Big batteries, and grid-connected battery energy storage in general, are in a prime position to cash in on the renewable energy transition, a major new report from the University of Queensland has confirmed.

The 27-page report, published on Tuesday, provides a detailed Performance Review of the 1.1MW/2.2MWh Tesla Powerpack battery that was installed at the University of Queensland’s St Lucia Campus in late 2019.

As RenewEconomy has reported, the $2.05 million grid-connected battery was installed to help the UQ become a 100% renewable ‘Gensumer’ – playing on both sides of the energy market, including as a generator via its 64MW Warwick Solar Farm, and using energy storage and demand response to power the Uni flexibly, sustainably, and economically.

The 2020 Performance Review report concludes that the St Lucia battery achieved “excellent results” from a technical perspective over the course of the year, including in its ability to beat the state’s gas peakers at their own game.

From a financial perspective, the battery delivered $158,000 of value for the University, more than half of which was earned through frequency control and ancillary services (FCAS) provided to the Queensland grid.

And while this amount underperformed total revenue expectations by around 27%, the UQ’s head of Energy and Sustainability, Andrew Wilson, says this was primarily driven by lower than forecast market pricing during Q2 and Q3, as well as barriers that prevented the battery from participating fully in the state’s FCAS market.

That said, FCAS, which the battery is enabled to do via a partnership with aggregator Enel X, was the largest contributor to overall battery revenue at $91,000 across the year (58% of total revenue), despite underperforming forecasts by around 25%.

“Under this arrangement, the battery is paid to remain on standby to quickly discharge energy to help arrest a fall in grid frequency following events such as a transmission line or generator tripping,” the report explains.

“This service (discharging energy to increase frequency) is known as ‘contingency raise’ FCAS. It is important to note that the battery earns revenue from FCAS for every interval it is available, regardless of whether a contingency event occurs or not.”

The report finds that the value delivered for the portion of energy that is reserved in the battery at all times for FCAS purposes was around $56/MWh, compared to the Queensland RRP for spot energy (also measured on a 24×7 basis), at around $45/MWh.

“This suggests that the small portion of energy reserved for FCAS purposes was more highly valued by the NEM during 2020 than generating that same volume of energy continuously across the year,” the report notes.

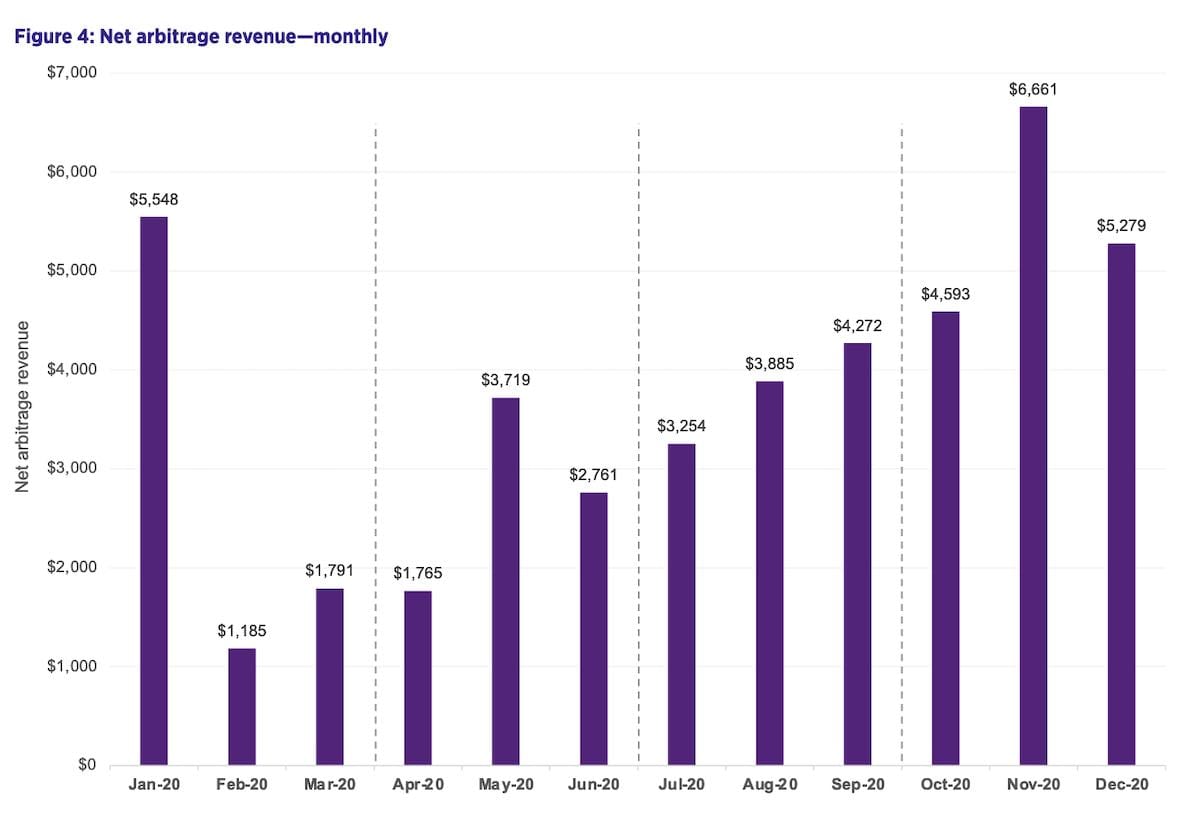

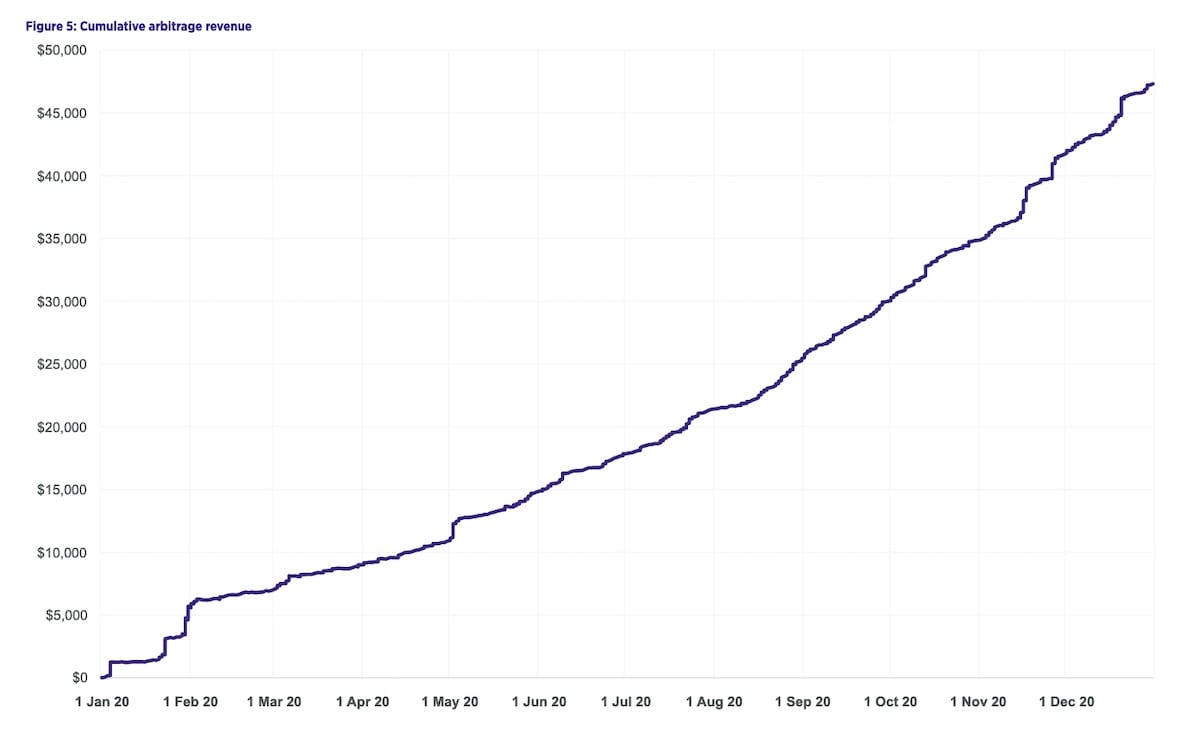

The second biggest contributor to revenue came through the battery’s arbitrage function, which was a surprise success, overperforming by almost 30% in its role of charging to store energy when prices are low and discharging to generate energy when prices are high.

The report shows that net revenue from arbitrage across 2020 totalled just under $45,000, exceeding business case assumptions by 28%, primarily a result of realised spreads being higher than forecast.

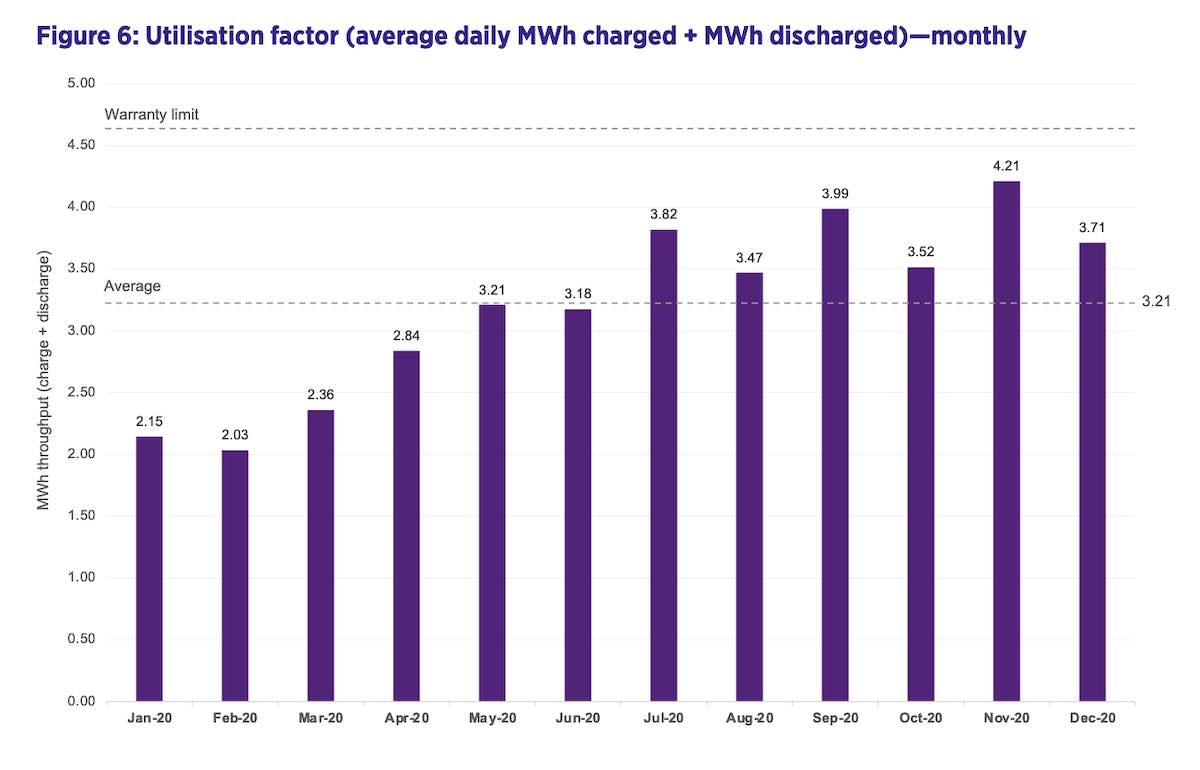

“The arbitrage function is the most well-developed revenue stream for the battery,” the report says. “Notwithstanding this, further opportunities for refinement and improvement exist, [including] further work … to optimise the balance between the minimum spread threshold adopted by the trading algorithm and the desire to maximise utilisation within warranty limits.”

But overall, the team says the findings of the performance review make it clear that “the UQ battery, and battery energy storage in general, are well positioned to seize the opportunities that will be created as the energy transition continues to gather momentum.”

“From an overall perspective, the performance of the battery during 2020 has solidified its place as a central part of UQ’s energy management program now and into the future, despite its size only being a fraction of overall site load,” the report says.

“This role will be amplified by a range of forces that are poised to rapidly reshape the energy market over the coming months and years. This includes yet further increases to the penetration of variable renewable energy sources, as well as the pending change to five-minute settlement as of October 2021.”