As the election moves into its final phase, with inflation soaring and interest rates rising putting the squeeze on households, everyone is talking about cost-of-living pressures.

Few candidates, however, are willing to talk about the trajectory of electricity prices. The canary in the coal mine has fallen off its perch and few will acknowledge it.

The reasons for price rises are clear, as already reported in this publication: It’s time we stopped kidding ourselves that coal is “cheap and reliable”.

Ageing coal generators, the exposure to international gas and coal fuel prices and inadequate transmission infrastructure are working together to confirm the end of the low-cost fossil fuel age in Australia.

In my view there are two foundational barriers holding back the transition to clean energy in Australia.

The first barrier, a lack of regulatory support, is reasonably simple to address, namely introduce an emissions reduction imperative into the National Electricity Objective.

With this imperative, all regulatory decisions in the future would have to consider emission reduction targets, thereby forcing regulators and governments to cease with the short-term decision making that has got us into the situation we have today.

The second barrier is the lack of an over-arching policy to reduce emissions. It’s a bit like saying Voldemort in the Harry Potter books.

Of course, I am talking about a carbon price in Australia. We know it’s the most efficient policy for reducing emissions. The options have been assessed in multiple reviews, and no more thoroughly than in the Ross Garnaut 2008 Climate Change Review.

It surely must be the time to have open and considered conversations about the transition and, the appropriate policy mechanisms to drive investment, as well as support for communities at the frontline of this shift to new industries and economic opportunity.

These conversations can lead to more certainty for all stakeholders including business, local government, communities and workers, and support the investment certainty so craved by businesses seeking to deliver the transition.

Implementing a carbon price is already backed by business. Late last year the Business Council of Australia proposed higher interim targets and the use of an expanded safeguard mechanism to achieve those targets [1]. The Australian Industry Group has also got behind an expanded and more active safeguard mechanism proposal [2].

Unless there is better energy policy providing certainty to markets, scaled up investment in new infrastructure by mainstream investors will be impeded.

And if investment isn’t fast enough then we remain beholden to the performance of ageing coal infrastructure and the volatility of international coal and gas prices.

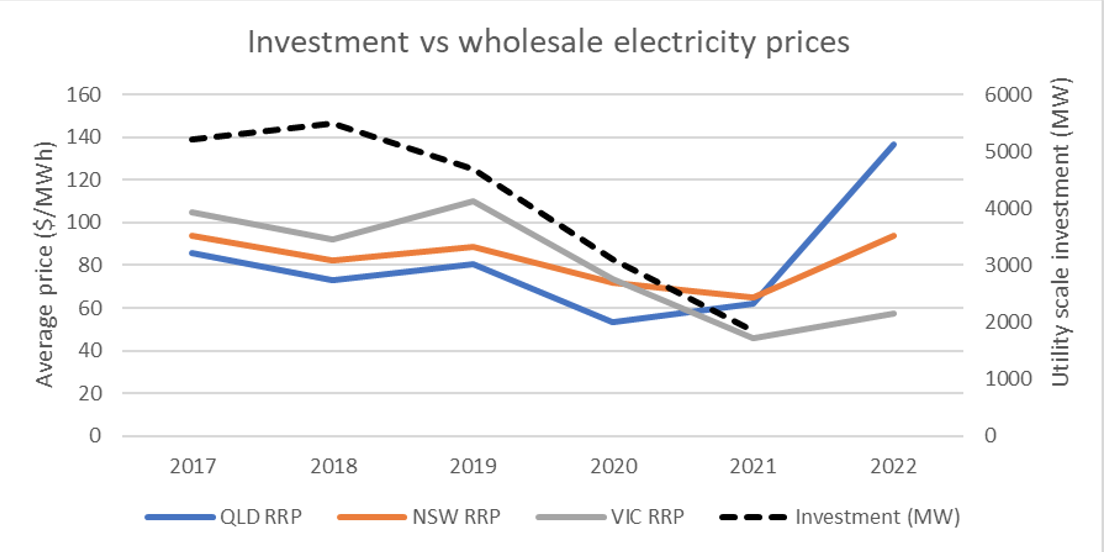

The correlation between investment and prices at this mid-transition point is already clear as the following graph shows – the drop off in investment is resulting in a sudden price hike.

Investors in the clean energy sector are currently managing a myriad of risks including, market volatility as the generation stock changes over, grid connection delays, MLF adjustments, market rule changes and equipment supply issues.

Uncertainty in the underlying policy environment could cause investment to slow to the point where the speed of transition puts even the long term 2050 target at risk, thereby exacerbating current household cost pressures and at the same time missing a once in a generation opportunity to boost the economy.

As someone with nearly 20 years in the renewables sector and with plenty of exposure to the potential risks and returns in this market, I believe the industry can mobilise for a fast and efficient transition given the right policy support.

At Sentient, clean energy – producing, storing, using or converting renewable energy – is one of our core investment pillars and we intend to fully leverage this opportunity for significant financial returns, social and environmental impact.

A messy and uncertain transition will cost the consumer more. Less renewables and more reliance on ageing coal generators or expensive gas plants will come at a huge cost and this will ultimately hit the customer’s bill.

The cost-of-living canary has fallen off its perch and few are sounding the alarm.

Lane Crockett is executive director of Clean Energy Solutions at Sentient Impact

[1] Achieving net-zero with more jobs and stronger regions – Business Council of Australia (bca.com.au)

[2] federal_election_policy_statements_energy_climate_mar_22.pdf (aigroup.com.au)