AGL Energy announced a $2 billion loss for the 2021-22 financial year as Australia’s single largest greenhouse gas emitter grapples with how it can transform its business and manage what the switch from fossil fuel base-load to flexible generation.

The deep losses revealed on Thursday serve as an example of the potentially painful transition that large incumbent energy companies face, having long built dominant market positions on the use of fossil fuels, and delayed the inevitable switch to renewables.

AGL, the country’s biggest coal generator and biggest emitter, is in the throes of a complex process of splitting the company into two, creating Accel Energy which will operate its fossil fuel assets and look much like a conventional energy business.

At the same time, a rebranded AGL Australia will retain most of the company’s renewable energy assets and will have a greater focus on the provision of retail services.

“Financial year 2021 was one of the toughest energy markets have seen, wholesale electricity prices were at levels not seen since 2012, while demand was impacted by lockdowns, mild weather and increasing penetration from rooftop solar,” AGL Energy CEO Graeme Hunt said.

“As we see the pace of change continue to accelerate, we are further assured and committed to our proposed demerger strategy. Subject to approval, the proposed demerger will create two new entities with clarity of purpose and strong foundations, which will position them well to lead the energy transition, while protecting and delivering value to shareholders.”

AGL said it has progressed plans to build new big battery projects at Liddell, Loy Yang and also Broken Hill, as well as the big battery that it has already committed to building at Torrens Island. AGL is aiming to amass a 850MW battery storage portfolio, repurposing much of the infrastructure being used by existing coal and gas power stations.

“During the year we completed a number of important acquisitions. Solgen and Epho have both boosted our presence in the commercial solar market and have continued to perform well, winning new material installation contracts,” Hunt said. “The Tilt acquisition, via PowAR, completed last week, will further support our orderly transition away from coal-fired power.”

“Lastly, our OVO transaction is a strategic JV, providing a future option to leverage the expected demand for EVs, residential batteries and demand management, while allowing customers to be active participants in the energy transition and reducing their own emissions.”

The switch is one of necessity for AGL, which has seen its profitability eroded as a result of the falling viability of conventional fossil fuel energy services.

The company conceded in June that it had been caught off guard by the pace of change under way in the Australian energy market due to a surge in new wind and solar projects entering the market.

That switch is impacting the way that its main assets – its huge coal generators in Victoria and NSW – are operated.

“There is no longer the demand for these plans to operate as baseload,” chief operating office Markus Brokhof told investors in a briefing.

The market value of the AGL business has likewise been eroded, with the company’s share price falling from a pre-Covid level of above $20 per share to below $7.30 per share in Thursday’s trading – seeing $8 to $9 billion being wiped off the company’s market capitalisation over the last 18 months.

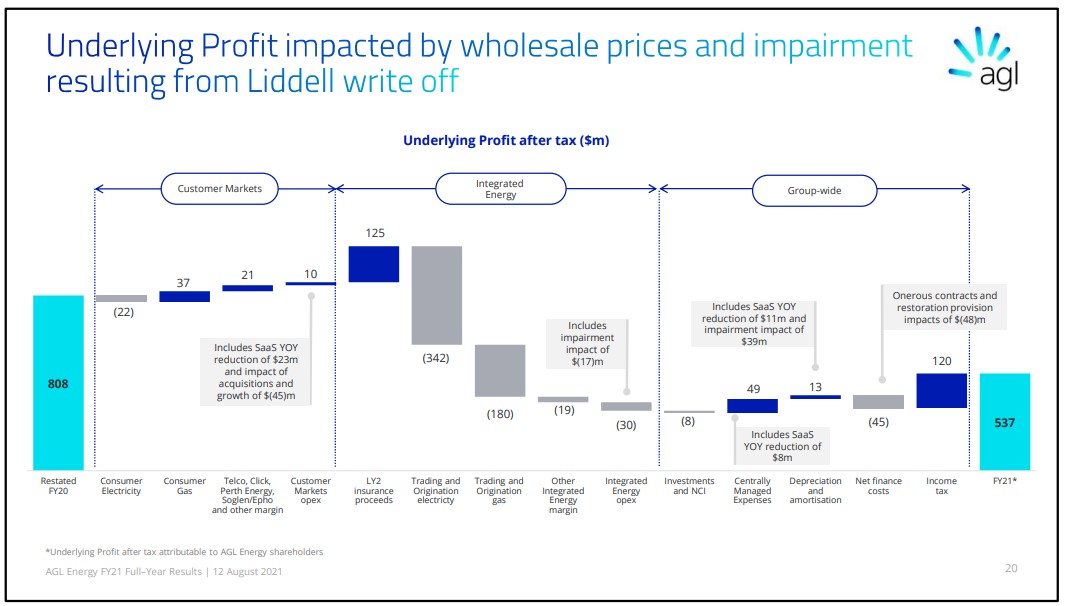

Releasing its full-year results for the 2021-21 financial year, AGL Energy said that it had recorded a further $2.06 billion in losses, triggered primarily by almost $3 billion in asset write-downs, project cancellations and a result of being stuck with high-priced power purchase agreements.

AGL said that across the full 2020-21 financial year, it had recorded $3.6 billion in write-downs across its electricity generation fleet, which had been devalued due to falling wholesale electricity prices, pushed lower by the increased supplies from wind and solar.

AGL said that it had also incurred a $124 million loss on the abandoned Crib Point gas import terminal, which had been planned for Victoria’s south-east coast. The import terminal had been proposed as a way of boosting gas supplies into the Victorian market but was effectively vetoed by the Victorian state government after being met by stiff opposition from environment and local community groups.

The financial results highlight the contrasting performance of the two sides of the AGL business. AGL’s services business, which includes its electricity, gas and retailing businesses, and its expansion into the telecommunications sector – continues to be highly profitable.

But the company’s energy business, which includes both its electricity generation and gas production segments, saw their underlying profitability collapse over the last year, due to combination of falling prices and falling demand.

While AGL said that it was committed to replacing its coal generation fleet with lower emissions sources, shareholder activism group the Australasian Centre for Corporate Responsibility (ACCR) said it was disappointed that the company had not directly committed to emissions targets consistent with the Paris Agreement.

“In the same week the IPCC delivered its “final warning” to humanity via its Sixth Assessment Report (AR6), AGL has told its shareholders that it simply will not adhere to the Paris Agreement,” ACCR’s Dan Gocher said.

“AGL claims that it is “not in position to commit to develop the necessary replacement electricity generation capacity” to replace its coal-fired power stations.”

“Just yesterday, AGL’s largest industrial customer – Tomago Aluminium – announced it would source the vast majority of its electricity from renewable sources by 2029, which is effectively the death knell for the Bayswater coal-fired power station.

“AGL shareholders have already suffered more than 70% in losses since 2017, and this feeble response from the board suggests there will be more losses to come,” Gocher added.