Federal and state governments are spending more than $10 billion a year propping up the fossil fuel industry, through a system of tax breaks and cash handouts that encourage the entrenched use of oil, gas and coal by Australian business, new research by the Australia Institute finds.

The biggest portion of that figure is the whopping $7.84 billion the federal government returns to business through its fuel tax credit scheme. That’s more than the $7.82 billion it put aside for the Army in the 2020-21 budget.

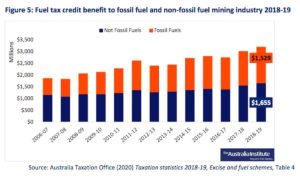

The progressive Canberra-based think tank, which is a vocal campaigner for aggressive climate action, found just over $1.5 billion of that $7.84 billion went on fuel used by the fossil fuel mining industry. In other words, it subsidised the fossil fuels used to help dig up more fossil fuels.

When the states and territories’ spending on fossil fuels is added to the tally, the fossil fuel industry will have received $10.3 billion of government support in the 2020-21 financial year.

While the term “fossil fuel subsidies” may conjure up images of government hand-outs to massive coal or gas companies, the research reveals a reality that is subtler but more entrenched.

The fuel tax credit is a scheme that allows business to claim a tax credit on part or all of the fuel excise they pay on petrol, diesel, or liquefied natural gas – excluding that which is used in cars and other small vehicles that travel on public roads. It applies to small, medium and large businesses alike.

Fuel excise currently stands at 42.7 cents per litre of petrol and diesel, and 29.3 cents per kilogram of liquefied natural gas. The government credits the full amount on fuel that is used for purposes other than road transport, and a partial credit on fuel used in heavy road transport.

Fuel excise is vaguely regarded as a means of taxing road use, so there would appear to be some logic to refunding that tax when the fuel is used for purposes other than public road use.

But The Australia Institute said the link to road use was an illusion. It claimed fuel taxes were “not linked in any way to road funding, as is commonly suggested by recipients of this subsidy; they simply contribute to general revenue, like most other federal taxation”.

It argued this was tax revenue that could be allocated to any purpose – including low-carbon purposes. The decision to give it back to businesses substantially reduces the real cost of fuel, and it must therefore be regarded as a fossil fuel subsidy.

Other than the notoriously loose “safeguard mechanism”, Australia does not have any policies, market-based or otherwise, that discourage companies from emitting large amounts of CO2. Nor does it have any policies to encourage the take-up of electric or low-emissions vehicles.

The fuel tax credit scheme is the opposite of a carbon tax, and in the absence of any other checks on carbon, it is an unchecked policy that encourages fossil fuel use. It therefore would seem incompatible with the federal government’s mealy-mouthed insistence it plans to reduce emissions to net zero at some point this century.

“Coal, oil and gas companies in Australia give the impression that they are major contributors to the Australian economy, but our research shows that they are major recipients of government funds,” said Rod Campbell, research director at The Australia Institute and co-author of the report.

“From a climate perspective this is inexcusable and from an economic perspective it is irresponsible. The major subsidies are Commonwealth tax breaks that mean the largest users of fossil fuels get a refund worth $7.8 billion on a tax that the rest of the community has to pay.”

The Australia Institute defines a “fossil fuel subsidy” as any instance “where governments choose to allocate scarce resources to fossil fuel industries in a way that restricts use of those resources for other government priorities”.

Beyond the spending on fuel tax credit, The Australia Institute found the federal government spent more than $1 billion on tax concessions on aviation fuel and tax breaks and petroleum producers operating in Commonwealth waters. It also spent a further $266 million in direct investments.

The report said these included “‘gas-fired recovery’ programs, various CCS and hydrogen projects, the clean-up of a disused oil rig, and spending on Hunter Valley coal railways via the federally-owned Australian Rail Track Corporation”.

The federal government has increasingly tried to marry fossil-fuel subsidies with supposedly “low carbon” technologies such as CCS and blue hydrogen (which makes hydrogen from fossil fuels and captures and stores the CO2 emissions using CCS), which will together receive more than half a billion of funding in the May budget.

The idea that either technology is low carbon is highly contested, given CCS technology is not able to capture anything like all of the emissions. Some supposedly “blue hydrogen” projects, such as the one in Victoria’s Latrobe Valley that is sponsored by both federal and Victorian governments, do not actually include CCS.

Of the states and territories, Queensland spent the most in fossil fuel subsidies – $744 million – mostly on its publicly-owned coal plants, coal mines and ports that export coal and import petroleum products. It is followed by Western Australia, which spent $135 million, and the Northern Territory, which spent $107 million.

Victoria spent $100 million on fossil fuel subsidies, South Australia $22 million, and New South Wales $17 million. The ACT was the only state or territory to spend nothing on fossil fuel subsidies, and Tasmania’s were deemed too little to tally up.