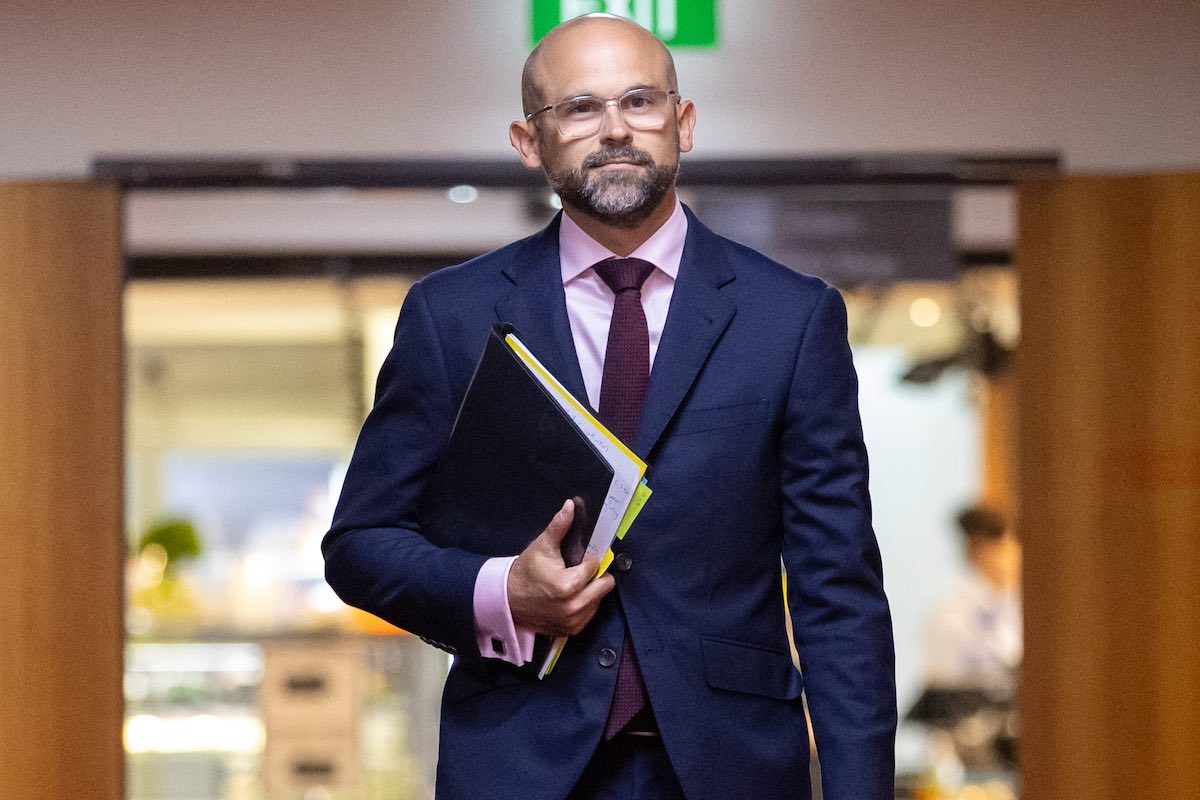

On Tuesday, Queensland’s LNP Treasurer and energy minister David Janetzki announced a policy to extend the life of state-owned coal power clunker Callide B reportedly three years beyond its scheduled closure date in 2028, with extensions also planned for the state’s other coal power generators.

Janetzki confirmed “coal generation will continue to play a central role in [Queensland’s] grid.”

This damaging policy reversal undermines what was formerly Queensland’s national leadership in building out large-scale renewable energy and storage, and its record uptake of rooftop solar, just as the climate emergency escalates and in the context of a national cost of living crisis driven by skyrocketing fossil fuel energy bills.

Since winning office from the former Miles Labor government in October 2024, the Crisafulli government has now locked in $1.4 billion of public capital to support the extension of high-emissions, expensive coal-fired generators at a time when Australia is plagued by fossil fuel hyperinflation. This includes $400m into maintenance for state-owned generators in 2024-25.

An October 2024 report by Queensland Conservation Council revealed keeping Callide B open beyond 2028 could cost taxpayers up to $420m a year, driving up electricity prices and damaging grid reliability.

The decision is essentially ‘coalkeeper 3.0’, and reflects the ‘coalkeeper 2.0’ capitulation of the NSW Labor government last year when it committed to pay Origin Energy up to $450m over two years to extend the operation of Australia’s largest coal-fired power station, Eraring, past 2027.

In another blow for the state’s accelerating renewables revolution, Janetzki announced a Queensland Productivity Commission review of the state’s emission reduction targets.

These were legislated by the Miles government with bipartisan support in 2024, and enshrined critical interim measures of 30% by 2030 and 75% by 2035 alongside its net zero 2050 target. Before the October election, now- Premier Crisafulli also pledged to repeal the state’s nation-leading renewable energy targets – 50% by 2030, 70% by 2032, and 80% by 2035.

Our February 2024 report on QLD’s energy transformation highlighted the seismic shift underway transforming the state from the coal colossus of old to a renewable energy superpower, charged by the strategic vision of the Palaszczuk government’s Energy and Jobs Plan – a blueprint to deploy $62 billion in public and private co-investment into 25GW of large-scale renewables and 7GW of rooftop solar.

This plan was instrumental to achieving the state’s renewable energy targets, and in scaling the ambition of its emissions reduction goals.

The status of the plan, and the commitment or otherwise of the LNP to it, is now unclear, and will not be made transparent until at least the end of the year with the planned release of the Crisafulli Government’s new 5 year fossil fuel roadmap.

The state’s extraordinary story of accelerating transition, and its benefits for the economy, cost of living, employment, jobs and climate has now been put at existential risk.

In just five years to 2023, the share of renewable energy in Queensland’s grid saw astronomical fourfold growth, rising from just 6% in 2018 to 25% in 2023. As of April 2025, renewables now account for more than 30% of Queensland’s energy generation, with coal falling to a record low of less than 64%.

Across the national electricity market, renewables now account for more than 42%, more than halfway to Australia’s federal target of 82% by 2030, and Queensland’s accelerating transition was critical to this energy system decarbonisation momentum – pivotal to both our national economic transformation as a clean energy and value-added export superpower and to permanently lower energy prices.

Alongside extending coal, the Queensland government is now also centring fossil gas as a “solution” to energy transition, bringing additional fossil gas capacity to the Queesland energy market on the basis of a spurious claim that this will put downward pressure on electricity prices.

Janetzki announced an additional $134m to CS Energy to develop the 400MW Brigalow Gas Peaker Project at Kogan Creek, and a decision to progress two new gas-fired generation projects by CleanCo and Stanwell at Swanbank and Gatton.

Across 2024, gas accounted for 7.4% of Queensland’s energy demand, and set the price 10% of the time. When gas-fired generation set the price, it was at an average of $189/MWh. In comparison, solar set the price 14% of the time in 2024, at an average price of negative $115/MWh, and wind (2% of prices set) at negative $233/MWh. The reality is incontrovertible: an energy plan must be centred on rapid deployment of large-scale renewable energy, firming and rooftop solar to slash energy bills.

An energy ‘roadmap’ that prolongs our existing overdependence on the fossil fuel cartel would only in theory reduce domestic gas prices by increasing supply into the energy market, in conjunction with the Federal Opposition’s detail-less plan to introduce an East Coast domestic gas reservation scheme – a superficial solution to a real problem, as argued by the Grattan Institute.

In practice, this translates to multibillion dollar taxpayer funded subsidies for the buildout of new gas energy and transport infrastructure, which will take years to approve and build, lock in high-emission, expensive fossil fuels for decades to come, and do nothing to address the cost-of-living, energy and environmental crises borne by Australians right now.

The 660MW Hunter Gas Power Station Project (Kurri Kurri) in NSW is a real-time example of the realities of a government-led ‘gas-fired recovery’, emblematic of the Morrison Government’s failed commitment to ‘create jobs, keep energy prices low, keep the lights on and reduce emissions’ by building new gas.

Originally approved at a budget of $600m with completion by December 2023, the project’s cost blew out by 40% to $900m, with delayed completion to December 2024. Final costs are expected to be well over $2bn, and completion delayed another six months to mid-2025. A gas-fired recovery resulted in a 230% cost blowout and at least a 1.5 year delay, delivering only continued reliance on end-of-life coal capacity.

The apparent intention of the Queensland government to rename its hydrogen division to Gas and Sustainable Fuels, shifting it from the Department of Energy and Climate to Queensland Treasury, is yet another signal that fossil fuels are here to stay under an LNP Government.

An energy plan with fossil gas at its core is a capitulation to the gas lobby at the expense of manufacturers, workers and households struggling with the cost of living, who will all pay more for energy because of it.

While gas as a transition fuel might have made sense a decade ago, the climate science and renewable and storage technology landscape has fundamentally changed. Gas plays a small and diminishing role in firming, which is now transitioning to batteries and other storage technologies.

The Crisafulli government today also estimated the total project and connection costs of Queensland’s critical long-distance CopperString transmission project at nearly $14 billion, well above the initial estimates of the former Palaszczuk Labor government.

CEF continues to emphasise the real-time disruption of battery storage and its key role in minimising the need for expansion of large-scale enabling infrastructure capacity in a period with significantly inflated financing costs.

Accelerating the adoption of residential battery storage alongside rooftop solar – e.g. through the Albanese federal government’s announcement of a national $2.3 billion battery booster program providing 30% rebates on new systems – is central to reducing exposure to cost blowouts on transmission infrastructure.

The renewable energy transformation is well underway across Australia, but continues to be throttled by regressive energy and industrial policies that demonstrate the power of government capture by vested fossil fuel interests embedded in the political landscape.

The latest announcements from Queensland are a case in point. Despite record private investment into renewable energy capacity and battery energy storage, the Crisafulli Government has now pulled multiple handbrakes on the state’s energy transition, including the decision to pause development approvals for four major onshore wind farm proposals.

This policy reversal and uncertainty deters capital and hamstrings investment into renewables. In doing so, it also puts the future of Australia’s value-added green metals and critical minerals industry in jeopardy: an accelerated transition to renewables at scale is the necessary precondition of our capacity to decarbonise our export commodities onshore pre-export, by processing them using zero-emissions energy.

Australia’s key trading partners are increasingly introducing future-facing carbon pricing measures and carbon border adjustments that will penalise us if we fail to act. Last month saw China, Australia’s largest trading partner, extend its domestic emissions trading scheme to cover its steel, aluminium, and cement sectors. This is a market signal Australia must take seriously.

In March, Rio Tinto announced two new offtake agreements for renewable energy and firming supply to decarbonise its Gladstone alumina and aluminium operations. To date, Rio has committed 2.7GW of large-scale wind and solar and 2.1GWh of firming capacity.

These projects, however, remain at risk of significant delays if, as appears to be the case, the Crisafulli government doubles down on maintaining Queensland’s legacy fossil fuel energy system.

Not only has the latter seen record fossil fuel price inflation and exacerbated the environmental, energy and cost of living crisis simultaneously, it compromises our greatest opportunity, to remake our economy, including the resources heartland of Queensland, as a zero-emissions trade and investment superpower in a rapidly decarbonising world.

Matt Pollard is an analyst at clean energy consultancy Climate Energy Finance and AM Jonson is an author at Climate Energy Finance