has quietly waved through another major wind farm in Victoria, almost adjacent to the Ararat project, despite being asked to intervene to halt the development.

The 63-turbine, 190MW Bulgana wind project proposed by Spanish group Enerfin in western Victoria had been referred to the Federal environment department earlier this year after opposition from some local residents.

But environment minister Greg Hunt ruled on June 19, a day after writing a letter to cross-bench Senators pledging to create a “wind commissioner”, that there was no need to intervene.

The Ararat wind farm is the first major wind project to reach financial closure in nearly two years, and is bigger than the entire 2014 financing in the country, after investment was brought to a halt in 2013 by the Coalition government’s desire to reduce the size of the renewables target, and in particular the number of wind farms.

The only other wind farms to gain financial close have been the small 19.4MW Coonooer Bridge Wind Farm, which did so in April after landing a contract with the ACT government. It got equity financing from Japanese giant Eurus and $39 million from ANZ, according to Stephanie Allport, data researcher at Bloomberg New Energy Finance.

According to Allport, the previous financings went all the way back to 2013, when the Bald Hills Wind Farm (106.6MW, owned by Mitsui & Co Ltd) and Portland Wind Energy Project IV (47MW, owned by Pacific Hydro) achieved financial closure, the latter with the help of the Clean Energy Finance Corp.

The CEFC has now been directed to focus its investments on new technologies such as large-scale solar and energy efficiency, as part of the deal between the Coalition and cross-bench Senators that also included the appointment of a wind farm “commissioner” to review complaints.

The Clean Energy Council expects between 30 and 50 projects will be required to meet the revised 33,000GWh target by 2020, or a total investment of around $10 billion.

The Ararat wind farm will provide payments to 42 land owners and, according to the Ararat mayor Paul Hooper, attracted no complaints.

GE, which is to provide the turbines for the Ararat wind farm, said the passage of the RET bill created certainty for equity partners to make “firm decisions” around long-term opportunities in Australia.

“With certainty comes investment – that’s our experience overseas and that’s what we’ll see here in Australia now that the RET is fully resolved,” GE Australia president Geoff Culbert said in a statement.

Matt Rebbeck, chief operating officer at RES Australia, praised the ACT government for its foresight in establishing innovative policies that are delivering low-cost clean energy projects. He said the ACT scheme was “a positive model for other states to follow”. Victoria and Queensland are among those considering similar schemes to boost renewable energy investment in their states.

OPTrust said it now had dedicated staff in Australia because of the opportunities to expand renewable energy production in Australia. Construction of the Ararat Wind Farm is expected to span two years, with power delivered to the grid from April 2017.

Swiss-based Partners Group will own 40 per cent of the venture, with OPTrust holding a 30 per cent stake, GE 25 per cent and RES 5 per cent.

Lawyers Herbert Smith, which advised on the Ararat project, said the wind farm would be the first “part merchant” renewable energy project to achieve financial close since the Moree solar farm closed in 2014. Moree was c0-financed by the CEFC.