Australia’s biggest wind project, the 530MW Stockyard Hill wind farm in central Victoria, faces more delays and has forced Origin Energy – the former project owner and now sole buyer of its output – to pay a shortfall penalty to the Clean Energy Regulator.

Stockyard Hill – hailed as a landmark in competitive wind energy pricing when it was first announced in 2017 – was supposed to be on line and producing a year ago, but like other wind and solar projects in Australia has faced significant connection delays.

Its issues, believed to relate to “oscillation” problems, mean that it has been unable to obtain its registration with the Australian Energy Market Operator, and so cannot begin production, despite finishing construction months ago.

Goldwind, which owns the project and is the main contractor, has not commented on the issues, other than noting last December that all 149 turbines had been installed, and it was awaiting registration and approval for beginning the commissioning process.

Origin, in its half yearly report, gave some insight into what it expects over the coming 12 months, suggesting it was not expecting full production to be reached until 2022.

Origin, in its half yearly report, gave some insight into what it expects over the coming 12 months, suggesting it was not expecting full production to be reached until 2022.

Already, the failure of Stockyard Hill to begin production of electricity, and renewable energy certificates, has been a major reason why it has chosen to pay a $152 million shortfall penalty to the CER.

Origin, like other retailers, is allowed – and now even encouraged – to pay a penalty if it can’t source enough RECs from wind and solar farms, or the market, and then make good at a later date.

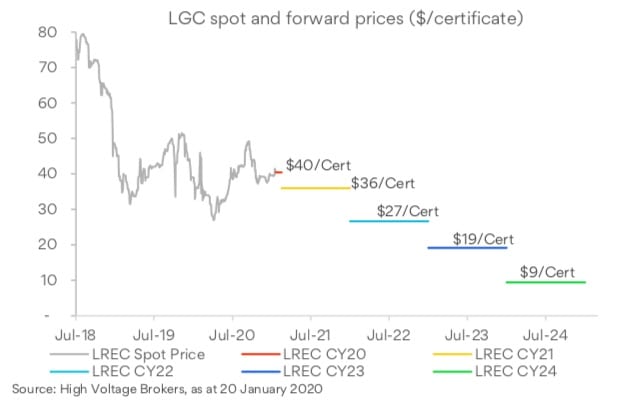

The CER rules allow a three year grace, and Origin and others believe the price of RECs (also known as LGCs, or large scale generation certificates) will be significantly cheaper in three years time. Or, in Stockyard Hill’s case, they will be virtually free as part of the “all in” deal for electricity and RECs from the project in the low $50s/MWh.

Origin’s presentation notes that the cost of the “penalty” will be $65/MWh, a number that causes right wing and anti-renewable commentators to hyper-inflate and exaggerate the supposed cost of the renewable energy target.

Origin says it will be able to buy the LGCs on market for around $17/MWh in a few years time, and its presentation forecast a further fall in prices to around $9/MWh once the huge backlog of wind and solar projects gets on line.

CFO Lawrie Tremaine noted in the analysts call that the oversupply in the market (and higher prices) is due to connection delays of a number of renewable projects – and not just Stockyard Hill.

“Delays to a number of renewable projects have resulted in a near term tightening in the LGC market, but our expectation is that this market will be oversupplied from 2022,” he said.

“The legislation provides an option for companies to under surrender certificates and pay a shortfall charge of $65.00 per certificate, which is refundable if the certificates are surrendered within three years.”

I