The regulator in Western Australia has recommended a dramatic increase in capacity payments for big batteries in coming years because of the new focus on batteries with six hours of storage rather than four hours.

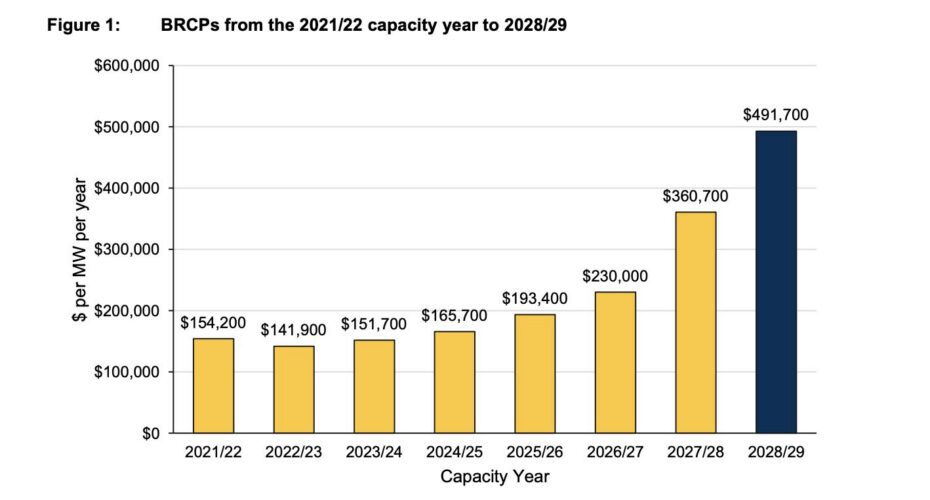

The Economic Regulation Authority has recommended annual capacity payments of $491,700 per megawatt from the 2028/29 year, up from $360,700 in the current year, and just $141,900 in 2022/23. The payments will apply to both batteries and gas generators, as well as other dispatchable generation.

Western Australia’s grid is separate from Australia’s main grid in the eastern states and has its own rules and regulations, and has long had capacity payments – historically handed out to coal and gas fired generators, but now increasingly to big batteries as the state makes the big switch from fossil fuels to renewables and storage.

The latest assessment is based on the new requirement that a battery with six hours of storage should be regarded as the benchmark for the state, rather than four hours – and the two hours of battery storage that has previously dominated installations in the eastern states.

The new calculation is based around a big battery sized at 200 MW and 1,200 MWh of storage, and so would deliver capacity payments of $9.8 million a year. The battery is free to earn other revenue from market arbitrage and other grid services, and through bilateral off take arrangements.

Regulators in both Australia’s main grid and in W.A. have significantly raised market signal in recent years to ensure enough dispatchable capacity remains in the grid as coal fired power stations retire.

In the National Electricity Market, the market cap for the wholesale electricity price has been raised to more than $22,000/MWh – and to more than $27,000/MWh in 2028 – to provide what the regulator says is the necessary investment signal in an increasingly volatile market.

In W.A., the state’s last coal-fired generators are expected to retire within four years, and the regular has been putting a new emphasis on flexible capacity, and on equipment such as battery storage that can respond quickly to any events on the grid.

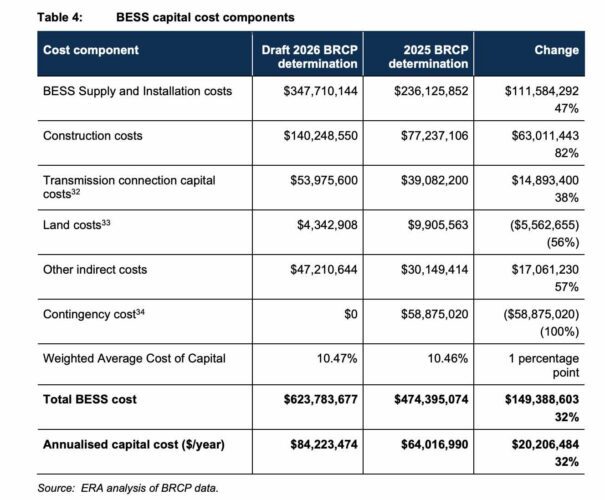

The ERA finding gives an interesting breakdown of battery storage costs, both the tech, the construction, the connections and the myriad other things that need to be done to get the project up and running.

It notes that the biggest reason for the increase in capacity payments is the fact that the batteries will be 50 per cent bigger in terms of storage – 1,200 MWh versus 800 MWh on the 200 MW example – and so will cost more.

The ERA also cites rising input costs from freight, materials, and labour costs, as well as an increase in transmission connection costs associated with the new Fixed Capital Charge (FCC).

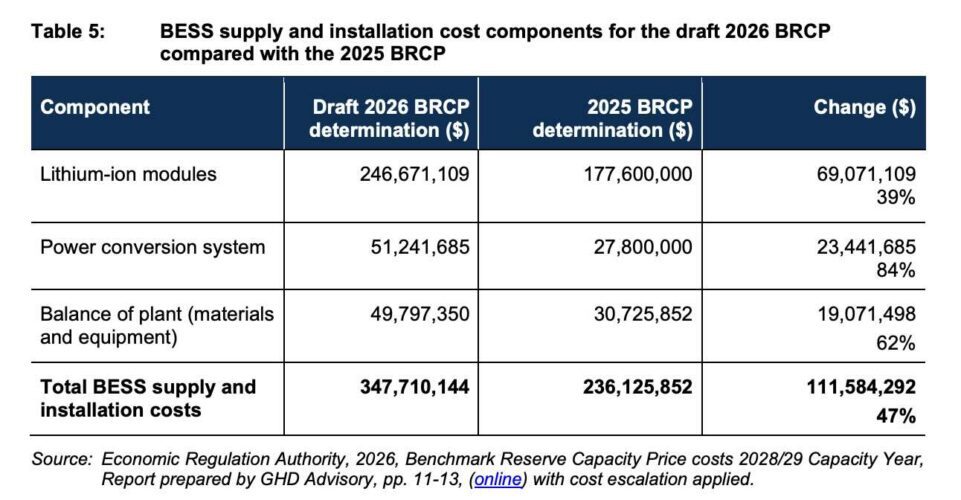

These costs are further broken down for the battery itself by one of the consultants for the report, GHD, which notes that battery cell prices have fallen, but overall costs have not because of the added costs of grid forming inverters and tightening grid codes and cyber security issues, among other things.

“The estimated cost for LFP battery containers (including delivery to site) is $246.7 million ($206 per kWh of rated battery capacity),” the GHD report says.

“This includes the estimated uplift to enable power and energy capacity that aligns with the specified technical requirements (200 MW/1200 MWh) at an ambient temperature of 41 degrees Celsius.

The estimated cost represents a slight reduction from last year’s estimate ($222 per kWh). Battery container costs may have reduced slightly due to economies of scale, competition among suppliers and stabilisation in logistics costs have also contributed to the reduction.

“However, battery container prices have not dropped significantly and this is attributed to broader system components such as structural components, thermal management, and safety systems that haven’t benefited from similar cost reductions.

“Steel prices remain volatile, and compliance with stricter fire safety, ventilation, and insurance requirements adds complexity.

“Despite long-term declines in battery cell costs, battery container prices remain high due to the complex integration of HVAC, fire-suppression, and monitoring systems, as well as the significant logistics and installation expenses associated with large container units.”

The cost of power conversion systems have also more than double to $282/kW of capacity from $139 a year ago.

GHD attributes this to the fact that grid forming inverters – which provide critical grid services such as system strength – are now standard, and the rise in semiconductor prices because of global supply shortages.

It also notes tightening grid cost and cybersecurity requirements, rising labour and logistics, and inflation in raw materials such as copper and aluminium.

If you would like to join more than 29,000 others and get the latest clean energy news delivered straight to your inbox, for free, please click here to subscribe to our free daily newsletter.