Consumers probably won’t notice much, but Australia’s main grid – known as the National Electricity Market – is about to undergo one of the biggest and most strongly contested changes of the past few decades, and if all goes well it will support the transition to a smarter, cleaner, cheaper and more reliable grid.

At midnight tonight (0001 Friday, October 1), the settlement period for trading on the NEM will switch to a single five minute trading period from the existing 30 minutes (encompassing six different trading periods).

The switch was urged way back in 2016 by big energy users who felt they were being ripped off by some of the repeated gaming of the 30 minute settlement period, where bids could be artificially inflated for one five minute period by withdrawing capacity before flooding the market with supply as everyone tried to cash in.

See: Battle royale brews over battery storage and control of energy markets

The switch to 5MS (five minute settlement) was supported by the providers and owners of new fast response technology, particularly battery storage and demand response, and it was fiercely resisted by the owners of incumbent, legacy technologies, particularly the slow to react baseload coal generators and gas generators, who could sense market power and windfall profits slipping from their grasp.

Now, after some fierce battles as regulators considered the proposed rule change (without being allowed to dial in environmental or climate considerations), and lengthy delays – much of it ostensibly to prepare complex software and bidding systems – the change is here.

All eyes will be on battery storage, particularly the biggest of them all – the Tesla big battery, aka the Hornsdale Power Reserve, in South Australia, which has been a flag bearer for the technology and trading strategies since it was first switched on nearly four years ago.

But some of the key players could also be the “aggregators”, the likes of Tesla and Reposit and others who have created “virtual power plants” that link household battery systems into a single resource than can trade the market.

“The move to 5MS will undoubtedly change the landscape of the NEM as we know it by promoting the use of renewable technologies and solutions over large incumbent coal generators which are already nearing their end of life,” says Matt Baumgurtel, from energy consultancy Hamilton Locke.

“In terms of market players, big batteries and ‘virtual power plants’ are likely to win out in this new system over old coal generators.” That’s because their fast response makes them better able to respond to negative price periods, as they can stop and start supply more readily than the large incumbents.

Australia currently has six big batteries operating in its main grid – Hornsdale, Lake Bonney and Dalrymple in South Australia, and Gannawarra, Ballarat and Bungala in Victoria.

Two others are in the process of commissioning – the fire-delayed Victorian Big Battery near Geelong, and the Wandoan battery in Queensland, the first in that state. The Wallgrove battery in western Sydney, the first in New South Wales, should be joining the rest soon. Many more are in the pipeline.

The companies that have trading rights over those assets – Neoen (Hornsdale, Victorian Big Battery and Bungala), AGL (Dalrymple, Wandoan), Iberdrola (Lake Bonney, Wallgrove), and EnergyAustralia (Gannawarra, Ballarat) – are keeping their cards close to their chest, and don’t want to give away their trading strategies.

Two of those companies – Neoen and Iberdrola – are well placed for the energy transition, given that their assets are almost entirely renewables and storage (although Iberdrola will be operating fast-start generators in South Australia and NSW). Neither would comment on the record.

The two others, AGL and EnergyAustralia, will be juggling their newly contracted battery storage assets, their growing portfolio of fast-start generators, and their lumbering legacy coal and gas generators. AGL declined to comment and EnergyAustralia didn’t want to tell us much.

“We are looking forward to seeing how 5 minute settlement reforms contribute to investment in dispatchable capacity and other infrastructure required to support the transition to clean, reliable and affordable energy,” an EnergyAustralia spokesman said in an emailed statement.

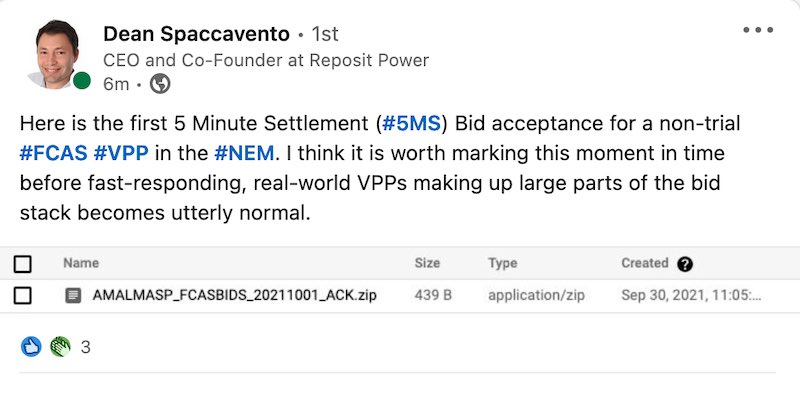

Dean Spaccavento, the CEO and founder of Reposit Power, laid claim in a LinkedIn post for a land-mark first of its category bid acceptance in the new 5MS regime, predicting “fast responding, real world VPPs” will soon make up large parts of the bid stack. That will be a big shift from the traditional dominance of old coalers.

Market players expect there to be some volatility in the early days as traders get used to different bidding strategies, but have suggested that wholesale prices could be more predictable over time.

John Cole, the CEO of Edify Energy, which has built the Gannawarra battery (operated by EnergyAustralia) and will build another for Shell, among others, and had developed many solar farms, says the switch to 5MS will unlock fast ramping capability of batteries and other fast responding machines.

“Successful market bidding will need to rely on accurate forecasts,” he says.

Hamilton Locke’s Baumgurtel says the more dynamic nature of 5MS bidding could also mean that the old days of reliable price spikes happening at particular times of the day may no longer be the case.

“Market pricing will be significantly more fluid with the corollary of this being that generators are going to need a much more dynamic bidding approach.”

But he also said that renewable companies would not be the only ones looking at battery storage; the big coalers also would be looking at battery storage to cover for the inflexibility of their “baseload” portfolio.

It might not be clear sailing for the operators of renewable assets either, and it could have impacts on power purchase agreements and FCAS (frequency control) payments. The days of “set and forget” bidding strategies are over. You can read their detailed analysis here.

Fluence, which sells trading systems, and so has a strong interest in this development, says renewables bidding at the price floor to minimise the number of times they are “constrained” off, means they could be exposed to more negative pricing events, or even be constrained off when prices are positive.

AEMO CEO Daniel Westerman says that the switch to 5MS is just one of a number of major reforms that will improve market efficiency, increase competition, accelerate the clean energy transition and deliver consumer benefits.

The others are the introduction of a new Wholesale Demand Response (WDR) mechanism, due on October 24, and a reduction in the time taken to switch retailers from up to three months to just two days.

“As one of the most significant reforms since the NEM’s inception in 1998, 5MS provides better price signal for investment in fast response and flexible technologies, such as batteries and gas-peaking generation,” Westerman said in a statement.

“Over time, improved price signals should lead to more efficient decisions by generators lowering wholesale costs which make up around one third of a typical bill.”

See also: Big Battery Storage Map of Australia