AGL says it will urgently rewrite its business strategy after rapid market change forced it to announce a massive loss in the December half, and as demand for home batteries, remote storage and electric vehicles is starting to “take off.”

CEO Brett Redman said the company had been banking on a slower transition to renewables and so-called “behind the meter” technologies, such as batteries and EVs, but now admits the speed of change requires an immediate response. The company will present that new strategy in late March.

“The external forces of customer needs, community expectations and technological change have always shaped our market,” he said at an analyst briefing announcing AGL’s dire December loss of $2.29 billion, much of it from huge writedowns announced last week.

“As we’ve said for some time, it is the speed with which those forces change that will dictate the velocity of our strategy. What we have seen in recent months is an acceleration of all of those forces beyond what we anticipated.”

This has caught out AGL – and many of the incumbent fossil fuel generators – on two fronts.

The energy juggernaut is heavily dependent on revenue streams from three massive coal plants and, as a result, is Australia’s single biggest carbon emitter. AGL thought those profit streams from coal would allow it to adapt to the energy transition in its own good time, but the rapid shift to renewables has forced wholesale prices down and coal is not delivering the windfalls anticipated.

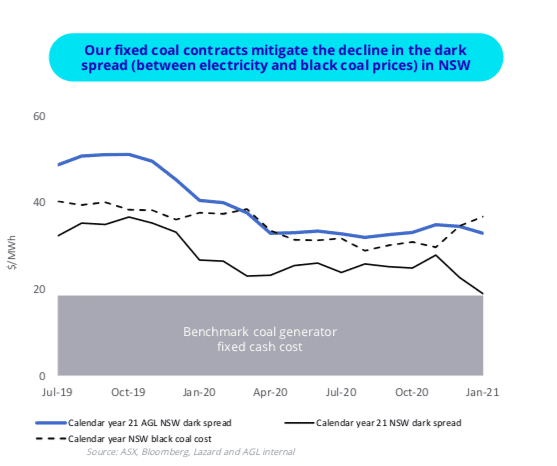

This graph below shows how the “dark spread,” the difference between the cost of coal generation and the price received, has halved for NSW coal plants over the past 15 months.

On the second front, consumers are switching behind the meter technologies, such as rooftop solar and battery storage, demand response and electric vehicles at a pace AGL had not imagined, and this is having an impact on the overall market. AGL has dabbled in all these offerings, but appears taken aback by the scale of transition.

“Demand for decentralised offerings, whether that’s home batteries and electric vehicles or remote generation and storage on industrial sites, is really starting to take off,” Redman said.

“This requires a different approach to trading and portfolio management … the market continues to change and the pace of that change is accelerating. It is incumbent on us, in turn, to accelerate our response.”

Redman was reluctant to give any details of what the new strategy would include, saying he wanted to be “thoughtful” about how to do it. “We’re not sitting on our hands with our eyes closed and our ears shut,” he said, while admitting that the impact on markets and utilities was not new, because Europe had already been there.

AGL’s coal generation business has a clear end date, with one of its three coal plants, Liddell in NSW, due to shut down by 2023. The last standing will be Loy Yang A in Victoria, which is set to close in 2048, far beyond the date set by scientists if the world is to cap average global warming at around 1.5°C.

So far, AGL’s replacement strategy has been to invest in around 2.5GW of renewable capacity (mostly wind) and 850MW of grid-scale batteries. It has also attempted to get in on the behind-the-grid revolution by offering home batteries and special deals for electric vehicle owners. It has diversified into telecoms services, and has made much of its “pivot” to consumer services.

That focus on the retail operations opens up the prospect of a potential demerger of the generation and retail sides of the business, as RenewEconomy contributor David Leitch has suggested – an option Redman did not rule out on Thursday, hinting there may be something to say on that front in March’s announcement.

Any such split would reflect the structural transition from the massive central generators of the fossil fuel age to the decentralised, decarbonised power networks of the net-zero future.

AGL’s huge six-month loss was largely a result of massive write-downs to wind farms, announced last week, itself a result of long-term power purchase agreements at inflated prices. But even without that, profit was down 27 per cent to $317 million.

Redman said he didn’t regret the investment in wind farms, despite the write downs. “The impairment is not good, but the whole-of-life economic returns are not bad,” he said.

Marcus Brokhof, head of AGL’s generation operations, said he hopes grid-scale batteries will be a “major revenue stream” in the low-carbon economy. Brokhof offered no further details on the progress of the company’s big battery projects announced last year, but hinted at something soon.

Those projects include a 200MW battery next to the Loy Yang coal plant in Victoria, and a 500MW battery by the Liddell coal plant in NSW. AGL is also exploring the possibility of a 50MW battery in Broken Hill in western NSW, and is supporting grid-scale battery in Wandoan (100MW/150MWh), Maoneng (four 50MW/100MWh batteries) and the already operating Dalrymple (30MW/8MWh).

AGL said it would review its plans for the Liddell battery after the NSW government announced its ambitious plan to decarbonise the state’s electricity generation, mostly through projects in the Hunter region where Liddell is located. That government plan seeks to mobilise $32 billion of private investment to build 12GW of renewable capacity and 2GW of storage.

AGL remains overwhelmingly a coal company, and the share of coal generation (more than 80 per cent) is significantly higher than the Australian grid average (around 65 per cent).

In the six months to December, its three coal plants sent out 17,797 gigawatt hours of electricity. Renewables (mostly wind) sent out 2,671 GWh, and oil and gas 1,136GWh. Its coal capacity now stands at 6,850 MW, oil and gas at 1,708 MW,, and renewables at 2,522 MW.

(Note: Battery storage capacity only provided in MW terms where AGL has yet to decide on market strategy and length of storage).