Australia’s biggest coal generation company, and the country’s biggest emitter, has flagged the potential mothballing of some of its remaining coal units well before their advertised closure dates.

In a presentation marking the announcement of its decision to split its business into two – New AGL focusing on customers and clean energy technologies, and PrimeCo to focus on its big coal and wind generation assets – the company says mothballing of units or “seasonally cycling” were options for its “ageing” fleet.

“AGL has historically worked hard to have all 12 coal units online as much as possible but this level of availability may no longer be required by the market,” said AGL chief operating officer Markus Brokhof.

“We can improve reliability outcomes, improve the commercial proposition, and still meet market needs by holding units in hot or cold reserve during shoulder months.

“In addition, to better manage the increasing duck curve, we can invest to lower units’ minimum generation levels to reduce losses through periods when demand is low in the system.

“Over the longer term, we would look to match generation with a more variable cost base and finally, this is not a step to be taken lightly, we may consider to mothball units.”

The units were not identified but presumably relate to the Bayswater coal plant in NSW – not due to close till the mid 2030s, and the Loy Yang A brown coal generator in Victoria, currently not scheduled to close until 2048, although most analysts say both must, and will, close well before then.

AGL’s third coal generation asset, Liddell, is due to close in 2023.

CEO Brett Redman said there were no accelerated permanent coal closures to announce, but insisted that Bayswater would close “no later” than 2035, and Loy Yang A no later than 2048. He said the assets would continue only so long as they were commercially viable.

In an interview with RenewEconomy, Redman said that while the technical lives of these power stations had not changed it was clear that AGL was dealing with the “forces of transition”

“As we go through this big transition, these stations will close. On the way there were will be moments in time where mothballing makes sense … we’re mindful that the market continues to evolve … we are mindful of those forces may change those dates.”

Brokhof said AGL said any mothballing or cycling, will be done in a way that ensures the need to meet demand and security of supply.

Nothing speaks louder of the clean energy transition than the early closure or mothballing of coal units, given that it is driven by the need for increased flexibility as rooftop solar drives changes in the shape of demand, and cheap wind and solar power pushes older and more expensive and dirty generation out of the market.

AGL’s decision follows news from EnergyAustralia that it will bring forward the closure of Yallourn power generator in Victoria to 2028 from 2032, and the decision by Origin Energy to introduce greater flexibility into the Eraring coal generator in NSW.

Many analysts expect more early closures, including potentially Eraring and Vales Point because of the “tidal wave” of new wind and solar investments.

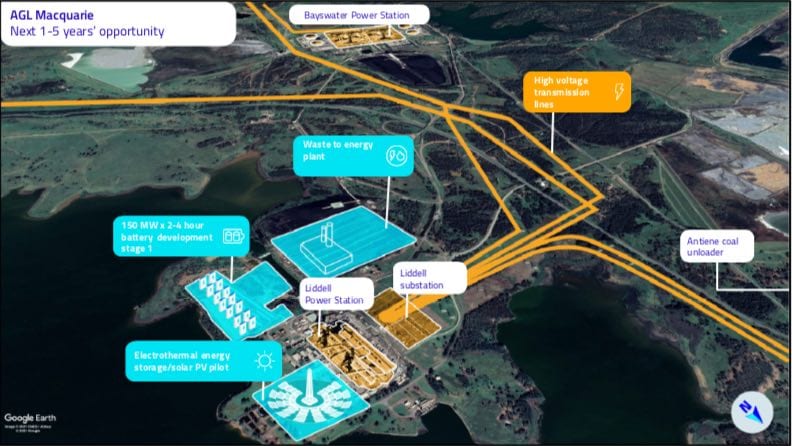

In the long term, AGL is focused on using its coal and major gas assets into new energy hubs, building big battery storage, some fast-start gas generators, waste to energy generation, electrothermal solar storage, and hydrogen hubs.

It already started this process in all these major hubs, with battery storage plans at Torrens Island in South Australia, at Loy Yang A in Victoria and at Liddell in NSW.

“PrimeCo may choose to develop, own or just be a landlord for these opportunities dependant on the respective business cases,” the company says. “These are all genuine opportunities to use the existing infrastructure to give a future to the sites and keep jobs in the local communities while creating value for PrimeCo.”

As an example, Brokhof said the Torrens site could feature more battery storage – over and above the proposed four hour 250MW battery, and a second flexible gas plant to fulfil future market needs alongside the already operating Barker Inlet Power Station.

As an example, Brokhof said the Torrens site could feature more battery storage – over and above the proposed four hour 250MW battery, and a second flexible gas plant to fulfil future market needs alongside the already operating Barker Inlet Power Station.

At the Bayswater/Liddell complex, projects included battery storage and some “exciting electrothermal solar storage technology” that AGL intends to pilot at Liddell.

See also: Biggest coal generator AGL to split business in two to focus on renewables transition

And: AGL mulls floating solar farm at Loy Yang, and electrothermal solar storage pilot