“Well, I stand up next to a mountain

And I chop it down with the edge of my hand

Well, I stand up next to a mountain

And I chop it down with the edge of my hand

Well, I pick up all the pieces and make an island

Might even raise a little sand

Yeah”

Jimi Hendrix Voodo0 Child Slight Return 1968

Something for AGL investors to worry about?

Even before thinking about the likely every increasing cost of being the largest carbon emitter in Australia, the drag from falling electricity prices, if you believe ACIL Allen forecasts, is going to be very strong. Wholesale prices are forecast to fall in NSW and Victoria every year until 2025 with the exception of NSW in 2023.

In theory we estimate AGL’s exposure to falling prices could be $200 m to $300 m pre tax each year. In practice we are completely certain the leverage won’t be as strong as that. It couldn’t be. Its also ridiculous to think management would just sit by and let it happen. Finally we just don’t believe the ACIL Allen price forecasts.

In the table that follows, which we try to explain in the rest of the note, we used base load futures prices to 2022 (these are higher than the ACIL forecasts) and the ACIL forecasts assuming the NEG is implemented out to 2025. ACIL presents their numbers in real 2018 $ and we have adjusted these to nominal dollars reading off the ESB graphs using a 2% inflation factor.

The numbers are very, very approximate and the time frames are long. Also we have assumed generation costs ex depreciation increase 4% per year. Some of AGL’s NSW coal contracts expire in 2025 and we imagine costs will go up again at that point.

AGL does other stuff, lots of it, so this is only one part of its overall profit outlook, even if it was correct. Any investor should do their own research and we are neither making a forecast or a recommendation. Just doing some analysis. We haven’t taken advice or spoken to management/investor relations.

AGL estimates, slight return

AGL is the largest generator and carbon emitter in the NEM mainly by virtue of its ownership of LYA in Victoria and Bayswater and Liddell in NSW.

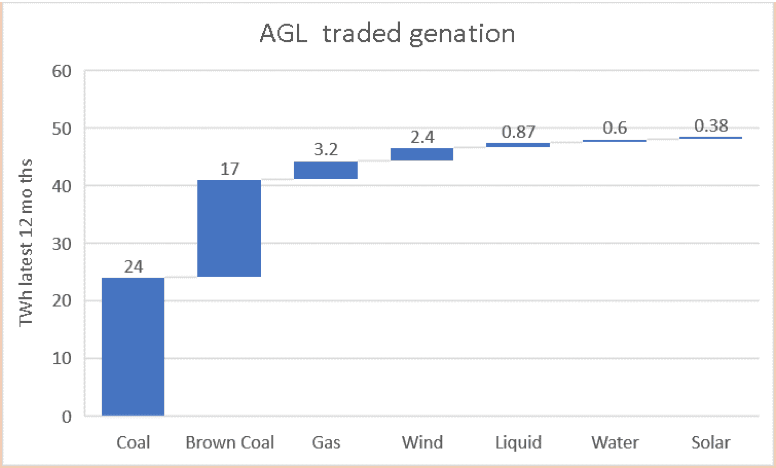

However it also has strong interests in renewables via the leveraged lease payments it makes for the REC and output rights to a number of wind farms, (the Hallett complex in South Australia and Macarthur in Victoria) as well a strong interest in South Australian gas generation. Generation for which NEM Review records it as the trader was 48 TWh the 12 months up to yesterday, more or less 25% of the NEM.

You would think this would make the AGL share price sensitive to electricity prices and expectations and broadly speaking you would be correct.

The following figure shows a 30 day moving average of the AGL share price divided by a 30 moving average of the ASX 200 index rebased to 100 – i.e., it’s the relative performance of AGL not the absolute performance and then we compare that with the 30 day median NSW pool price.

Share price move on estimates of the future but we think the pool price is a leading indicator of the futures and contracts prices. If pool prices are consistently higher than futures prices then futures prices will be bid up to prevent arbitrage. In turn when prices get above the required price new investment takes place.

Not too much should be made of the chart its just there to confirm that there is a relationship as theory would predict.

Estimates

The following chart shows AGL EPS growth, actual for FY17 and expectations for FY18, FY19 and FY20 as collected by Factset. The expectations were as at July 2017 and then July 2018. The figure shows that growth expectations for FY19 and FY20 have come down in the past 12 months and just 6% growth is expected for FY20.

Growth expectations for FY19 have nearly halved over the past 12 months.

AGL Earnings sensitivity to futures and pool prices

The key to AGL’s earnings sensitivity is the extent and speed with pool price changes are passed on to customers. The simplest way to think about it is to ignore AGL’s wind and gas volumes.

The wind volumes mostly have payments to infrastructure partners that work to around $110 MWh per year (from memory). They are in the money (pool & REC prices) at the moment but its not always the case and wont be in the future on ACIL’s modelling.

Most of the gas volume is in South Australia and its just a special case.

That leaves the coal volumes and the first point to note is that a part of that is locked into aluminum contracts. The Tomago contract runs until 2028 and is essentially at a fixed margin, the Portland smelter contract though runs only until 2022.

Net of those contracts we estimate AGL presently has about 29 TWh of Coal generation.

Ever $1 MWh of price change is therefore $29 m of pretax earnings change or say $20 m after tax. Relative to a consensus FY18 net profit after tax [NPAT] of $1 bn that’s a 2% sensitivity. A $10 MWh change is a 20% sensitivity.

If we look out to 2023, and no fund manager really has a strong view on events so far in the future, then AGL loses Liddell, about 8.5 TWh and possibly/probably ditches the Portland contract, of say 5-6 TWh. This leaves the overall exposure to power prices at about 27 TWh not that different to today.

How much pricing power?

We assume that changes in wholesale power prices are passed through to the retail market with a lag of 6-18 months. Most of the retail market is still serviced by large gentailers and retail price contracts are typically of 12 month duration.

Despite the modest state of competition any significant change in wholesale prices has to be pushed through else market shares will be impacted.

It may be a little different in QLD where AGL/ORG/EA contracts with CS Energy and Stanwell may run longer than 12 months and somewhat delay pass through but we doubt if its that significant.

Similarly in Victoria ORG may have some multi year contracts with AGL/EA/Alinta but basically the retail price changes will be phased in over 18 months.

AGL’s consumer/household volume is about 14 TWh. AGL’s business customer volume is about 11 TWh and price changes are passed through over say three years.

On this basis we estimate that around 16 TWh of generation is repriced every 12 months.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.