A major new report from the CSIRO has mapped out how Australia can – and must – develop a domestic silicon and solar cell supply chain, from mining through to manufacturing, to support and de-risk its rapid shift to renewables.

The report, authored by PwC for the national science agency, finds that despite Australia’s world-leading role in solar research and development, and its world leading uptake of rooftop PV, its reliance on overseas supply chains remains a major weak spot.

That’s because, as federal energy minister Chris Bowen continues to remind us, Australia has a huge task ahead of it to reach its renewable energy target of 82 per cent renewables in the electricity grid by 2030 – in just 80-odd months.

On the solar side of this equation, alone, Bowen says that will require the installation of some 22,000, 500W solar panels every day for the next eight years, or 60 million by 2030.

Simply getting our hands on this amount of stock will be a tall order. And if we don’t – quite apart from missing our renewable energy and climate targets – Australia is in danger of missing out on major economic and social benefits.

“Australia already has the highest per capita deployment of rooftop solar in the world, and there are several mega-projects in the solar development pipeline,” says CSIRO senior principal research scientist Chris Vernon.

“But one of the greatest risks to Australia’s solar ambitions and energy future is our reliance on overseas supply chains for solar cell technology.”

The report says production of silicon in Australia is the first step to breaking this dependence on overseas markets, and creating a buffer against the sort of supply chain disruption seen during the Covid pandemic.

The report says that while silicon is abundant in Australia in the form of quartz, currently this is shipped overseas – predominantly to China – where it is smelted to silicon, then to high purity silicon.

Around 70 per cent of silicon is produced in China, while China also dominates the production of polysilicon. But CSIRO believes it doesn’t have to stay this way.

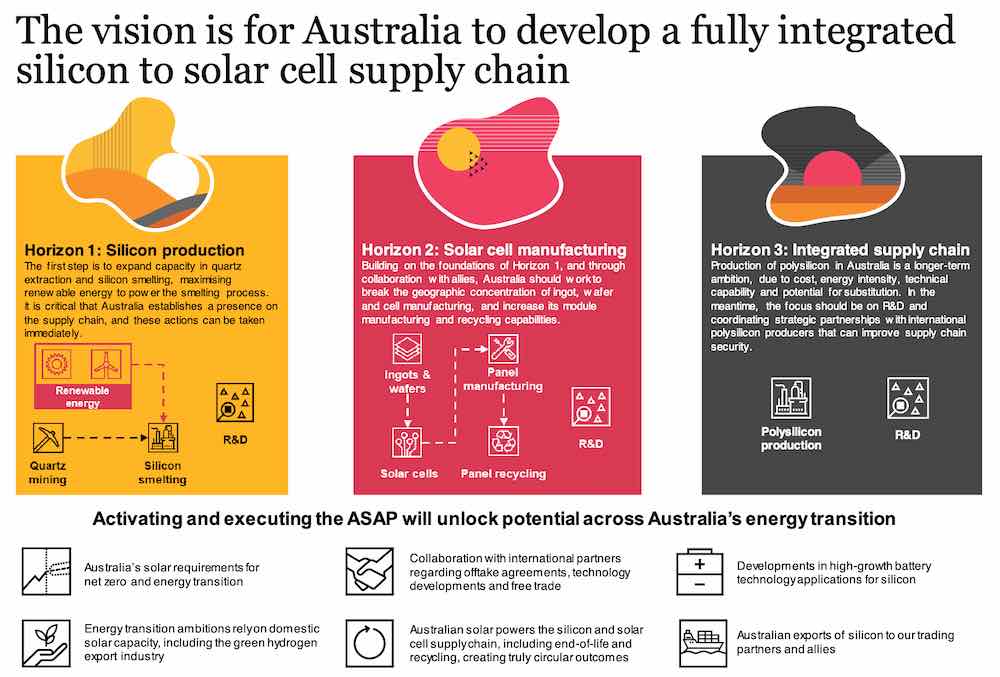

The Australian Silicon Action Plan sets out three “horizons” to aim for, based on the time and technology that will be needed for each step towards establishing the new supply chain.

Horizon 1 focuses on silicon production, and the clear and achievable actions that can be taken today to expand Australia’s capacity in this area.

These include identifying potential locations for new smelting facilities, integrating renewable power into smelting processes, and research funding into next generation processes and technologies.

This then paves the way to Horizon 2, which aims for solar cell manufacturing; and Horizon 3, which focuses on building up an integrated, low-carbon and circular solar cell supply chain, such as supporting polysilicon production and focusing R&D efforts on developing and scaling emerging and future technologies.

“[The plan] suggests a pathway for the creation of an industry that has the potential to provide employment and reskilling opportunities, the delivery of significant economic benefits that come from adding value to Australia’s mineral endowment, development of new industries in regional Australia… all while improving Australia’s energy security and independence,” says Vernon.

“This vision will not be achieved without a high level of collaboration between all stakeholders, from miners and refiners to state and federal governments, to R&D providers, to the manufacturing industry.”

Happily, Australia’s state and federal energy ministers have just this week demonstrated precisely the sort of political cohesion that will be needed for tasks like that being set out by the CSIRO.

Bowen is behind the idea and in July announced a $45 million extension of funding to the Australia Centre for Advanced Photovoltaics, declaring “this is Australian technology; we want to see more of it made in Australia.”

The local production of solar panels is also in line for a share up to $3 billion in federal funding support from the newly created National Reconstruction Fund.

Some of Australia’s foremost solar academics are also behind the move to local manufacturing.

Professor Renate Egan, who is secretary of APVI, while also leading the UNSW activity in the Australian Centre for Advanced Photovoltaics, says APVI’s early estimates of the Australian market suggest it could support around 1GW a year of local module manufacturing.

“If you look at China, the reason China has got where it is today is because they have had the confidence in the downstream market; the supplier then doesn’t have to take as much risk in supplying the product,” Egan told RenewEconomy in July.

“China’s government basically said, we could support a 100GW market, so let’s manufacture at that level and if we can sell some overseas, great!’

“That’s the sort of confidence we need,” Egan told RenewEconomy on Friday. “Let’s back ourselves.”

Starting at the start, the CSIRO report maps out a bunch of potential sites for silicon production – many of them in

regional Australia and close to oil, gas and coal projects.

![]()

“Given the need for skilled labour and port facilities, silicon production has the potential to create regional employment and support workforce transition from fossil fuel industries,” the report says.

And its final word: “We don’t have time to waste.”