An up to 2GW offshore wind project proposed for the New South Wales Hunter region has been awarded a feasibility licence by the federal government, setting in motion the next stage of development for what would be Australia’s first floating offshore wind project.

Federal energy minister Chris Bowen said on Thursday that the Novocastrian Offshore Wind Farm, being developed by Norwegian energy giant Equinor and Oceanex Energy, was the only project being offered a licence in the Hunter zone, due to others being proposed for overlapping areas and found to be of “lower merit.”

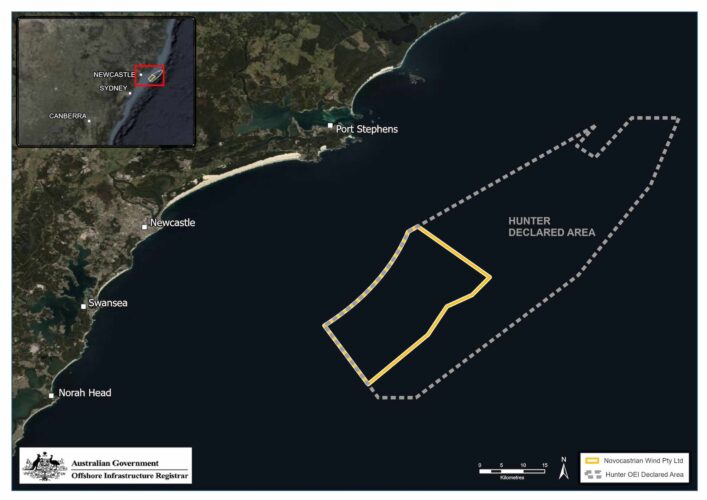

Competition was always going to be tough for a spot in the comparatively small Pacific Ocean zone, which covers an 1,800km2 stretch between Swansea and Port Stephens, and will be the first in Australia to host floating turbines.

But there are plenty of prospective developers bound to be disappointed with the minister’s decision. Among them – Bowen says there were eight applications – might be BlueFloat Energy’s Eastern Rise Offshore Wind Project, proposed at an installed capacity of 1.725 gigawatts.

A consortium made up of Spark Renewables, Simply Blue Group and Subsea7 had also been vying for a spot in the Hunter zone, with its up to 2GW Sea Fern Floating Offshore Wind project, while French nuclear giant EDF had put forward the massive up to 10GW Newcastle Offshore Wind project.

The chosen project has strong local ties through Oceanex, which was established in Australia in 2020 by two of the founders of what will likely be the nation’s first operational offshore wind farm, the 2GW Star of the South in Victoria.

The company commissioned and in 2022 published an extensive Supply Chain mapping report for the offshore wind industry and Oceanex CEO and co-founder Andy Evans has said he hopes to have the $10 billion 130-turbine Novocastrian project under construction from 2030.

Evans says he and Oceanex co-founder Peter Sgardelis have been looking at New South Wales for a long time as an ideal candidate for offshore wind.

“It’s the biggest energy user, with the most black coal coming off the market, so we were always enthused by New South Wales – and particularly the Hunter,” Evans told Renew Economy on Thursday.

“It’s been a powerhouse, powering New South Wales and Australia for almost 100 years. Great deepwater port, great skill sets… great workforce used to big projects. So it was a really natural site for us to look at.”

Evans says the company will now look to work “even more tightly” with the Hunter community as the project progresses.

“We want to make people aware of all the great community benefits that will flow from offshore wind and that we’ll be providing.

“We know a lot of it’s around information provision, getting feedback, and hopefully developing a project the whole Hunter is really proud of,” he tells Renew Economy.

Bowen says that, should the Equinor and Oceanex project go ahead – there are many hurdles yet to jump before it is actually approved – it would employ around 3,000 workers during construction and create around 200-300 permanent local jobs.

The Novocastrian Offshore Wind Farm is also expected to inject development expenditure worth hundreds of millions of dollars into the Hunter region and leverage existing heavy industry, generating enough electricity to power two Tomago smelters.

“The Hunter has been an industrial and economic powerhouse for generations, and my decision today is a big step towards providing that powerhouse with reliable renewables,” Bowen said in a statement.

“The project I’ve shortlisted offers the biggest rewards for the Hunter and Australia – supporting our workforce and energy security, protecting our environment and sharing our marine space with the people and industries who rely on it today.”

The news of a seventh feasibility licence awarded to an offshore wind project proposed for Australian waters – another six have been awarded to projects in Victoria’s Gippsland zone – comes just days after Bowen formally declared the nation’s fourth development zone, also off the NSW coast.

The Illawarra zone will be even smaller than the Hunter zone, at 1022 sq km – reduced by a third from its original plan and pushed 20km out to sea, rather than the initially proposed distance of 10km.

Bowen says the zone’s size reduction followed extensive community consultation with local leaders, industry, unions, First Nations people, community groups and individuals. The changes aim to better protect little penguins, rocky reefs and the southern right whale.

But the shrinking and shifting of the Illawarra zone could also be due to the fact that offshore wind has not been an easy sell to NSW coastal communities, amid concerns about potential environmental, commercial and visual impacts.

This sentiment has been eagerly fanned by the federal Coalition, which has promised to cap solar and wind projects, tear up offshore wind contracts and – as of this week – officially throw the Australian energy transition into chaos with a half-baked plan for nuclear power.

Just this week, the leader of the National Party David Littleproud turned up in Wollongong to personally campaign against the new Illawarra offshore wind zone and plump for the Coalition’s coal-preserving nuclear plan.

“The National Party, part of a future Coalition government, will not allow this to happen,” he said to cheers from a small crowd of anti-wind farm protesters, according to a report in the Illawarra Mercury.

Meanwhile, further north in Newcastle, local member Sharon Claydon says there is no region as well placed to take advantage of the opportunities presented by the offshore wind industry.

“Newcastle’s world class infrastructure, our deepwater port, skilled workforce, abundant resources and energy smarts means our region is poised to lead this transformation,” Claydon said.

“A new offshore wind industry in Newcastle means new jobs in local manufacturing, construction, maritime, transport and logistics industries, as well growing our vocational education and training pathways – at TAFE and University.”

And in April, one of the world’s biggest coal ports, the Port of Newcastle in New South Wales, put its hand up to become an offshore wind hub, to service the projects expected to populate the Hunter development zone.

The Port of Newcastle (PON), which is 50/50 owned by Macquarie’s The Infrastructure Fund and China Merchants Port Holdings Company, said on LinkedIn that a recent study had confirmed it as a “prime candidate” to support floating offshore wind (FOW) deployment.