The Australian Energy Market Operator is predicting that the country’s remaining coal fired generators are likely to close much quicker than expected, saying they are becoming less reliable, more difficult to maintain and less able to compete with the growing share of renewables.

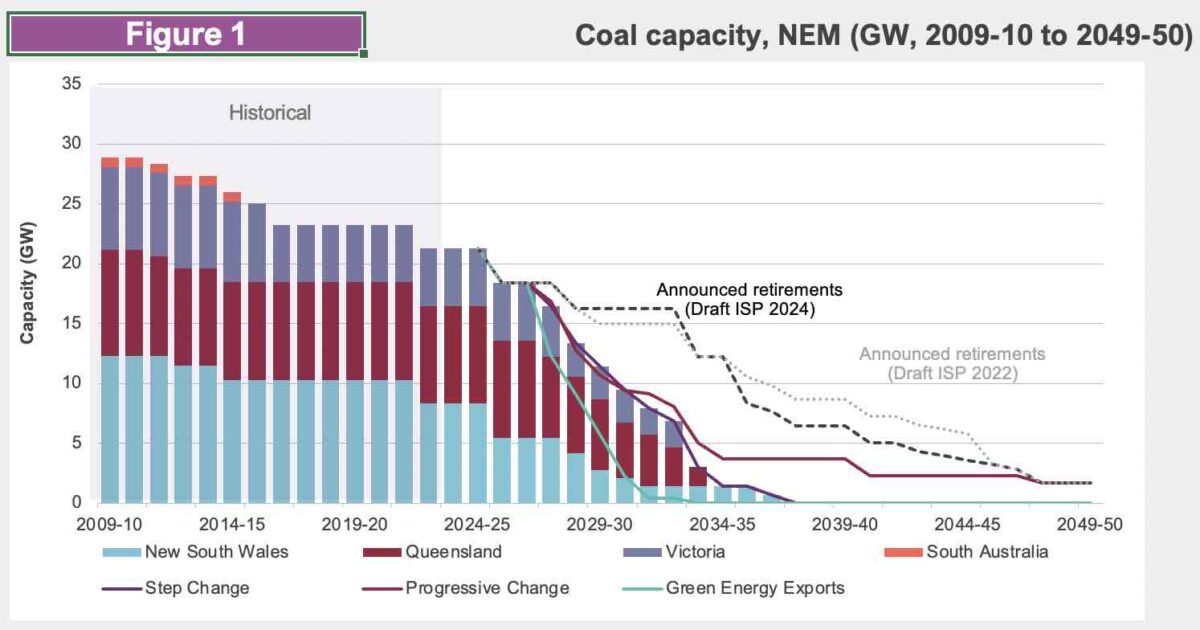

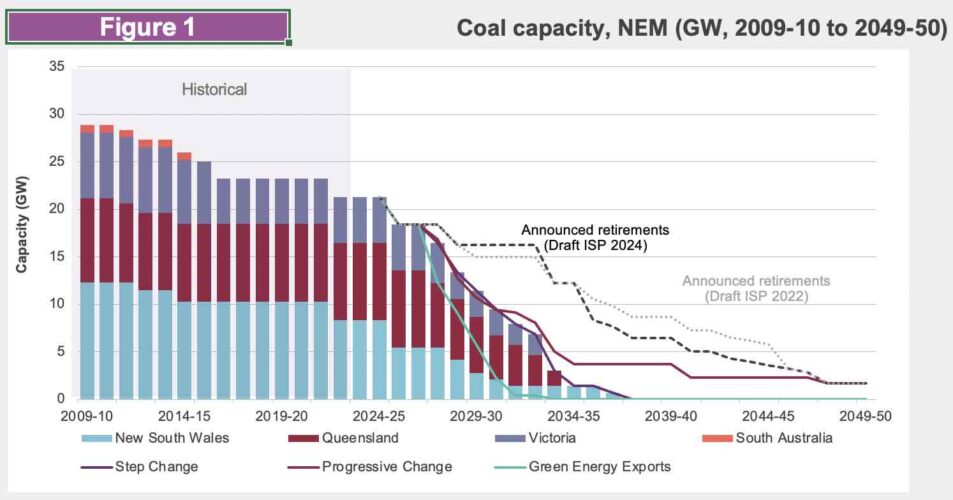

AEMO’s draft 2024 Integrated System Plan, the latest version of its 30-year planning blueprint, suggests coal fired generation will be gone from Queensland and Victoria within a decade – by 2033/34 – and that the last coal unit will close in NSW by 2038.

The prediction accelerates the exit of coal by five years from the previous ISP, and is part of a broad reassessment of the state of the energy transition, which includes a growing recognition of the central role of households, who will install a lot more rooftop solar, and electrify their homes much quicker than thought.

“Our updated analysis shows that Australia’s coal power stations are likely to close earlier than planned, and Australians are electrifying their homes and businesses at a faster rate,” CEO Daniel Westerman says in a statement accompanying the report.

The draft 2024 ISP includes a range of other predictions, including that the country will still reach the federal government’s 82 per cent renewable energy target by 2030 – although there are major new caveats such as grid access, supply, labour, and social licence.

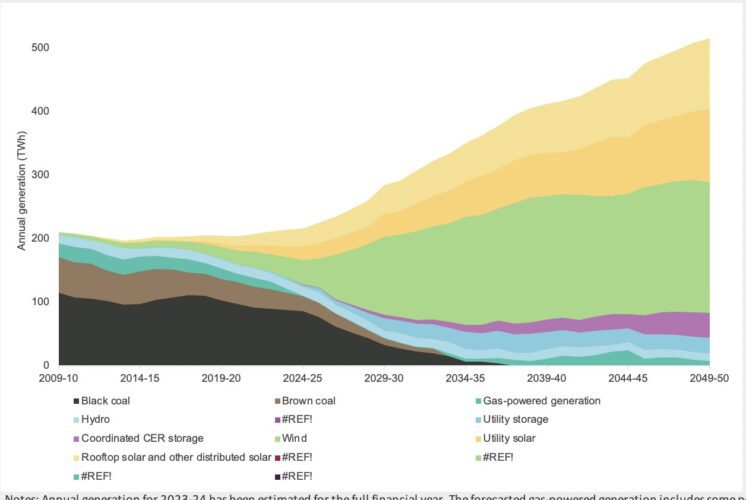

In recognition of the growing interest that households and businesses have in taking control of their energy destiny, AEMO has boosted its forecast rooftop solar capacity by 18 gigawatts to 72 gigawatts by 2050, a four-fold increase from current levels.

See: Households to take centre stage on grid with solar, EVs, heat pumps and electric cooktops

Large scale renewables will need to triple to 57 GW by 2030 and more than double again to 126 GW by 2050 to accommodate the coal closures and the economy-wide push for electrification. Firming capacity – defined as dispatchable storage, hydro and gas-powered generation – will also need to quadruple by 2050 to 74 GW.

Intriguingly, AEMO now says it will need more flexible gas capacity in the future – 16 GW instead of 10 GW – but the amount of actual gas generation is predicted to plunge over the coming decade, and when it returns these plants may not be burning fossil gas at all, but comprise mostly green hydrogen, and gas from biomass.

AEMO is also holding firm on its call for 10,000 kms of new transmission – and half of this in the next decade through a series of now contested new links – saying it will deliver $17 billion of net benefits, although this benefit is smaller than previous estimates because of the jump in the costs of transmission.

But the two big themes of this updated ISP are the predictions of the early demise of coal, and the central role to be played in the grid by households, and what’s known as “distributed energy resources”, which includes batteries, electric vehicles, and demand management.

“Coal-fired generators, the ageing workhorses of Australia’s electricity supply, are now retiring,” the document says. “They are less reliable, more difficult to maintain, and less competitive against firmed renewable supply.

“Ownership has become less attractive, with higher operating costs, reduced fuel security, high maintenance costs and greater competition from renewable energy in the wholesale market.”

AEMO says that in the most likely Step Change scenario, about 90% of the current 21 gigawatts (GW) of coal capacity would retire by 2034-35, and all before 2040. Even in Progressive Change (narrowly beaten as the central scenario by Step Change), only 4 GW of coal generation would remain in 2034-35.

However, an important caveat has been raised by the revelation that state energy ministers will now have the power to force coal generators to stay on line if their early exit threatens grid reliability or grid security.

Interestingly, in the updated ISP, the Progressive Change scenario (favoured by 42 per cent) assumes the same 82 per cent renewable share in 2030 as the central Step Change (favoured by 43 per cent), but smaller growth in future years, mostly as a result of a significant slowdown in distributed energy resources.

The good news in the main Step Change scenario is that households will be much more energy efficient and will draw considerably from batteries and rooftop solar, but will also need more electricity for appliances and especially for electric vehicles.

However, the increase in rooftop PV means households on average will consume around the same amount of power from the grid, despite their uptake of EVs, heat pumps, and electric cooktops.

Businesses and industry, on the other hand, will double their electricity consumption from the grid to serve a growing, decarbonising economy, and for green energy products such as hydrogen. They will want that power to be sourced from zero emissions wind and solar, and backed up, or firmed by storage.

That brings the report back to the central challenge of ensuring enough capacity is built before the coal fired power stations shut down, and ahead of the demand for large scale electrification.

AEMO says more than 6 GW of new capacity is needed each year until 2030, up from the 4GW outlined in the last ISP, and well ahead of current run rates.

It wants wind to dominate installations of large scale renewables through to 2030, to offset the already substantial amounts of utility scale coal and the growing amount of rooftop PV, and by 2050 it sees the need for 70GW of wind capacity and 55GW of large scale solar.

Interestingly, AEMO does not appear to place much credence on the suggestion that offshore wind will grow exponentially and it appears to model only the mandated capacity in the state of Victoria, which sees it as essential to replace its brown coal generation.

Renewable energy zones and new transmission links will also be essential, AEMO says, but so too will a skilled labour force, equipment supplies, and social licence – all of which are at risk.

“The transition is urgent, and faces significant risks if market and policy settings, social licence and supply chain issues are not quickly addressed,” the report says.

AEMO concedes there has been a 30 per cent increase in the costs of transmission projects, and transmission project costs will continue to increase beyond the rate of inflation as the sector adapts to market pressures and to account for environmental and land costs.

The report makes clear that the required new transmission for the step change scenario, which focuses on domestic needs, is 10,000kms out to 2050. Under the Green Export scenario, that would grow to more than 26,000kms as huge wind and solar projects in remote areas were connected to the grid.

Federal energy minister Chris Bowen welcomed the report, saying it “reiterates what we already know, firmed renewable energy is not just clean, it’s the cheapest way to ensure a reliable grid.”

“While today’s draft forecasts 90% of the increasingly unreliable coal fleet is likely to retire by 2035 – the LNP’s only semblance of a plan is a technology that by their own admission will not be commercial before then – risking energy security for households and industry across the country,” he said.

“It’s past time for Dutton and O’Brien to be honest with Australians about how they plan to replace the 90% of aging, and increasingly unreliable coal-fired power generation forecast to close over the next decade – given they have called for a pause on all new renewables and transmission.”